-

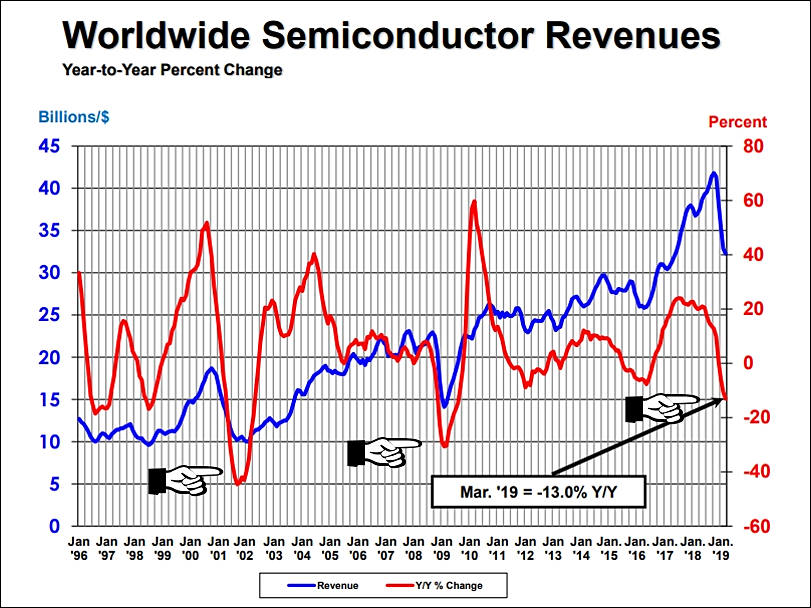

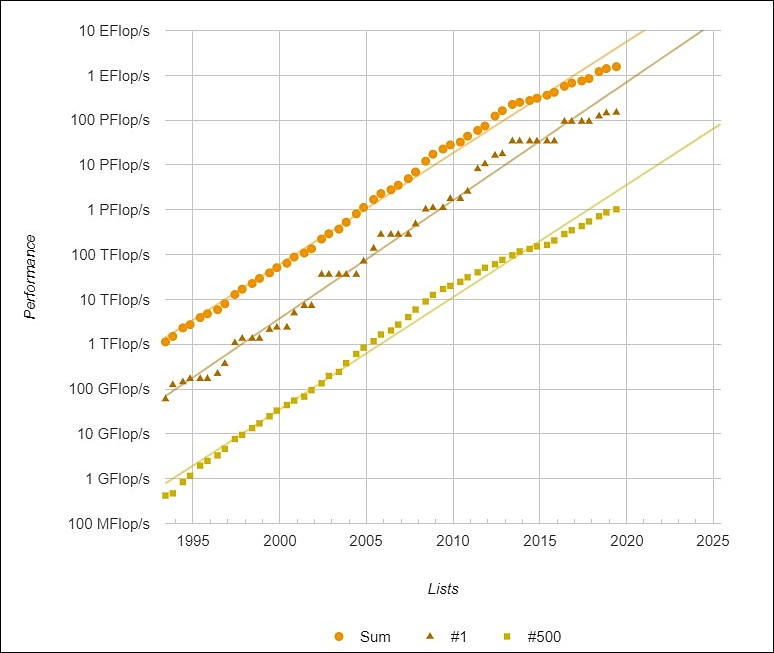

How slowing down progress look at supercomputers chart

sa8790.jpg774 x 653 - 58K

sa8790.jpg774 x 653 - 58K -

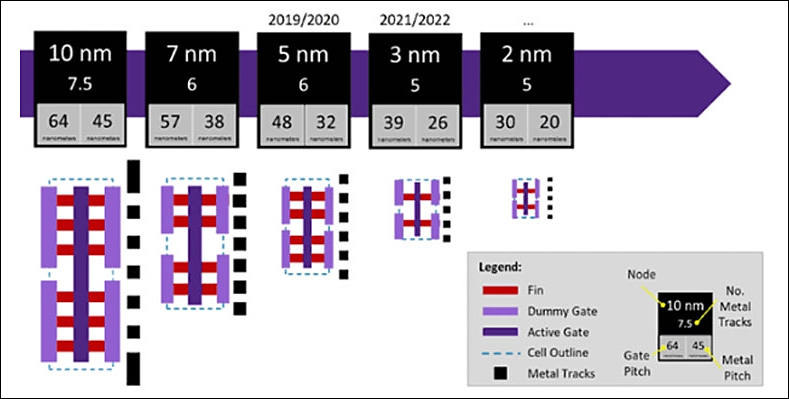

TSMC now hopes to scare competition with 2nm plans

One of their top managers told that they plan to make new factory tailored for 2nm processes soon, near their upcoming 5nm plant.

