It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

The Nikkei Asian Review was able to find out details about the current state of the construction of TSMC plant in Arizona from the chairman of the board of directors Mark Liu. At least $ 12 billion will be spent on the construction of the enterprise, the construction of the buildings will begin next year, but TSMC has already formed a team of 300 specialists with experience in working with 5nm technology. They will oversee the construction of the plant in Arizona and monitor its technological armament. About 300 more young specialists with little experience in such industries will be sent to the south of Taiwan, where they will undergo a one-year “young fighter course” at the enterprise where 5nm products are already being produced. The training will be conducted in English to facilitate further adaptation of TSMC employees to work in the United States. The authorities of the latter of the countries are ready to provide the required number of work visas for future employees of the enterprise in Arizona, although TSMC, when recruiting staff in this situation, prefers candidates with an open visa.

-

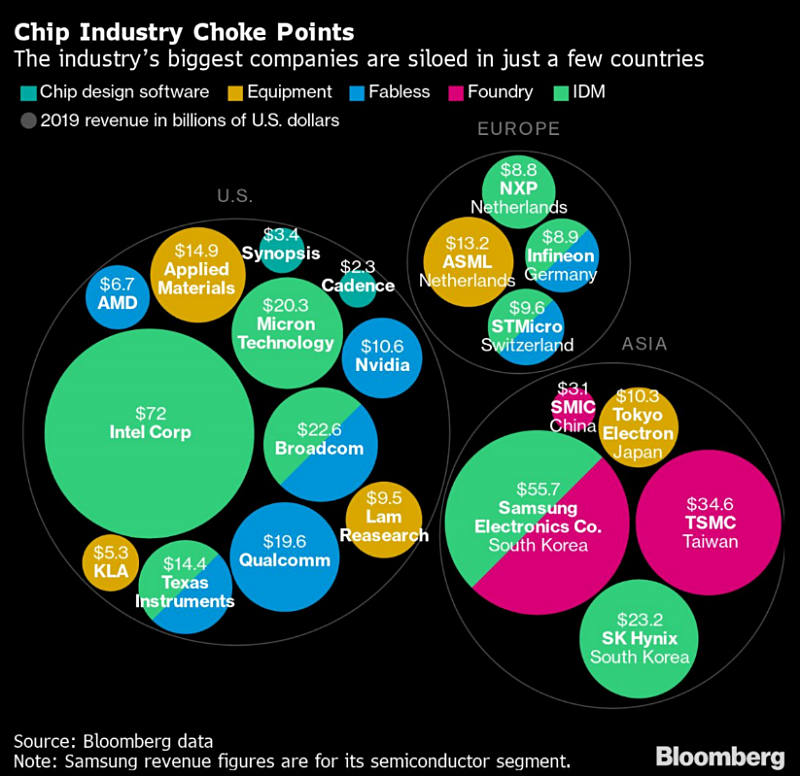

China's SMIC, which has been added to a US trade blacklist, may have to put the development of its sub-14nm process technologies on hold.

-

On 3nm and Apple

Industry sources say Apple has already placed orders for the A and M series processors using the 3nm process technology. Sources did not say how many chips Apple ordered, but it did come to light that the vast majority of orders were for the M-series chipsets used in Apple computers. According to preliminary estimates, initially TSMC will produce up to 600 thousand 3-nm chips per year, and their mass production will start only in 2022. Considering that the first deliveries of such chips will be very limited, it can be assumed that the processors intended for the most expensive and productive Apple computers will be the first to be transferred to the 3-nm process technology.

It is also strong wish to move all production to US, at least for Apple.

Previously, TSMC announced that its 3nm process technology will provide a 10-15% increase in chip performance and a 20-25% increase in their energy efficiency.

And it looks like end of free performance gains.

-

Charlie Demerjian (author of SemiAccurate):

- 10nm in "full production" and "shipping for revenue" since late 2018. Charlie still doesn't think it's viable. Much more real than it once was though, but not good enough.

- Superfin is unquestionably far better than base 10nm. Better in just about every way. Yields are better, but still on the low side.

- CNL had a yield of <25% even with iGPU disabled (seems a bit high to me but huh).

- 10nm SF yields are far better but not as good as 14 (no surprises there). Past 50%.

- Not enough 10nm capacity to handle the entire product stack yet. Charlie doesn't like Rocket Lake, considers the backport "painfully stupid". Will be huge and a power hog.

