It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Semiconductor Manufacturing International (SMIC) expects to post a revenue increase of 17-19% sequentially in the second quarter of 2021, with gross margin ranging from 25% to 27%.

SMIC reported revenue grew about 22% on year and 12.5% sequentially to US$1.1 billion in the first quarter of 2021, while gross margin came to 22.7% compared with 18% in the prior quarter and 25.8% a year earlier.

SMIC utilized 98.7% of production capacity in the first quarter.

Now each and everyone must pay to cover huge costs of barely moving forward for semiconductors industry.

And it is only front bumper that touched the wall.

-

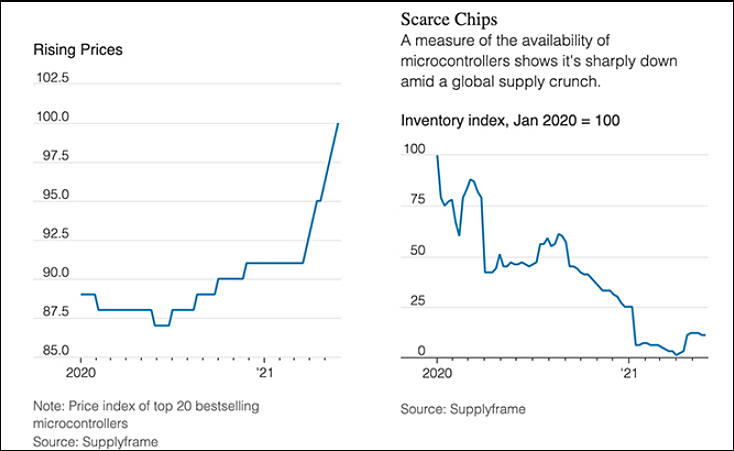

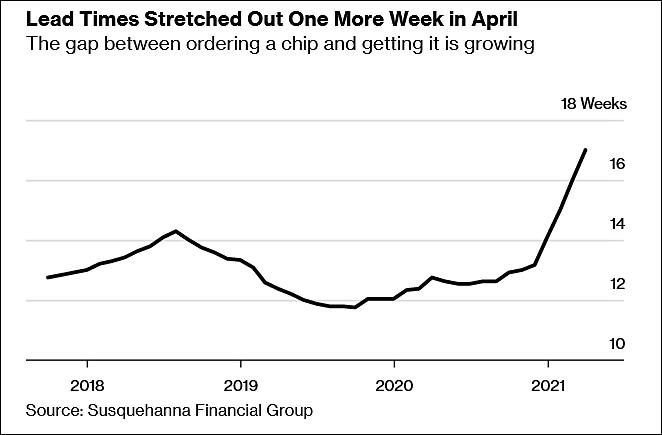

Lead times for some product categories are growing at an even more alarming rate. For example, the power management ICs wait time increased to 23.7 weeks in April, about four weeks longer than a month earlier. Lead times for industrial microcontrollers have increased by three weeks, which market participants say is one of the steepest increases in recent years.

According to people familiar with the supply chain, delays primarily hit small producers, whose orders are satisfied on a leftover basis. For example, headphone manufacturers are faced with having to wait more than 52 weeks for their orders. This forces such companies to redesign products, shift priorities, and even abandon certain projects altogether.

The situation is no better with automotive chips. NXP Semiconductors, a major automotive chip supplier, now has a lead time of over 22 weeks, up from 12 weeks late last year. STMicroelectronics, another key supplier of automotive ICs, increased its lead time by more than four weeks to 28 weeks in April.

sa17285.jpg662 x 435 - 35K

sa17285.jpg662 x 435 - 35K -

Taiwan-based United Microelectronics (UMC), Vanguard International Semiconductor (VIS) and Powerchip Semiconductor Manufacturing (PSMC), China's Semiconductor Manufacturing International (SMIC), and Globalfoundries are all expected to hike their foundry quotes again to respond to their continued tight capacities at 8- and 12-inch fabs.

-

New US bill

- Provide $52 billion to support domestic semiconductor manufacturing

- Authorize $81 billion for the National Science Foundation from fiscal 2022 to fiscal 2026

- Authorize $16.9 billion for the Department of Energy over the same period for research and development and energy-related supply chains in key technology areas.

