-

sa6515.jpg800 x 600 - 74K

sa6515.jpg800 x 600 - 74K -

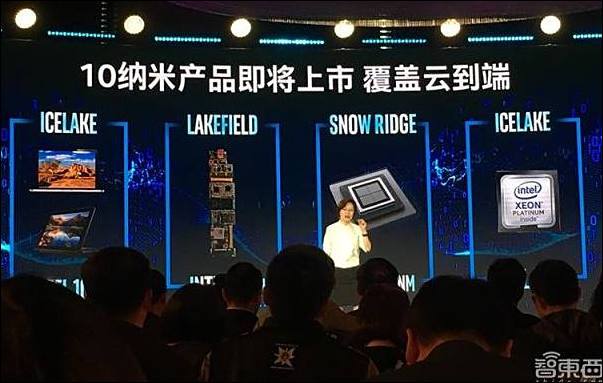

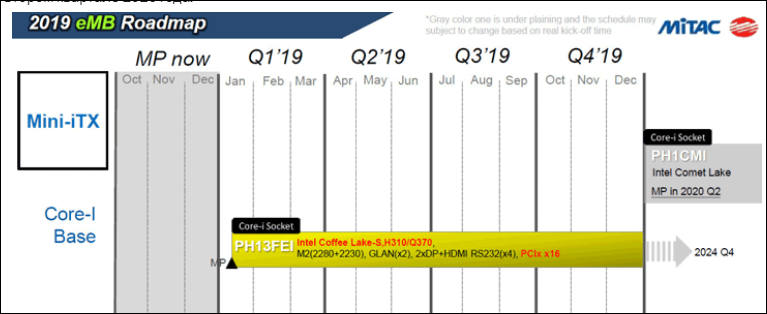

Intel still not fully sure if it can make 10nm in 2019

sa6811.jpg719 x 257 - 117K

sa6811.jpg719 x 257 - 117K -

Industry insiders tell that GlobalFoundries will be completely sold part by part to different manufacturers, their top assets can be bough by companies who still in this rat race.

-

Rumors are that we can hear some bad news during 2019 concerning 5nm process and such

Top investors are pulling out of industry. Mubadala Investment sold all AMD stock.

Now it become known that Vision Fund that belong to Softbank fully sold their $4 billion stocks package, even bearing some losses due to NVidea stock price drop.

2019 can be first year where all industry will hit the wall and will be faced with rising costs and fewer sales. -

TSMC 7nm process can actually have issues

Rumors are that costs of TSMC production is still pretty high and suitable for top smartphones only.

AMD new Radeon shortages are related to this.

Same as postponing new Ryzen release, industry rumors are that actual CPUs release will be divided by stages with only top price CPUs coming around September-October and most popular ones can be shifted up to December.

AMD mass market GPU Navi chips release will be also shifted to November-December on even to after 2020 CES.

-

Industry new rumors

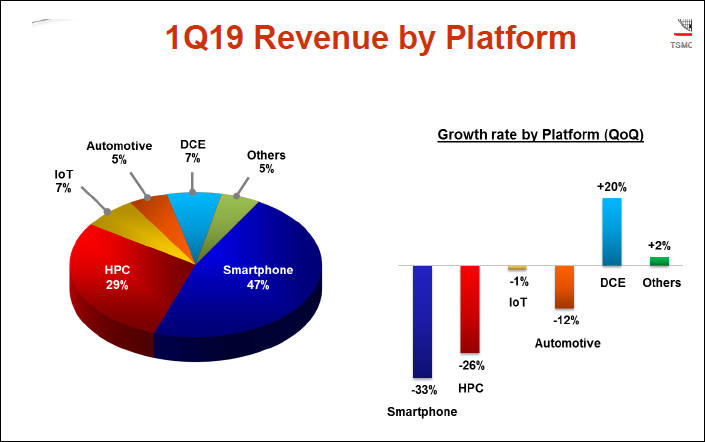

Despite the optimism about its 7nm chip sales, TSMC expressed caution about the foundry's overall operations citing factors on a macro level. The foundry expects 2019 to be "a slow year" for its business and also the global chip sector. It forecasts that the foundry segment will register only flat growth.

Small industry rumors leaks suggest that actual price for 7nm product is very high due to very low yields still. Issues with 7nm process can be real reason behind too big prices for iPhone and Samsung smartphones, as well as Radeon VII. In case of really lower prices they had no chances to supply the product.