- 14nm shortage caused by the fact that Intel had to bloat up die sizes.

- OEMs told they were to get a "small fraction" of orders of TGL. Improvements to yield won't fully help because no. of wafer starts is still low.

- He doesn't think 10nm will ever exceed 14nm capacity-wise.

- Ice Lake delayed again due to a bug, but this is a good thing. Looking like it'll come mid-late Q2 to early Q3 (although Charlie originally said March + 1.5-2 month delay?).

- Performance looks pretty poor. Akin to CL-SP actually - performance per socket remains the same but power rises. Core count for shipping parts dropped from 38 -> 36.

- Ice Lake is disappointing. Sapphire Rapids is way better. Comes in Q2 22.

- SPR was originally supposed to launch in Q2 21 to ship for Aurora but... yeah. Even then it was basically going to be a broken, alpha product which would be refined over multiple tapeouts.

- Once SPR fully rolls out and is fully sorted out it'll actually be pretty solid.

- The problem with SPR is timeline. ICL-SP was supposed to compete with Rome (and it would still lose even with the on-paper and significantly better specs than reality). Milan is going to likely beat SPR... over a year earlier and before ICL-SP rolls out. By the time SPR releases, Genoa will be here or right around the corner. Genoa was supposed to compete with GNR which is late 2023 now.

- If both companies iterate perfectly on their roadmaps as planned (much easier on AMD's side right now), Intel can not catch up to AMD until late 2024 or early 2025.

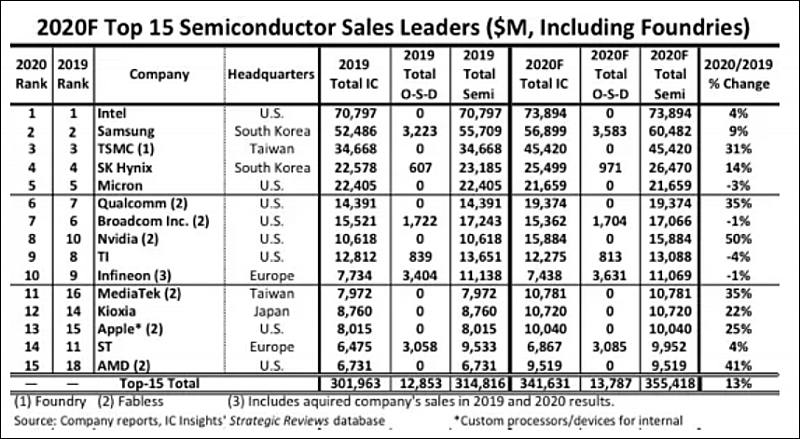

- AMD's biggest problem? Unsurprisingly - capacity.

- 7nm is significantly more delayed than the 6-12 months first claimed. PVC is in-hands basically now and it was the first 7nm product. Now it's on TSMC. Sometime December this year anyway.

- Intel may not know how much of a delay we're looking at with 7.

- Charlie thinks there are several problems with 7, not just 1. However, Charlie hasn't heard anything absolutely solid on the specifics here.

- Doesn't think Intel could sell fabs. Too many things problems involved. Fabs would need to be evaluated for the buyers needs etc etc.

- Foveros is more suited to low-power chips than servers/high power.

- Question about why ARM is more competitive in recent attempts vs previous attempts - Answer: more developed eco-system, lack of real glass-jaws compared to previous designs. Amazon is a bit more of a special case because they can design chips to exactly what they need with all the strengths and benefits that suit them best.

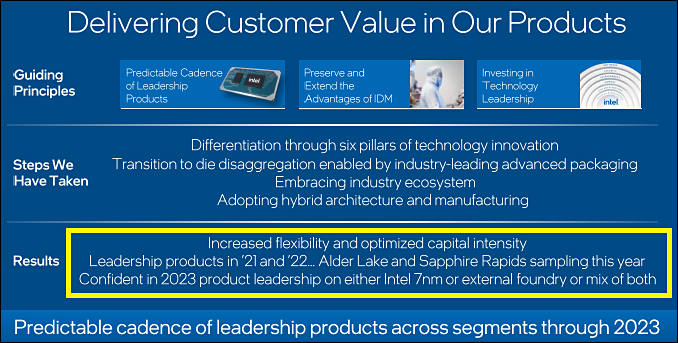

- Intel are going to out-source CPUs, but what and where is still being debated internally. Decision will be made in Q1 between SS and TSMC for different products. Nothing is set in stone yet.