Unofficially they plan to have first commercial 2nm chips ready in 2024.

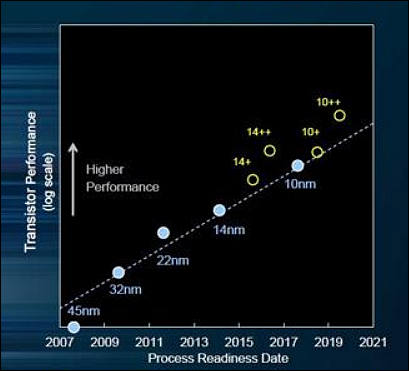

I highly doubt it, as one of them main reasons of TSMC winning this round had been misleading marketing calling real 10-11nm process as 7nm.

So, most probably nice graphics on top will be in reality significantly different and we can see some new marketing stunts.

Global foundries, of course, also never had 12nm process that AMD used for previous Ryzen chips, it had been just renamed and improved 14nm, ala Intel 14nm+++.

sa8755.jpg789 x 399 - 47K

sa8755.jpg789 x 399 - 47K -

Intel started to think about separating factories

While during recent meeting they told that no such plans this year exist, but they also told that they will return to such option within 2020. If we will see 10nm/7nm still not working we can see extremely fast and sudden merger or separation. So, such we can be already to only 2 companies competing in 2021 (Samsung and TSMC).

-

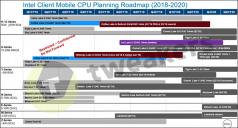

Sales of smartphones in the China market tumbled by 31.3% on quarter and 16.7% on year to 71.7 million units in the first quarter of 2019.

Big dangers for semiconductors progress ahead, as with development costs rising exponentially drop on smartphone market can lead to disaster.

-

TSMC plans considering 5nm (marketing ones)

TSMC has already kicked off risk production of 5nm chips, said the report, adding that the process is expected to be ready for commercial production in the second quarter of 2020 when the phase-one facility of the foundry's new Fab 18 comes online.

Dubbed N5+, namely 5nm Plus, the process node will feature both performance and power consumption advances, according to a recent Chinese-language Commercial Times report. The foundry is expected to move N5+ to risk production in the first quarter of 2020, the report said.

-

Notes from SemiAccurate's CC about Intel

- Cannon Lake 10 nm, "launched" in 2017 with a single Lenovo China laptop, had single digit yields

- Charlie reported a "level of fear he had never seen" around then from Intel sources [Similar to Olympus]

- The original plan was for four fabs to move to 10 nm. 3 out of the 4, including one in each of Israel, Arizona, and Oregon, will NOT move to 10 nm.

- No info on what the 4th fab is doing, but at least 75% of the original 10 nm fab capacity is no longer there.

- COAG (Contact Over Active Gate) was to have saved INTC 10% in area. It completely failed, impacting integrated graphics. This is why the Q4 2017 10 nm Canon Lake had no iGPU

- 10nm is slower, and its yields are < 50% that of 14 nm.

- The recently leaked Dell roadmaps confirm that the INTC 2017 claim that 10 nm and 10nm+ processes will be behind on performance compared to 14 nm.

- Ice Lake 10 nm will only be the low performance end of the stack. It will also come in 14 nm variants.

- High core count and performance as well as AI with Bfloat 16 will remain at 14 nm.

- All INTC custom foundry customers have bailed, including Cisco, Panasonic, and LG. The entire INTC custom foundry effort was a flaming disaster.

- Questioned about INTC 14 nm shortages, Charlie mentions (previously behind the paywall) that this was driven by massive hits to server customers from Spectre and Meltdown security flaws, which drove volume buys to restore capacity [China buys ahead of tariffs in Intel speak].

