It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Micron will reduce the production of DRAM and NAND memory chips, writes The Wall Street Journal. The current market situation and, in particular, the decline in demand for this type of product, forced the American manufacturer of operational and flash memory to make such a decision.

Real face of capitalist scum.

-

State-owned Yangtze Memory Technologies Co. has seen US chip semiconductor equipment companies, including KLA Corp. and Lam Research Corp., halt business activities at the facility. This includes installing new equipment to make advanced chips and overseeing highly technical chip production.

The US suppliers have paused support of already installed equipment at YMTC in recent days and temporarily halted installation of new tools, the people said. The suppliers are also temporarily pulling out their staff based at YMTC, the people said. --WSJ

-

Yantze Memory Technologies Co (YMTC) manufactures flash memory for various manufacturers. The company was founded in 2016, it is growing rapidly and, according to the Biden administration, poses a “direct threat to American companies.” No one even tries to pretend that there is no question of ousting a successful competitor, everything is done extremely brazenly and openly. That is, American officials directly declare that they are hindered by YMTC, since it is eating away the market from the United States, and it is honestly impossible to compete with it.

So.... NAND is not much profitable for US companies.... And because of this they want to kill competition... Yeah.

-

This year, the third quarter was not associated with an upturn in business activity, and demand for solid-state memory continues to remain low. At the same time, manufacturers do not have time to proportionally reduce production volumes, and prices for NAND memory chips in the contract market, according to TrendForce experts, may fall by 30-35% in the second half of this quarter.

Previously, TrendForce analysts included in their forecast a decrease in prices in the futures market ranging from 15 to 20%. Decline in demand for consumer electronics, according to the authors of the forecast, next year will force manufacturers of flash memory chips to increase their activity to capture market positions. It will no longer be possible to increase revenue only by increasing production volumes, since the market is oversaturated with this type of product.

-

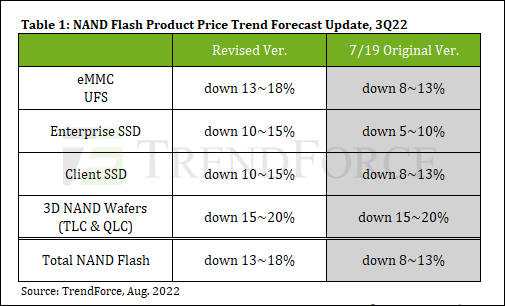

Analysts from TrendForce revised their forecast for a decrease in the cost of 3D NAND flash memory. If earlier a fall of 8–13% was predicted, now analysts are talking about a collapse to 13–18% by the end of Q3 2022.

In the client SSD segment, prices for 3D NAND flash memory are falling by 10-15%, analysts say. This will be supported by weak demand in the market for Chromebooks and laptops for educational purposes, as well as the growing consumption of more affordable products (SSD) based on 176-layer memory chips of the likely company YMTC, which, due to the rationale for their production costs, realizes output volumes.

The same 10-15% price reduction for 3D NAND flash is expected in the SSD market.

sa7231.jpg505 x 306 - 42K

sa7231.jpg505 x 306 - 42K -

NAND flash prices are being pushed up by Micron's and Western Digital's latest moves to increase their NAND flash prices by about 10%. While memory chip makers have been cautious about increasing output, semiconductor foundry house UMC has announced a plan to expand its fab in Singapore. Despite the Russia-Ukraine conflict, Taiwan's chipmakers see little impact on their supply chains.

