-

TSMC is on track to enter 3nm chip production with monthly output set to reach 55,000 wafers in the second half of 2022, according to sources familiar with the matter. The 3nm process output will climb further to 100,000 units in 2023.

Number of various paper promises from TSMC rises exponentially, something is not right.

We can clearly see something is bad with 7nm+ EUV process, not enough capacity even for original 7nm and tiny capacity for 5nm so even Apple had been forced to make 2-3x less CPUs despite banning Huawei and all other clients.

-

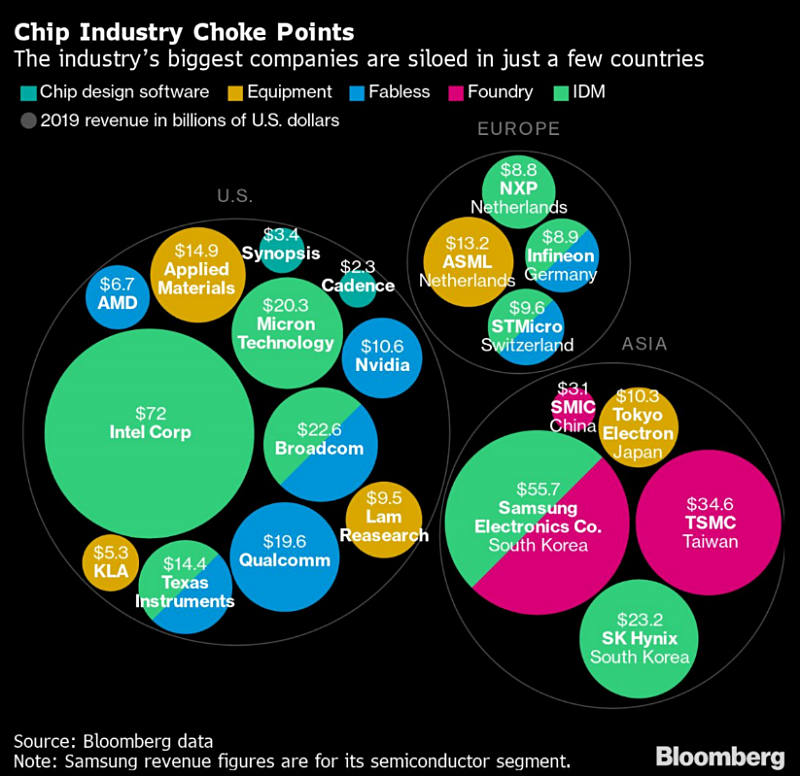

Fewer players due to rising costs of development of LSI's

Toshiba has announced it will dissolve its system LSI business, with the move to affect about 770 employees.

Toshiba Electronic Devices & Storage (TDSC), which operates Toshiba's system LSI business, indicated it will concentrate resources on analog ICs and microcontroller units for motor control, and continue to direct product development resources to the area. In the advanced system-on-a-chip business, TDSC will end new product development but will continue to support existing customers.

-

The value of the global semiconductor material market is expected to rise only slightly from US$52.88 billion in 2019 to US$52.94 billion in 2020, and is estimated to grow about 6 percent from 2020 to US$56.36 billion in 2021.

China is expected to rank as the second largest semiconductor material market with purchases valued at US$9.34 billion in 2020 and US$10.42 billion in 2021, ahead of South Korea's US$8.54 billion in 2020 and US$9.04 billion in 2021.

In terms of semiconductor production equipment, Taiwan was the third largest market with US$8.63 billion in purchases for the first seven months of this year, up 10.6 percent from a year earlier.

China was the largest semiconductor production equipment buyer in the seven-month period with purchases at US$9.84 billion, up 45.2 percent ahead of South Korea, which spent US$9.49 billion on semiconductor equipment, up 54.1 percent.

Worldwide, sales of semiconductor production equipment for the seven-month period totaled US$38.43 billion, up 23.2 percent from a year earlier.

-

Intel Ice Lake-SP CPUs delayed again

At best they will become available in April 2021.