-

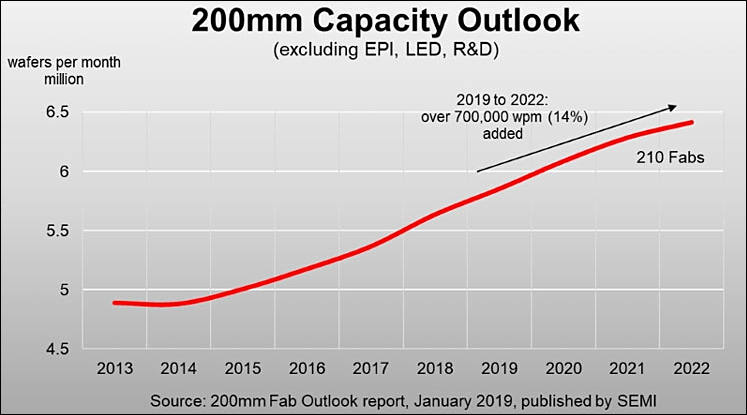

200mm Wafer production rise as sign of issues

Start of trend on this curve exactly coincide with Intel 14 first issues and inability to move to 10nm fast.

Also everywhere in industry you can see old equipment being put back to work. As specialists do not expect any real progress soon.

sa6990.jpg747 x 415 - 41K

sa6990.jpg747 x 415 - 41K -

For five decades, there have been amazing improvements in the productivity and performance of integrated circuit technology. While the industry has surmounted many obstacles put in front of it, it seems the barriers keep getting bigger, IC Insights noted. Despite this, IC designers and manufacturers are developing solutions that seem more revolutionary than evolutionary to increase chip functionality.

TSMC's 5nm process is under development and scheduled to enter risk production in the first half of 2019, with volume production coming in 2020. The process will use EUV.

It'll be big wall, not barriers. Because as soon as real improvement will stop they won't be able to use usual practice or ramping up volume and/or price.

Already buyers of premium smartphones are mostly paying for slow progress we can observe. Intel also specially made price hike to try to inject more money (as it is only thing that current management understand).

-

Intel 10nm mass production can be shifted further into 2020

Rumors started spreading that in the fall of 2019 we can see another false start of Intel 10nm process. Yields are still really horrible without any light in the tunnel ahead.

In the fall we can see release of 2-4 processors with really high prices to make supply volumes fit existing production. -

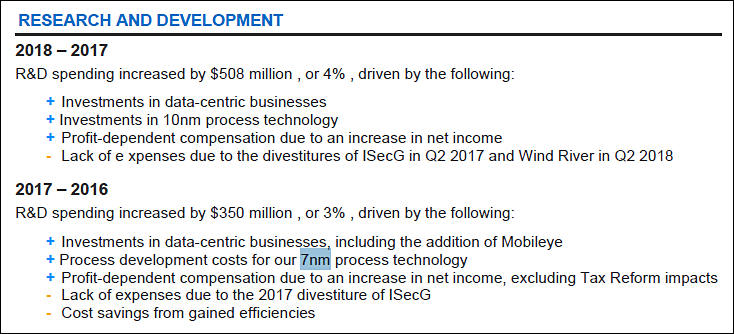

Intel spent 29 billions in 2018 on 10nm and related things, this is up from around 12 billions that was enough during days of first 14nm chips.

And results are really disappointing, number of defective chips is still at 90-99%.

-

Industry rumors are that Samsung is talking to buy most GlobalFoundries assets. Same as I said before already.

-

Intel develops their own 7nm process, but have even worse results than 10nm

sa7232.jpg734 x 334 - 78K

sa7232.jpg734 x 334 - 78K -

The semiconductor roadmap could extend a decade to a 1-nm node or it could falter before the 3-nm node for lack of new resist chemistries.

People now talk about disturbing uncertainties that are natural outgrowths of the many challenges perpetually appearing on the path to next-generation chip.

One of the next big challenges is brewing more sensitive resist materials for the 3-nm node. Today’s chemically amplified resists (CARs) “are OK for the current and maybe next generation, but we’d like new platforms,” said Tony Yen, a vice president at ASML.

The resists are one way to reduce random errors known as stochastics, an old problem but one raising its head aggressively as engineers push toward the 5-nm node. Yen was bullish that ASML will deal with the defects that threaten yields.

Phillipe Leray, a metrology specialist at imec, was less optimistic. “We have to tackle the defect challenge in the near future,” he said. “Time is running out, and I don’t see any solution around the corner.”

The challenges are so steep that engineers are widening the scope of solutions they are considering in every area of chip technology. “We are looking at just about everything in advanced patterning,” said consultant Erik Hosler, noting that EUV emerged from the advanced patterning section of the conference that he now helps oversee.

Moving to 450-mm wafers and 9-inch reticles is one of the few areas not worth pursuing given the cost and limited payback. “We had an extensive 450-mm effort years ago, but you need a whole ecosystem, and without it, we won’t drive that change,” said Rich Wise, a technology manager at Lam Research.

“We are making progress, but we can extrapolate to where features are less than the diameter of a silicon atom, so lithography-driven scaling will come to an end,” said Harry Levinson, a lithographer with AMD and GlobalFoundries for more than 30 years.