- Intel are looking for a new CEO. There are multiple candidates, one has been shot down, 3 potential left. They are hoping to make the decision in Q1, probably after the Jan call. Does seem like Bob's going either way.

- Question: Will Intel do anything else with the backported core? A: I hope not.

- Intel won't outsource everything to TSMC because TSMC doesn't have the capacity. Intel grabbing capacity shouldn't take capacity away from AMD - TSMC should prioritise customers with long-term plans to stay with them.

- There is a 10nm desktop product coming (Alder Lake-S) but Charlie doubts there will be much capacity for it due to it being needed elsewhere.

-

Taiwan Semiconductor Manufacturing Company (TSMC) is ending its volume discounts. For its biggest customers, TSMC used to offer a discount - when you purchase 10s or 100s of thousands of 300 mm (12-inch) wafers per month, the company will give you a deal of a 3% price decrease per wafer, meaning that the customer is taking a higher margin off a product it sells. Many of the customers, like Apple, NVIDIA, and AMD, were a part of this deal.

Today TSMC is terminating this type of discount. Now, every customer will pay full price for the wafer, without any exceptions.

Need money.

-

TSMC is expected to have an about 20% sequential increase in wafer shipments for 5nm process in first-half 2021, according to industry sources.

Almost all of this will go to non Apple orders.

-

Nvidia's new GeForce RTX 30 GPUs have been in tight supply due to unsatisfactory 8nm process yield rates at its foundry partner Samsung, according to industry sources.

Who could have though.

-

The Nikkei Asian Review, citing UMC's customer service specialists, reported that there were no free quotas until the end of the second quarter of next year in most areas of activity, and for some, all orders were distributed until the very end of 2021. Even the desire of customers to pay more no longer allows UMC to timely fulfill all orders in full. It is reported that among the victims of the shortage of UMC customers there are large companies ordering the release of chips for working with Wi-Fi and Bluetooth - these are Intel, MediaTek and Realtek.

TSMC in this regard also cannot boast of matching the level of supply and demand. According to the source, TSMC's main component production quotas have been allocated until the third quarter of next year. Representatives of Kinpo Electronics note that the components ordered now will have to wait six, eight or even twelve months. Display maker AU Optronics said demand exceeds supply by 10% and the gap is widening.

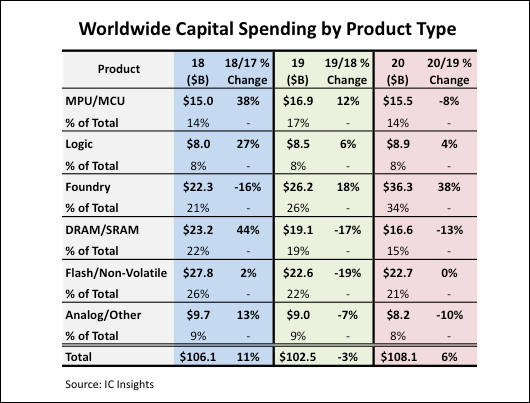

This is result of extreme monopolization on market, especially this relates to equipment for making chips, as US now try to control all and everything and it slowed down production a lot.

-

TSMC plans to launch an enhanced version of 3nm process technology in 2023, with Apple being the initial customer adopting the process, according to industry sources.

For Apple 3nm launch is very important, if it will fail or delays by 1-2 years it can be real dissaster.

As process advantage is 60-70% of all Apple performance gains for now.

-

At the last quarterly reporting conference, the head of Intel, Robert Swan said that the company's specialists have managed to fix a defect that caused a delay in the development of 7-nm technology. By January, management should decide which of 2023 products Intel will produce and which will be outsourced.

“We will continue to invest in seven (nanometers). We will invest in five. We will invest in three, continuing to move forward, ”the head of the processor giant assured investors. He added that Intel will continue to be a vertically integrated manufacturer that independently produces products it develops.

Tragedy of 10nm still going on. But 7nm will join the party soon.

-

Three new EDA (electronic design automation) tool development companies were established in China this year.

In March in Nanjing, the former Synopsys regional sales manager set up X-Epic. In early August, X-Epic was joined by former Cadence VP TC Lin with over 30 years of experience with EDA tools. He has been appointed to the post of the startup's chief scientist. Finally, in early November, another Cadence veteran, Tiyen Yen, was appointed as X-Epic's VP of Research and Development.