So, this diversion played well.

- AMD Rome delivers a 1.6x performance delta over INTC's current and for the next year Cascade Lake.

- AMD will have a 50 to 60% server CPU performance advantage until at least late 2021.

- AMD Milan will have an amazing 15 chiplets.

- AMD is pushing chiplets very hard.

-

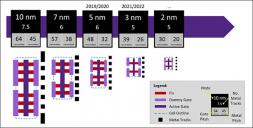

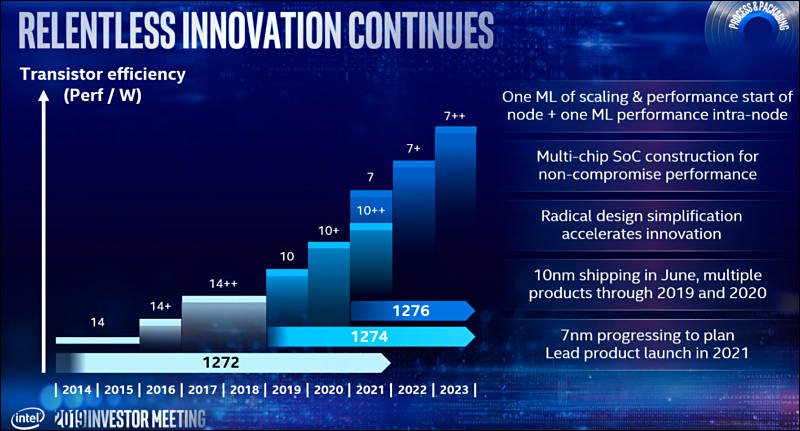

New Intel PR

10nm Process Technology: Intel’s first volume 10nm processor, a mobile PC platform code-named “Ice Lake,” will begin shipping in June. The Ice Lake platform will take full advantage of 10nm along with architecture innovations. It is expected to deliver approximately 3 times faster wireless speeds, 2 times faster video transcode speeds, 2 times faster graphics performance, and 2.5 to 3 times faster artificial intelligence (AI) performance over previous generation products1. As announced, Ice Lake-based devices from Intel OEM partners will be on shelves for the 2019 holiday season. Intel also plans to launch multiple 10nm products across the portfolio through 2019 and 2020, including additional CPUs for client and server, the Intel® Agilex™ family of FPGAs, the Intel® Nervana™ NNP-I (AI inference processor), a general-purpose GPU and the “Snow Ridge” 5G-ready network system-on-chip (SOC).

The company plans to effectively deliver performance and scaling at the beginning of a node, plus another performance improvement within the node through multiple intra-node optimizations within the technology generation.

7nm Status: Renduchintala provided first updates on Intel’s 7nm process technology that will deliver 2 times scaling and is expected to provide approximately 20 percent increase in performance per watt with a 4 times reduction in design rule complexity. It will mark the company’s first commercial use of extreme ultraviolet (EUV) lithography, a technology that will help drive scaling for multiple node generations.

The lead 7nm product is expected to be an Intel Xe architecture-based, general-purpose GPU for data center AI and high-performance computing. It will embody a heterogeneous approach to product construction using advanced packaging technology. On the heels of Intel’s first discrete GPU coming in 2020, the 7nm general purpose GPU is expected to launch in 2021.

sa8215.jpg800 x 467 - 89K

sa8215.jpg800 x 467 - 89K

sa8214.jpg800 x 431 - 74K

sa8214.jpg800 x 431 - 74K -

Recent reports indicate that the 7nm node is expensive, thus leading several large players to scale back product development on leading nodes, thus leaving about 10 percent of TSMC’s 7nm production capacity underutilized.

Strange reports.

-

AMD goals

- AMD publically assured that they believe that TSMC could keep up with demand, this means that issue is present and actual

- AMD plans to increase CPU prices

- AMD hence plans to increase gross margin to 41% this year and up to 44% next year as they try to move as much money into investors pockets as possible

- We will see repeat of smartphones and cameras market issues in next 2 years in CPU market.