“Limits do exist, but the best way around them is to change the paradigm,” said Chris Mack, a veteran consultant and author on lithography. “The brick wall is often in our own minds — innovations can move it and then we repeat the process of pushing.”

Almost all will be talking about brick wall one year from now and in two years all main industries will hit it.

-

Intel will continue to maintain its 14nnm process. Although 10nm process of Ice Lake will debut in the second half of 2019 it will stay limited to notebook computers (U and Y series first).

And even in 2020 all desktop computer CPUs will remain at 14nm.

It is real tragedy.

Expect more doom and gloom news soon about TSMC new process. Industry rumors are that Apple and Samsung are around 8-16 months from total stop of LSI process shrinkage and it'll be tragedy for high end smartphones. And same tragedy for all semiconductor industry, as buyers of smartphones now pay for around 70% of all progress expanses, any slowdown or sharp downturn can mean massive issues.

-

Although Intel has announced its 10nm Ice Lake will begin mass production in the second half of 2019, Digitimes Research's sources from the upstream supply chain has revealed that there are still many issues with the CPU giant's mass production schedule for 10nm process.

Intel previously said that its new 14nm Comet Lake would have a performance not worse than Ice Lake. Digitimes Research believes Intel could shift its investments directly to 7nm process development, skipping 10nm.

Things are bad, really bad.

-

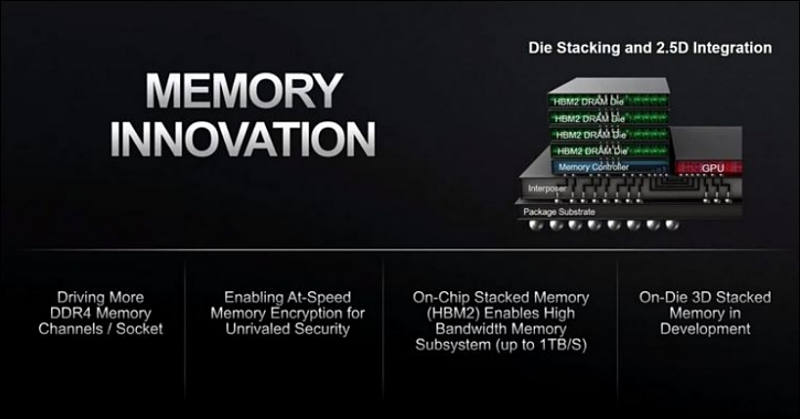

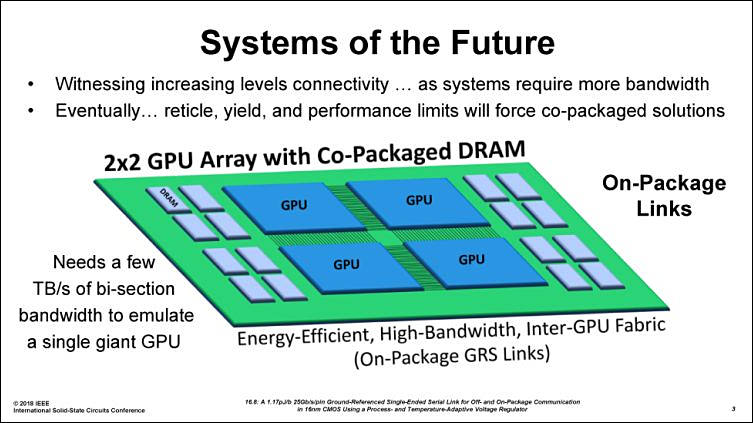

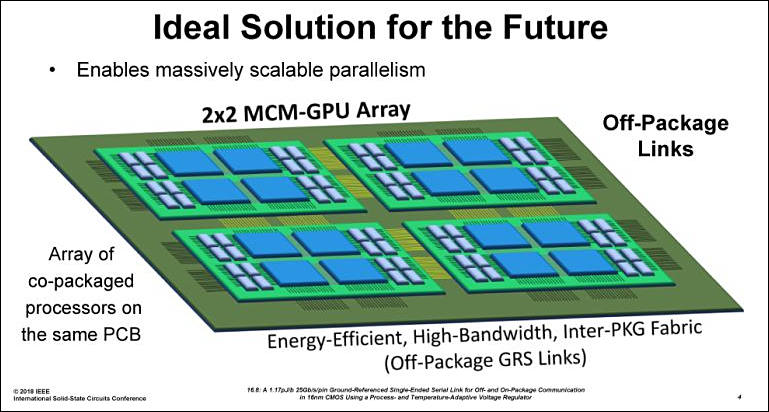

Unfortunately 3D stacking has huge issues in case of CPUs

-

3D stacking of RAM and NAND is nothing new, for example it had been used in lot of Panasonic cameras.