- Authorize $10 billion to NASA’s human landing systems program

The largest part of the 1,400-page plan is a proposal previously known as the “Endless Frontier Act.”

Also exist an amendment, that provision from Schumer and Sen. Todd Young, R-Ind., would give new life to the National Science Foundation, appropriate $81 billion for the NSF between fiscal 2022 and 2026, and establish a Directorate for Technology and Innovation.

-

Shit already hit the fan - you will need to wait for sub 5nm chips at least 3-4 more years

TSMC and Samsung have recently begun adopting ultra-hard ultraviolet lithography with the adoption of 7nm and 5nm technologies, although it was initially thought that this transition would begin with 32nm technology. The laser wavelength used in lithography was 193 nm (DUV) for many years, and in EUV lithography it had to be reduced to 13.5 nm.

The next technological stage should be the transition to EUV lithography with a high refractive index (high-NA EUV). Reducing the laser length from 193 to 13.5 nm as part of the migration from DUV reduced the refractive index from 1.35 to 0.35. The transition to the next stage in the development of EUV lithography should slightly raise this figure to 0.55, which is still very low. This will further reduce the size of the transistors without excessively increasing the number of photomasks.

ASML announced at the January reporting conference that it was delaying the implementation of the new version of EUV for at least three years. Previously, it was believed that the technology will be mastered by 2023, and now the introduction of the EUV version with a high refractive index value is postponed until 2025 or 2026.

-

The global semiconductor shortage, disrupting the automotive industry and threatening the supply of consumer goods, will last for at least a year. This was announced by the Singapore-based company Flex, which is one of the largest contract electronics manufacturers.

Flex's outlook for shortage ends is one of the bleakest since semiconductor supply disruptions faced by manufacturers around the world.

“With such high demand, the end of the deficit is expected in mid to late 2022, depending on the product. Some expect the **deficit to continue into 2023*, ”said Lynn Torrel, chief procurement and supply chain specialist at Flex. She also noted that semiconductor manufacturers, with which Flex works, have canceled their forecasts for the timing of the end of the shortage.

Semiconductor industry just needed this big extra money, so they created all the spectacle.

Note that shortages are in the industries that had been always very accurately planned. But such industries also make something you can't live without, so they can rip each and everyone.

-

Addition on new ASML scanners

The current instrument for deep ultraviolet lithography is ASML NXE: 3400C, and the next generation high-NA EUV lithography scanner will be ASML EXE: 5000. It will be equipped with completely new 0.55 NA optics,

One high-NA EUV scanner will cost about $ 300 million (current generation ASML scanners cost about $ 180 million each). Perhaps it will become the most expensive industrial appliance in the global economy.

Samsung, TSMC and Intel are gradually moving to 7 and 5 nm technology nodes using ASML NXE: 3400C scanners. According to the available information, in the 7 nm process technology, one pass with a 40 nm step is enough, but already in 5-nm chips, the same TSMC uses a 30 nm step, which is close to the physical limit at this aperture.