-

Not only 10nm is not ready, it will be slower even in Intel dreams

AMD approach with chiplets is much smarter, but be ready to expect lot of bad surprises in Zen 2.

sa8064.jpg409 x 371 - 21K

sa8064.jpg409 x 371 - 21K -

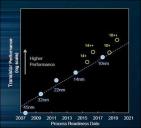

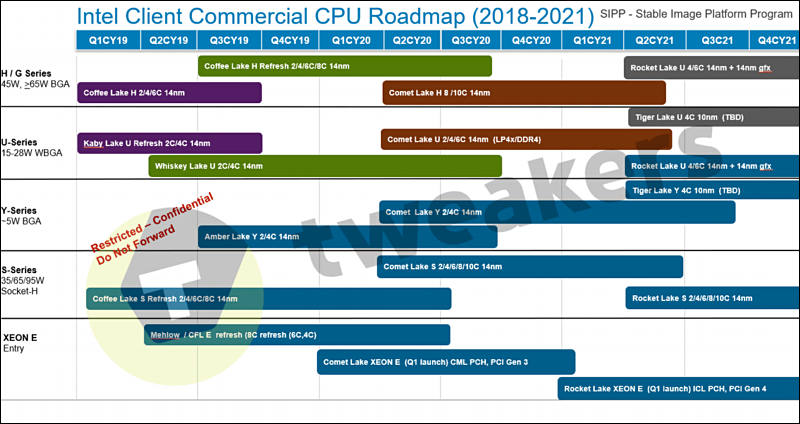

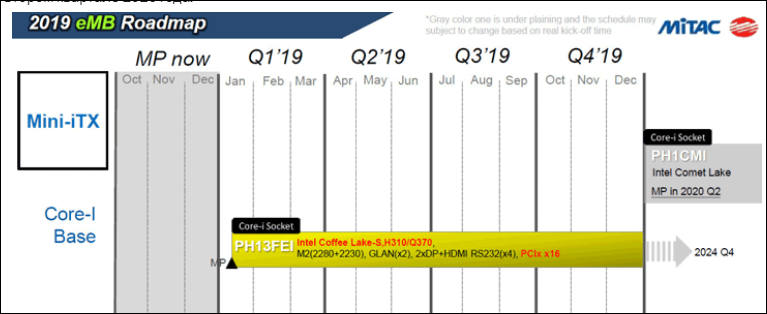

Intel 10nm pushed to 2022 at least (most probably it is total toast)

Leaked roadmaps from Dell people.

Next year Intel plans to add another 2 cores while keeping same deficient double channel memory system, and this time thermal throttling will be real severe.

sa8061.jpg800 x 424 - 78K

sa8061.jpg800 x 424 - 78K

sa8062.jpg800 x 431 - 81K

sa8062.jpg800 x 431 - 81K -

GlobalFoundries is being sold part by part now.

ON Semiconductor Corporation (Nasdaq: ON) (“ON Semiconductor”) and GLOBALFOUNDRIES today announced that they have entered into a definitive agreement for ON Semiconductor to acquire a 300mm fab located in East Fishkill, New York. The total consideration for the acquisition is $430 million, of which $100 million has been paid at signing of the definitive agreement, and $330 million will be paid at the end of 2022, after which ON Semiconductor will gain full operational control of the fab, and the site’s employees will transition to ON Semiconductor. Completion of the transaction is subject to regulatory approval and other customary closing conditions.

The agreement allows ON Semiconductor to increase its 300mm production at the East Fishkill fab over several years, and allows for GLOBALFOUNDRIES to transition its numerous technologies to the company’s three other at-scale 300mm sites. Under the terms of the agreement, GLOBALFOUNDRIES will manufacture 300mm wafers for ON Semiconductor until the end of 2022. First production of 300mm wafers for ON Semiconductor is expected to start in 2020.

-

TSMC expects 7nm process technology to account for more than 25% of the foundry's total wafer revenues this year.

TSMC has moved its N7 Plus process, namely 7nm incorporating EUV, to volume production,

The foundry is scheduled to begin risk production of chips using 6nm process technology in the first quarter of 2020. TSMC's N6 process delivers 18% higher logic density over the N7 process, with design rules fully compatible with N7 technology.