Issues with horrible 10nm process quality remain.

For complex multicore processors that are able to run at high frequency company have 4-7 defective units for each normal one.

-

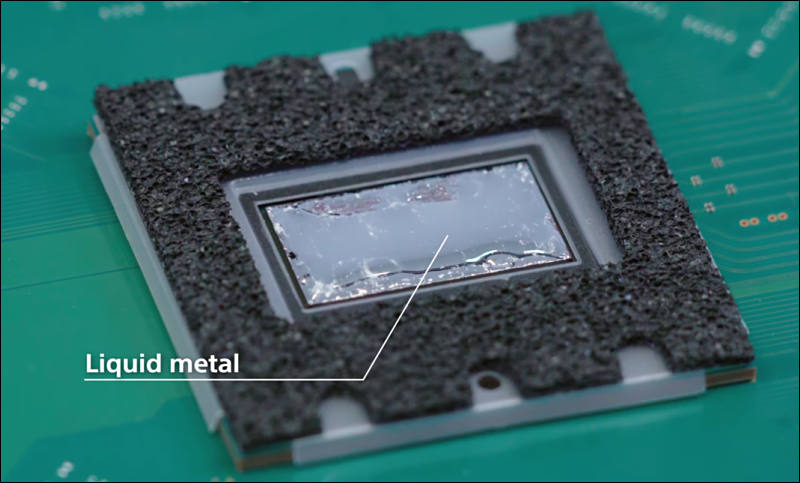

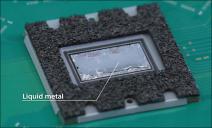

Liquid metal solutions as sign of issues

ASUS notebooks

Playstation 5

sa14950.jpg800 x 483 - 55K

sa14950.jpg800 x 483 - 55K -

TSMC CEO CC Wei has reiterated his previous remark that the foundry expects to see 5nm process technology to account for 8% of its total wafer revenues this year. The proportion will climb further to nearly 20% or above the level, said Wei.

TSMC turned into essentially monopoly with extreme profit margins on 7nm and especially 5nm devices.

-

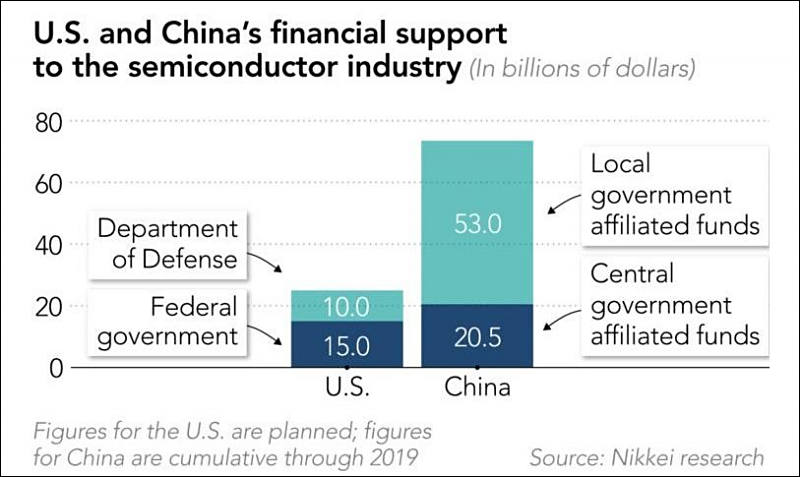

As predicted, US manufacturers also want free money

The Decadal Plan, developed with contributions from a broad cross-section of leaders in academia, government, and industry, identifies five “seismic shifts” shaping the future of chip technology and calls for an annual $3.4 billion federal investment over the next decade to fund semiconductor R&D across these five areas.

“Federal government and private sector investments in semiconductor R&D have propelled the rapid pace of innovation in the U.S. semiconductor industry, spurring tremendous growth throughout the U.S. and global economies,” said John Neuffer, SIA president and CEO. “As we enter a new era, however, a renewed focus on public-private research partnerships is necessary to address the seismic shifts facing chip technology. The federal government must invest ambitiously in semiconductor research to keep America on top in semiconductors and the game-changing future technologies they enable.”