-

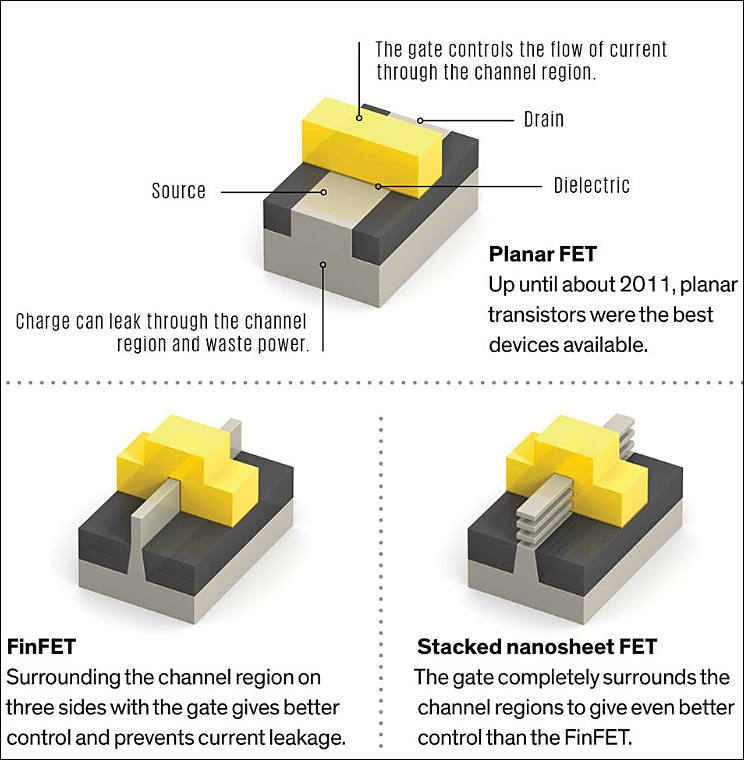

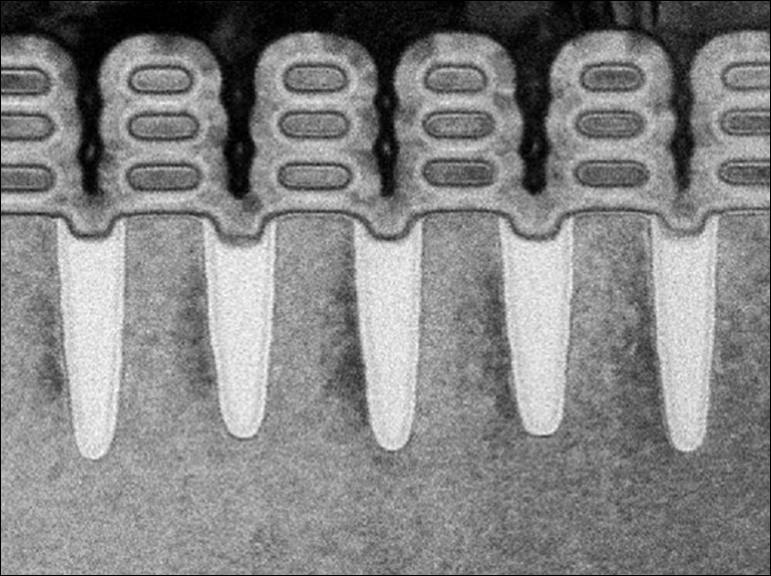

Nanosheet FET transistors

sa17414.jpg771 x 576 - 81K

sa17414.jpg771 x 576 - 81K

sa17413.jpg744 x 760 - 79K

sa17413.jpg744 x 760 - 79K -

US news

Of the $190 billion in spending laid out in the bill, more than $50 billion is available to "increase U.S. production and research into semiconductors and telecommunications equipment," with $2 billion focused specifically on chips used by automakers.

Now they are directly using peoples pocket.

-

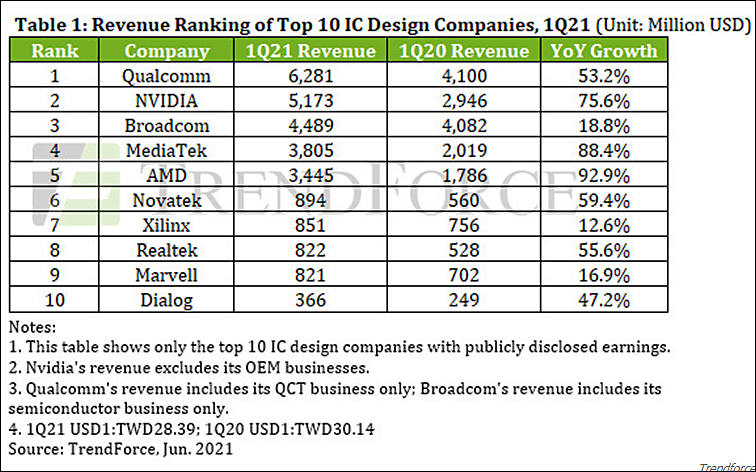

Unstable shipments of Intel's recently introduced Tiger Lake-U Refresh processors, coupled with the ongoing shortages of certain ICs, will put pressure on the supply chain in releasing notebooks with the new processors in the third quarter of 2021, according to industry sources.

Intel also needs money.

-

Intel CEO Pat Gelsinger said that he expects 10 “good years” of growth in the semiconductor industry during a panel at CNBC’s Evolve conference on Wednesday.

“We believe the market, the world, is in a very expansionary period,” Gelsinger told CNBC’s Jon Fortt. “I predict there’s 10 good years in front of us, because the world is becoming more digital, and everything digital needs semiconductors.”