TSMC's 5nm process technology, development is well on track with customer tape-outs starting this quarter. The company expects to move the node to volume production in the first half of 2020. TSMC regards 5nm as "a large and long-lasting node". The initial ramp may be slower than that for the N7, but the foundry will manage to ramp up the N5 "quickly".

And may be really last one at mass market.

And warning signs are ahead:

sa8007.jpg705 x 442 - 37K

sa8007.jpg705 x 442 - 37K -

AMD's 7nm CPU and GPU are expected to be adopted by Sony in its next-generation PlayStation and the processors are estimated to be ready in the third quarter of 2020 for the games console's expected release in the second half of 2020, according to industry sources.

The sources from the IC back-end services sector noted that the processors' packaging and testing will be handled by Advanced Semiconductor Engineering (ASE) and Siliconware Precision Industries (SPIL).

We have some issue with 7nm TSMC process companies try to cover up. And note - this process is very close to modern 14nm by Intel and much less advanced compared to 10nm that Intel fails to make working for last years.

-

And here it is consequence of such lack of big progress

sa7839.jpg753 x 423 - 62K

sa7839.jpg753 x 423 - 62K

sa7840.jpg769 x 412 - 65K

sa7840.jpg769 x 412 - 65K -

The Semiconductor Industry Association (SIA) has disclosed semiconductor sales for February 2019 fell 7.3% on month and 10.6% from a year earlier to US$32.9 billion. Sales declined on both sequential and bases across all regional markets. February semiconductor sales in the Americas registered decreases of 12.9% sequentially and 22.9% on year, while those in China were down 7.8% on month and 8.5% from the same period in 2018

NAND and DRAM price drops play important role here, but any sales drop are very dangerous for industry where costs are exponentially rising. And it is no place for mergers already.

-

Intel 10nm high performance chips are not expected even in 2020

Next generation will be same 14nm with attempt to add another 2 cores.

-

New Xbox and Playstation are delayed till 2020 at least

TSMC is having issues with ramping up 7nm production and still don't have good costs for now. it is enough for premium products but not for profit limited ones.

We can see also very strange scenery with Ryzen 2 release. Some models can be available only months after announcement or even early 2020.

-

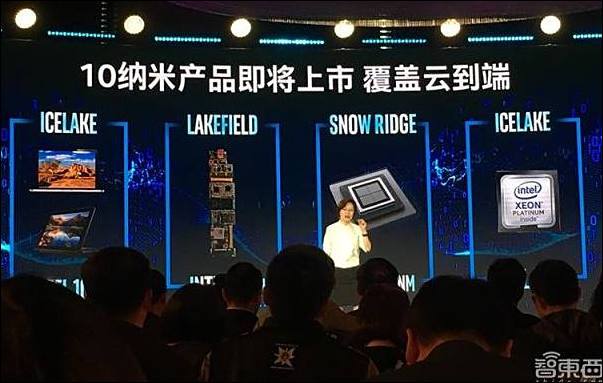

Intel keeps having huge issues with 10nm, and this year we can see only minimal volume products - small notebooks U/Y processors, few Xeon chips that will be shipped in reality in 20202 at best and few paper announcements of Lakefield and SnowRidge chips.

Intel also cuts most of their high qualified info systems staff and transfer all support of it to Infosys who uses low qualified Indian remote contractors. This will allow few top managers to get tens of millions of bonuses this year.