The second Chinese EDA company launched in Shanghai in May is Shanghai Hejian Industrial Software. In late October, the company hired a senior Chinese head of R&D from Synopsys, who has spent nearly twenty productive years in the latter. The formation of Shanghai Hejian Industrial Software is funded by local authorities and venture capital firm Summitview Capital.

The third startup, Amedac (Advanced Manufacturing EDA Co), was founded in September by the former vice president of Synopsys China, Chieh Ni, who worked for the American company for ten years. In addition, Synopsys owns over 20% of the startup, and Ge Qun, Synopsys Senior Vice President and Chairman of China Operations, is one of the board members of Amedac. Other key investors in Amedac include Summitview Capital and the State Institute of Microelectronics of the Chinese Academy of Sciences.

All is bad for US.

-

Rumors are that Intel will be making all top CPUs using TSMC 5nm process

But release will start only in 2022, as presently TSMC have big issues with their high performance variant of 5nm process and they have very limited number of equipment.

-

Snapdragon 875 can be forced to be manufactured only using Samsung very low volume 5nm process

Samsung now struggle to produce any significant amount of 8nm products without lot of defective plates.

5nm process is not mature and extremely low quality. But TSMC is overloaded with Apple orders.

-

TSMC has allocated a US$3.5 billion budget for setting up a subsidiary in Arizona, where the pure-play foundry plans to build a wafe fab using 5nm process technology.

The foundry said on Tuesday its board of directors approved "an investment to establish a wholly-owned subsidiary in Arizona, United States of America, with a paid-in capital of US$3.5 billion."

TSMC's Arizona fab project, announced in May this year, is expected to start construction in 2021 followed by production in 2024, industry sources believe. The foundry has reportedly appointed the director for the new fab, selected team candidates and started hiring for the US project.

We have here transfer of non existing money from US database to TSMC (via their biggest clients and investors). So, actually it will be US using printed money and trying to get something real and nice on their soil.

-

How actual issues look like now

- Ryzen 5xxx CPUs - shortages

- Radeon RX 6xxx GPUs - expected shortages

- NVidia 3xxx GPUs - severe shortages

- Sony Playstation 5 - severe shortages

- XBOX Series X - shortages

- Apple A14 series LSIs - shortages

-

Intel issues again

At the quarterly reporting conference, the head of Intel, Robert Swan, said that the company will determine the range of products, the release of which will be entrusted to a third-party contractor, by January next year. A lab in Oregon, which previously developed advanced manufacturing processes, may gradually lose its value as a result of such outsourcing.

Industry experts interviewed by Oregon Live express doubts about the possibility of reverse migration. According to them, if the process of delegating authority to TSMC is launched, then it will be extremely difficult for Intel to return advanced technologies to its own conveyor.

-

Huawei could be handed lifeline if sanctions less severe than previously thought

The US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business, people briefed by Washington said, in a potential lifeline for the Chinese group. Analysts believe this could mean that tough US sanctions this year against China’s leading technology group could be less threatening to its overall business than previously thought. While the sanctions would still pose a grave challenge to Huawei’s 5G business, the company’s important smartphone arm might have a chance to recover.Jefferies’ Mr Lee said if Washington was willing to allow Huawei’s smartphone business to survive, both US chip company Qualcomm and MediaTek could receive licences later this year to resume sales of certain chips needed for smartphones to Huawei. However, industry experts caution against too high expectations on the matter, pointing to what they say are the Trump administration’s erratic policy decisions. -

Last year, Tsinghua Unigroup recruited 72-year-old Yukio Sakamoto, the former CEO of Elpida Memory, as senior vice president. This veteran of DRAM production is directly involved in the establishment of the national Chinese production of RAM chips. Reporters from the Japanese news agency Nikkei asked Mr. Sakamota about China's prospects for semiconductor manufacturing and heard many interesting things.

According to the professional, current trends in semiconductor technology are working for the benefit of China. This area has almost reached the limit of its capabilities, exploiting the classic CMOS process technology. Thus, China, who is catching up by development of national semiconductor technologies and industries, is moving faster than those who are ahead of it. Distance is being reduced fast and nothing can be done about it.

-

Actually lot of engineers went back or went to US due to destruction of HiSilicon and very bad prognosis for SMIC.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320