But almost all new cameras not using it.Issue is heat dissipation, you can't stack RAM on top of desktop processor, as this is thing that managers keep telling to investors to calm them. Not only your processor frequency will need to drop a lot, but you will also get lot of issues with memory as need to move back to much larger elements to keep it stable.

Intel will certainly try something like this in the low end, Atom power level chips, and may be Y chips. But even in U chips it will be issues.

sa7480.jpg800 x 535 - 36K

sa7480.jpg800 x 535 - 36K

sa7481.jpg800 x 419 - 35K

sa7481.jpg800 x 419 - 35K -

Intel keeps having huge issues with 10nm, and this year we can see only minimal volume products - small notebooks U/Y processors, few Xeon chips that will be shipped in reality in 20202 at best and few paper announcements of Lakefield and SnowRidge chips.

Intel also cuts most of their high qualified info systems staff and transfer all support of it to Infosys who uses low qualified Indian remote contractors. This will allow few top managers to get tens of millions of bonuses this year.

sa7734.jpg603 x 383 - 46K

sa7734.jpg603 x 383 - 46K -

New Xbox and Playstation are delayed till 2020 at least

TSMC is having issues with ramping up 7nm production and still don't have good costs for now. it is enough for premium products but not for profit limited ones.

We can see also very strange scenery with Ryzen 2 release. Some models can be available only months after announcement or even early 2020.

-

Intel 10nm high performance chips are not expected even in 2020

Next generation will be same 14nm with attempt to add another 2 cores.

-

The Semiconductor Industry Association (SIA) has disclosed semiconductor sales for February 2019 fell 7.3% on month and 10.6% from a year earlier to US$32.9 billion. Sales declined on both sequential and bases across all regional markets. February semiconductor sales in the Americas registered decreases of 12.9% sequentially and 22.9% on year, while those in China were down 7.8% on month and 8.5% from the same period in 2018

NAND and DRAM price drops play important role here, but any sales drop are very dangerous for industry where costs are exponentially rising. And it is no place for mergers already.

-

And here it is consequence of such lack of big progress

sa7839.jpg753 x 423 - 62K

sa7839.jpg753 x 423 - 62K

sa7840.jpg769 x 412 - 65K

sa7840.jpg769 x 412 - 65K -

AMD's 7nm CPU and GPU are expected to be adopted by Sony in its next-generation PlayStation and the processors are estimated to be ready in the third quarter of 2020 for the games console's expected release in the second half of 2020, according to industry sources.

The sources from the IC back-end services sector noted that the processors' packaging and testing will be handled by Advanced Semiconductor Engineering (ASE) and Siliconware Precision Industries (SPIL).

We have some issue with 7nm TSMC process companies try to cover up. And note - this process is very close to modern 14nm by Intel and much less advanced compared to 10nm that Intel fails to make working for last years.

-

TSMC expects 7nm process technology to account for more than 25% of the foundry's total wafer revenues this year.

TSMC has moved its N7 Plus process, namely 7nm incorporating EUV, to volume production,

The foundry is scheduled to begin risk production of chips using 6nm process technology in the first quarter of 2020. TSMC's N6 process delivers 18% higher logic density over the N7 process, with design rules fully compatible with N7 technology.

TSMC's 5nm process technology, development is well on track with customer tape-outs starting this quarter. The company expects to move the node to volume production in the first half of 2020. TSMC regards 5nm as "a large and long-lasting node". The initial ramp may be slower than that for the N7, but the foundry will manage to ramp up the N5 "quickly".

And may be really last one at mass market.

And warning signs are ahead:

sa8007.jpg705 x 442 - 37K

sa8007.jpg705 x 442 - 37K -

GlobalFoundries is being sold part by part now.

ON Semiconductor Corporation (Nasdaq: ON) (“ON Semiconductor”) and GLOBALFOUNDRIES today announced that they have entered into a definitive agreement for ON Semiconductor to acquire a 300mm fab located in East Fishkill, New York. The total consideration for the acquisition is $430 million, of which $100 million has been paid at signing of the definitive agreement, and $330 million will be paid at the end of 2022, after which ON Semiconductor will gain full operational control of the fab, and the site’s employees will transition to ON Semiconductor. Completion of the transaction is subject to regulatory approval and other customary closing conditions.

The agreement allows ON Semiconductor to increase its 300mm production at the East Fishkill fab over several years, and allows for GLOBALFOUNDRIES to transition its numerous technologies to the company’s three other at-scale 300mm sites. Under the terms of the agreement, GLOBALFOUNDRIES will manufacture 300mm wafers for ON Semiconductor until the end of 2022. First production of 300mm wafers for ON Semiconductor is expected to start in 2020.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320