This is not some accident, as such guys start to talk about "10 good years" you need expect wall being hit at any moment now.

Only in past year this guys already scammed world for more than 100 billions, and I am not counting almost same amount they got free from taxpayers pockets.

-

No, they seriously need your money

A group of bipartisan lawmakers on the Senate Finance Committee have introduced legislation that seeks to incentivize chipmakers to manufacture their silicon in the US. The Facilitating American-Built Semiconductors Act would provide companies with a 25 percent tax credit when they invest in domestic semiconductor manufacturing equipment and facilities.

According to the panel, as much as 70 percent of the cost advantage overseas chip foundries offer come on the back of foreign subsidies. The proposed subsidy would be in addition to the $52 billion the Senate earmarked last week as part of the US Innovation and Competition Act.

Interesting facts, isn't it?

All over the world government criminals go into people pockets to make super profitable chip makers at the others expense to later just steal this money and live posh life.

-

TSMC is set to move N4 (namely 4nm process) to risk production in the third quarter of 2021, while its N3 technology development is on track with volume production scheduled for second-half 2022.

Both so highly advertised processes want to keep same FinFET transistors and keep all the heavy logic areas on almost same size.

Also it is not clear how soon or if at all TSMC will propose full performance variants of tech.

TSMC 5nm still exist only as totally limited mobile only thing, where it is only Apple that special integrated chips that can use it.

-

Taiwan-based IC design houses, including first-tier players and those specializing in LCD driver ICs and MOSFET chips, have been notified by their foundry partners about another price hikes starting July 1.

You will see the wall meetup in slow motion soon.

-

Sales of smartphones in the China market remained lackluster in May, with related shipments declining 31% from a year earlier to 22.6 million units in the month, according to data from the China Academy of Information and Technology (CAICT).

As we can see shortage of chips is artificially made thing.

-

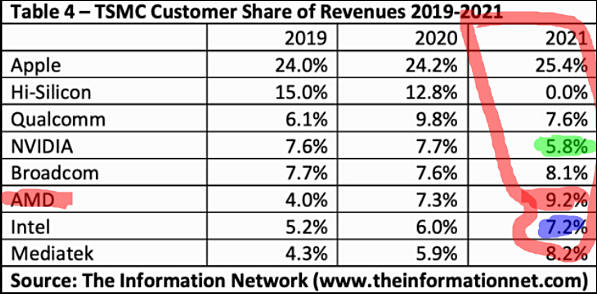

TSMC alone accounts for 92 percent of the supply of cutting-edge chips, with Samsung providing the rest. The company also reportedly makes about 60 percent of the chips for car manufacturers around the world. Which means that when those companies run out of capacity, there’s not a lot of other places to go to get those processors.

Imperialism, the last stage of capitalism.

Demise era.

-

The existing shortage of chips in the electronics market will continue to worsen and will peak in the second half of this year, said Intel CEO Pat Gelsinger. He told about this in an interview with Bloomberg.

“I don't think the chip industry will return to a healthy balance of supply and demand by 2023, I think things will get worse in a wide variety of industries before they get better."

-

At the beginning of 2019, Samsung Electronics hoped to implement a 3nm process technology in the 3GAE variety by the end of 2020 at the pilot production stage, and by the end of 2021, move to mass production. Compared to 7nm technology, the plan was to increase the switching speed of transistors by 35%, reduce power consumption by 50%, and the density of the transistors was to increase by 45%. The targets are currently revised downward. For example, the gain in speed has been reduced to 10%, the increase in density has been reduced to 25%, and in terms of energy consumption, progress has deteriorated to 20%. Informed sources report that the appearance of 3-nm serial products in the performance of Samsung will have to wait until 2024.

Its the wall.

-

Nikkei Asian Review cites recent comments from Huawei CEO Catherine Chen. The Chinese giant is determined to continue developing semiconductor components in-house, she said, and the HiSilicon division will not undergo any restructuring or downsizing. In 2020, the number of HiSilicon employees exceeded 7000 people.

This is interesting.

-

Secret of auto chip shortages revealed

IC foundries including TSMC, United Microelectronics (UMC) and Vanguard International Semiconductor (VIS) have signed supply contracts with their automotive customers for orders set to be fulfilled in 2022 and 2023.

Manufacturers will pay big money in advance. As IC guys need lot of money, tens of billions now.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320