sa7734.jpg603 x 383 - 46K

sa7734.jpg603 x 383 - 46K -

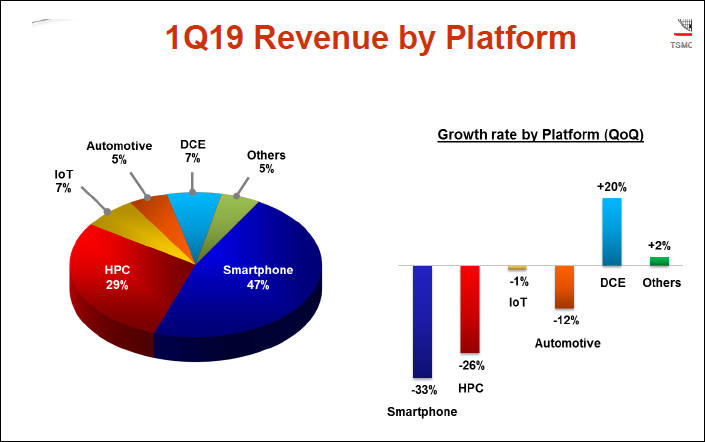

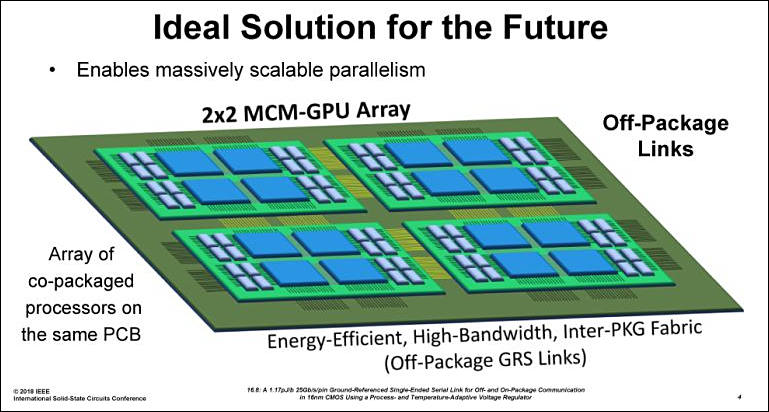

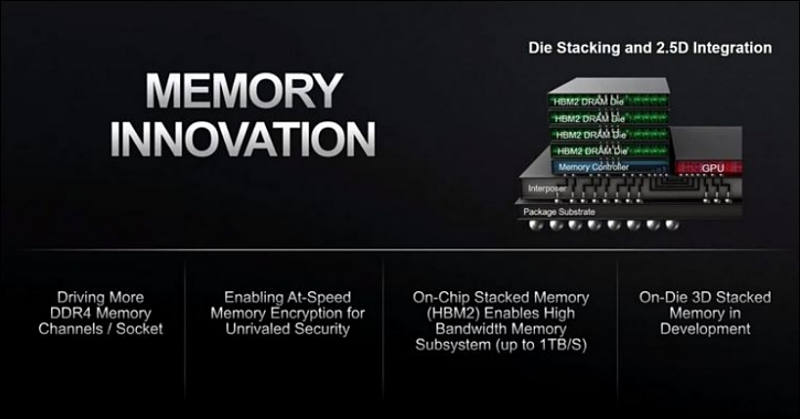

3D stacking of RAM and NAND is nothing new, for example it had been used in lot of Panasonic cameras.

But almost all new cameras not using it.Issue is heat dissipation, you can't stack RAM on top of desktop processor, as this is thing that managers keep telling to investors to calm them. Not only your processor frequency will need to drop a lot, but you will also get lot of issues with memory as need to move back to much larger elements to keep it stable.

Intel will certainly try something like this in the low end, Atom power level chips, and may be Y chips. But even in U chips it will be issues.

sa7480.jpg800 x 535 - 36K

sa7480.jpg800 x 535 - 36K

sa7481.jpg800 x 419 - 35K

sa7481.jpg800 x 419 - 35K -

Unfortunately 3D stacking has huge issues in case of CPUs

-

Although Intel has announced its 10nm Ice Lake will begin mass production in the second half of 2019, Digitimes Research's sources from the upstream supply chain has revealed that there are still many issues with the CPU giant's mass production schedule for 10nm process.

Intel previously said that its new 14nm Comet Lake would have a performance not worse than Ice Lake. Digitimes Research believes Intel could shift its investments directly to 7nm process development, skipping 10nm.

Things are bad, really bad.

-

Intel will continue to maintain its 14nnm process. Although 10nm process of Ice Lake will debut in the second half of 2019 it will stay limited to notebook computers (U and Y series first).

And even in 2020 all desktop computer CPUs will remain at 14nm.

It is real tragedy.

Expect more doom and gloom news soon about TSMC new process. Industry rumors are that Apple and Samsung are around 8-16 months from total stop of LSI process shrinkage and it'll be tragedy for high end smartphones. And same tragedy for all semiconductor industry, as buyers of smartphones now pay for around 70% of all progress expanses, any slowdown or sharp downturn can mean massive issues.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319