-

i'm confussed. "in current capitalist economics we have crisis of demand that exceed crisis of production." wouldn't this cause prices to rise based on basic economics of demand > supply? How does "crisis" change economics.

Any reason for confusion? I mean that current capitalism has crisis of demand for oil caused by multiple issues one of them is huge debt. But it also have crisis of production caused not only by nature (it is main cause), but as we discussed here - also by financial issues.

Capitalists used their universal weapon to mitigate previous crisis times, to fix overproduction crisis with printing money and adding new debt. Unfortunately now it does not work, due to natural limits and also due to huge debt.

-

@Vitaliy_Kiselev i'm confussed. "in current capitalist economics we have crisis of demand that exceed crisis of production." wouldn't this cause prices to rise based on basic economics of demand > supply? How does "crisis" change economics.

-

Yes, but fortunately, there was just a chart up on the site about the low fuel densities of batteries, flywheels, and old vine bottles, so I figured they were safe to omit. :-)

-

Thanks for detailed answer.

Peak oil (and peak resources) is not my theory, it is scientific theory that for now proven be very accurate. You can even get conventional US oil and see good match.

You did not get any point of view from newspapers or big news sites. It is just well paid articles depicting various interests of big capital with some small spice of some editorial stuff made after bad day full of vodka. :-)

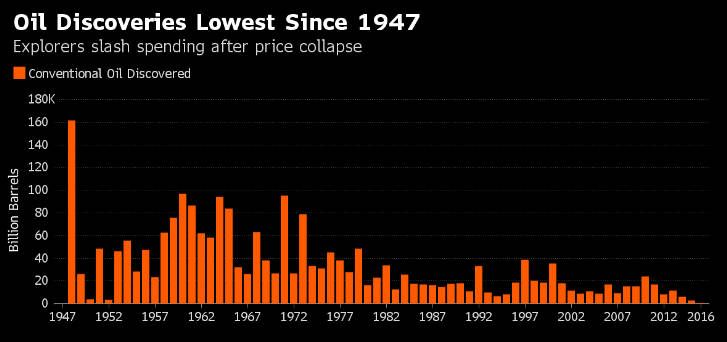

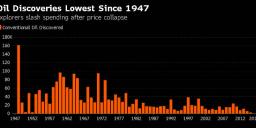

You continue to focus on obvious statement that lower oil prices in capitalism lead to less proven oil discoveries. I never told that it is not true, quite opposite. I just stated that it is not important on general scale.

Chart also does not include coal, wood remains and old vine bottle discoveries. :-)

-

@Vitaliy_Kiselev - I've been reading your posts about peak oil for several years now. I'm very interested in that topic though not yet entirely convinced. One of the reasons I keep checking in on PV is for this point of view that is very different from what I typically get. (I thoroughly read four papers and news services each day, plus copious other reading.) From my other posts, you may have noticed that I seek out multiple sources and try to apply critical thinking. So my main point on this low is simply that I don't think one can extrapolate a useful trend from it simply because of the unusual circumstances of the low oil price last year. To me that neither supports nor refutes the idea of a peak oil scenario -- it simply is a useless data point.

If you look at the Bloomberg chart you cite ( http://www.bloomberg.com/news/articles/2016-08-29/oil-discoveries-at-a-70-year-low-signal-a-supply-shortfall-ahead ), the past few years definitely drop off precipitously, but then, you can also see a cyclical pattern with a fairly flat trendline since 1980. (Note, 2016 is only showing figures through August, not all year.) If you look at the next chart in the Bloomberg report, it shows a precipitous drop in spending on exploration.

I was curious how these charts corresponded, so I overlaid one on the other with the same year scale (attached). A couple of things seem clear from the chart. First, there is a very clear reduction of new reserves discovered compared to the number of exploration wells sunk -- in other words, we're getting much less oil from each exploration well dig (which supports your peak oil theory to a degree. I do recall the charts you've shared about diminishing returns of energy extraction costs versus energy received, which is frightening.) Also, there is some mild correlation between number of wells sunk and new reserves discovered. But the huge drop in new exploration since 2014 can't help but play a significant role here.

One thing that's missing from the discussion though is that these new discoveries shown in the chart are only conventional drilling -- the chart does not include Canadian tar sands or fracking, so it doesn't tell the whole story.

oil-correlation.jpg1200 x 707 - 131K

oil-correlation.jpg1200 x 707 - 131K -

Of course decreased investment is a major factor in why so little new oil was discovered last year. There may be other factors involved, but you can't discount the record low investment in exploration for new reserves.

Check my previous response.

Real issue is not investments, recent big oil prices did not help discoveries much. Issue is natural limits.

There certainly is a glut of pumped oil right now, compared to current demand and storage capacity. It's a little upsetting to see so many oil nations open the pumps to maximum in an attempt to make up for revenue lost due to the low oil price. They're undermining their own efforts and increasing wasteful consumption at the same time.

Believe me, and I check this things for many years, it is now shortage of oil. And issues are severe. In normal economics you can not have "too much" energy and basic resources, it is nonsense.

Thing that you want to express is that in current capitalist economics we have crisis of demand that exceed crisis of production.

img1302.jpg727 x 342 - 38K

img1302.jpg727 x 342 - 38K -

@Vitaliy_Kiselev - Of course decreased investment is a major factor in why so little new oil was discovered last year. There may be other factors involved, but you can't discount the record low investment in exploration for new reserves. ("It was a terrible year for mushrooms--I didn't find a single one." "How much time did you spend hunting them?" "None at all, but that's not a factor.")

If those numbers came in during a year of US$70-100/b prices, they would be extremely sobering, however, as it is, the low exploration is a real outlier from previous years and makes it difficult to extrapolate any real trend in new proven reserves out of these numbers. (In my opinion.)

There certainly is a glut of pumped oil right now, compared to current demand and storage capacity. It's a little upsetting to see so many oil nations open the pumps to maximum in an attempt to make up for revenue lost due to the low oil price. They're undermining their own efforts and increasing wasteful consumption at the same time.

-

It is really scary.

-

Don't hold your breath waiting for a fusion reactor. They still have no clue how to contain the reaction.

-

It is sad to disappoint you, but reality bites. While investment really decreased most of issues are not related to it.

There is an energy glut at the moment. There are serious people in Houston, the energy business capital of the world, who do not believe oil will ever go above $60 again. With both Thorium fission reactors and Lithium-Tritium fusion reactors coming on line in the next 20 years,

Thorium reactors won't be build in next 20 years, as even research reactors are not finished. And all of them have huge issues.

And, of course, there is no "energy glut" at the moment.

-

There's a reason it is so low. There is an energy glut at the moment. There are serious people in Houston, the energy business capital of the world, who do not believe oil will ever go above $60 again. With both Thorium fission reactors and Lithium-Tritium fusion reactors coming on line in the next 20 years, oil and gas as energy sources will disappear, except for jet fuel. Even that might go away with the advent of new engine technologies.

-

No one is investing much in discovering new wells with oil at <US$50 / barrel.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320