The Decadal Plan’s proposed additional federal investment of $3.4 billion annually would strengthen the U.S. semiconductor industry’s global leadership position, add $161 billion to U.S. GDP, and create half a million U.S. jobs in the next 10 years, according to findings from an earlier SIA study.

And ti is very small early start, very soon they will start asking for $100 billions.

-

WILL HUAWEI MAKE A COMEBACK WHEN THE CHIPS ARE DOWN? by Gerry Brown

Huawei still stands tall despite years of ferocious onslaughts by the US bully wielding the “whole of nation " power and strong-arming its allies to wipe out the private Chinese company . Lesser businesses would have died a brutal and quick death on the first attack. The last straw that broke Huawei's back was a global ban slapped by USA(--) on supply of high-end chips to Huawei for its top of the range smartphones. Plus embargo of EUV lithography machines produced only by Dutch ASML to SMIC for manufacture of sub-10 nm chips. The semiconductor siege on Huawei seems complete. Can Huawei make a comeback, like it did after walking out of a deal to sell the company to Motorola for $7.5 billion in 2003? -

TSMC expects to post revenues of between US$12.4 billion and US$12.7 billion in the fourth quarter of 2020, which is a 3.4% sequential increase at the midpoint. Gross margin and operating margin for the third quarter are estimated at 51.5-53.5% and 40.5-42.5%, respectively.

TSMC also raised its global semiconductor market outlook this year to 4-6% growth, while revising its foundry market growth forecast to nearly 20% from the previously estimated 14-19%. TSMC expects to post a 30% revenue surge in US dollar term this year.

TSMC's net profits grew 35.9% on year and 13.6% sequentially to NT$137.31 billion (US$4.78 billion) in the third quarter of 2020. EPS for the quarter came to NT$5.30, or US$0.90 per ADR unit.

-

SMIC FinFET N+1 advanced technology is total joke.

Let me explain, it is being made on equipment for 40-65nm process (and they have not a lot of such even), and claimed as being 7nm class, this is lie. Of course it is equivalent to around 28nm old process.

Their idea is to use extreme amount of masks and exposures, it works for some military orders and for marketing purposes, but does not work for any commercial order.

Cost and performance of smartphone chip will very bad.

-

There's always Plan B... tunnel from China to TSMC is almost complete... all machines and engineers will suddenly wake up in mainland :)

-

Actually lot of engineers went back or went to US due to destruction of HiSilicon and very bad prognosis for SMIC.

-

Last year, Tsinghua Unigroup recruited 72-year-old Yukio Sakamoto, the former CEO of Elpida Memory, as senior vice president. This veteran of DRAM production is directly involved in the establishment of the national Chinese production of RAM chips. Reporters from the Japanese news agency Nikkei asked Mr. Sakamota about China's prospects for semiconductor manufacturing and heard many interesting things.

According to the professional, current trends in semiconductor technology are working for the benefit of China. This area has almost reached the limit of its capabilities, exploiting the classic CMOS process technology. Thus, China, who is catching up by development of national semiconductor technologies and industries, is moving faster than those who are ahead of it. Distance is being reduced fast and nothing can be done about it.

-

Huawei could be handed lifeline if sanctions less severe than previously thought

The US is allowing a growing number of chip companies to supply Huawei with components as long as these are not used for its 5G business, people briefed by Washington said, in a potential lifeline for the Chinese group. Analysts believe this could mean that tough US sanctions this year against China’s leading technology group could be less threatening to its overall business than previously thought. While the sanctions would still pose a grave challenge to Huawei’s 5G business, the company’s important smartphone arm might have a chance to recover.Jefferies’ Mr Lee said if Washington was willing to allow Huawei’s smartphone business to survive, both US chip company Qualcomm and MediaTek could receive licences later this year to resume sales of certain chips needed for smartphones to Huawei. However, industry experts caution against too high expectations on the matter, pointing to what they say are the Trump administration’s erratic policy decisions. -

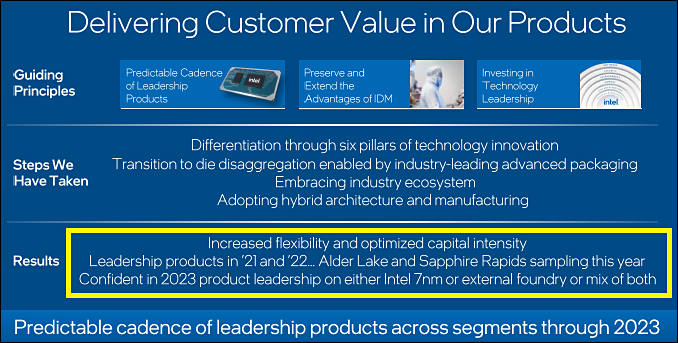

Intel issues again

At the quarterly reporting conference, the head of Intel, Robert Swan, said that the company will determine the range of products, the release of which will be entrusted to a third-party contractor, by January next year. A lab in Oregon, which previously developed advanced manufacturing processes, may gradually lose its value as a result of such outsourcing.

Industry experts interviewed by Oregon Live express doubts about the possibility of reverse migration. According to them, if the process of delegating authority to TSMC is launched, then it will be extremely difficult for Intel to return advanced technologies to its own conveyor.

-

How actual issues look like now

- Ryzen 5xxx CPUs - shortages

- Radeon RX 6xxx GPUs - expected shortages

- NVidia 3xxx GPUs - severe shortages

- Sony Playstation 5 - severe shortages

- XBOX Series X - shortages

- Apple A14 series LSIs - shortages

-

TSMC has allocated a US$3.5 billion budget for setting up a subsidiary in Arizona, where the pure-play foundry plans to build a wafe fab using 5nm process technology.

The foundry said on Tuesday its board of directors approved "an investment to establish a wholly-owned subsidiary in Arizona, United States of America, with a paid-in capital of US$3.5 billion."

TSMC's Arizona fab project, announced in May this year, is expected to start construction in 2021 followed by production in 2024, industry sources believe. The foundry has reportedly appointed the director for the new fab, selected team candidates and started hiring for the US project.

We have here transfer of non existing money from US database to TSMC (via their biggest clients and investors). So, actually it will be US using printed money and trying to get something real and nice on their soil.

-

Snapdragon 875 can be forced to be manufactured only using Samsung very low volume 5nm process

Samsung now struggle to produce any significant amount of 8nm products without lot of defective plates.

5nm process is not mature and extremely low quality. But TSMC is overloaded with Apple orders.

-

Rumors are that Intel will be making all top CPUs using TSMC 5nm process

But release will start only in 2022, as presently TSMC have big issues with their high performance variant of 5nm process and they have very limited number of equipment.

-

Three new EDA (electronic design automation) tool development companies were established in China this year.

In March in Nanjing, the former Synopsys regional sales manager set up X-Epic. In early August, X-Epic was joined by former Cadence VP TC Lin with over 30 years of experience with EDA tools. He has been appointed to the post of the startup's chief scientist. Finally, in early November, another Cadence veteran, Tiyen Yen, was appointed as X-Epic's VP of Research and Development.

The second Chinese EDA company launched in Shanghai in May is Shanghai Hejian Industrial Software. In late October, the company hired a senior Chinese head of R&D from Synopsys, who has spent nearly twenty productive years in the latter. The formation of Shanghai Hejian Industrial Software is funded by local authorities and venture capital firm Summitview Capital.

The third startup, Amedac (Advanced Manufacturing EDA Co), was founded in September by the former vice president of Synopsys China, Chieh Ni, who worked for the American company for ten years. In addition, Synopsys owns over 20% of the startup, and Ge Qun, Synopsys Senior Vice President and Chairman of China Operations, is one of the board members of Amedac. Other key investors in Amedac include Summitview Capital and the State Institute of Microelectronics of the Chinese Academy of Sciences.

All is bad for US.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320