-

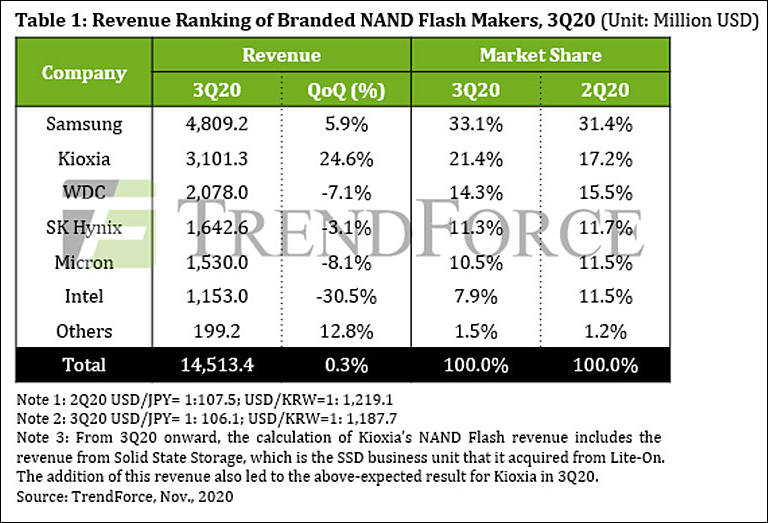

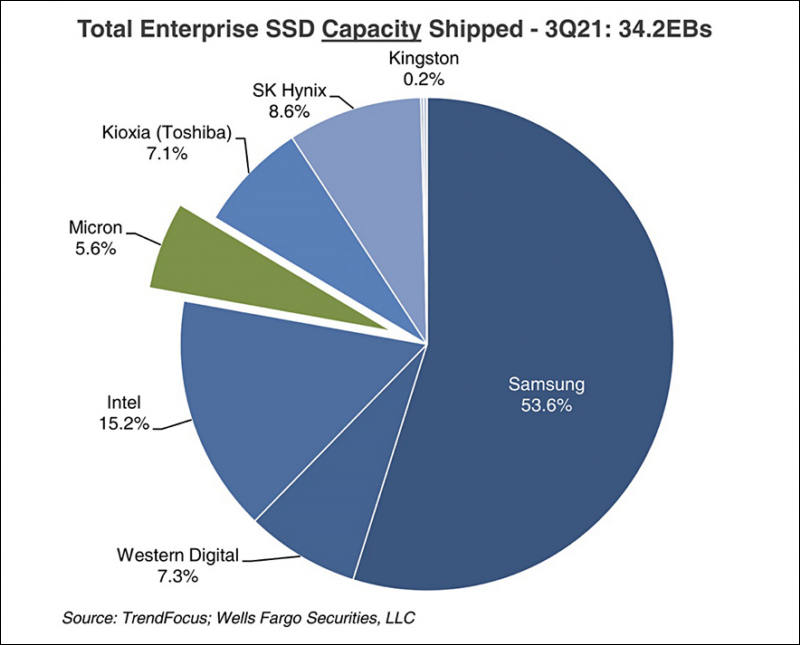

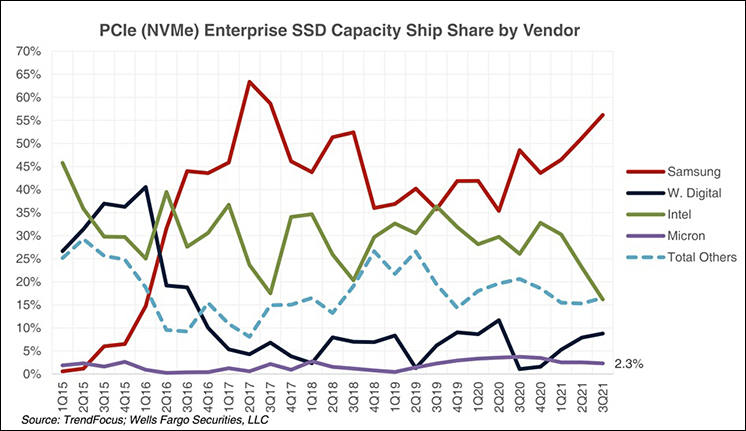

Samsung slowly becoming monopoly on enterprise SSD marker

sa19200.jpg800 x 645 - 47K

sa19200.jpg800 x 645 - 47K

sa19201.jpg746 x 431 - 57K

sa19201.jpg746 x 431 - 57K -

Samsung Electronics reportedly is mulling raising quotes for its own-brand SSD products in the first quarter of 2022.

-

According to the results of the current quarter, TrendForce experts believe that the cost of eMMC and UFS flash memory modules may grow by 5% on a quarterly basis. Consumer SSDs are projected to rise in price by 3-8%, while enterprise-class SSDs are projected to rise by 13-18%. Overall, the NAND flash market is expected to increase average prices of 5-10% for the current quarter.

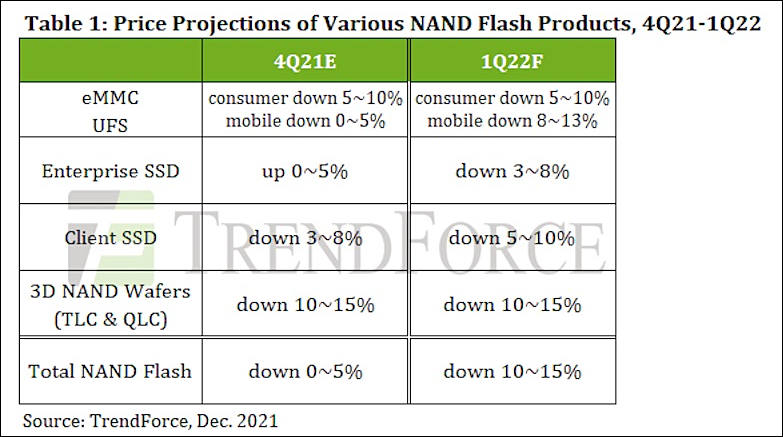

In the last quarter of the year, analysts expect prices to decline. In the consumer segment of eMMC and UFS, the decline may be 5-10% qoq, in the mobile segment - 0-5%. Client solid-state drives are expected to fall in price by 3-8%, while enterprise-class SSDs will continue to rise in price, showing growth of 0-5%.

Between October and December, inclusive, the overall average price reduction in the NAND flash market could be between 0% and 5% compared to the third quarter of the year.

-

NAND flash prices are expected to stay stable in 2022, but the supply of such chips is likely to turn tight in the second half of next year, according to Wallace Kou, president of Taiwan-based NAND controller vendor Silicon Motion Technology.

-

The global NAND flash memory market is expected to reach the balance of supply and demand in 2022, when the overall bit supply growth is expected to stay at about 30%, according to Wallace Kou, president for flash device controller specialist Silicon Motion Technology.

-

DRAM and NAND flash prices are expected to rise about 10% sequentially in the third quarter of 2021.

-

Contract market prices for NAND flash memory are poised to rise faster than those for DRAM chips in the third quarter of 2021, according to industry sources.

-

Adata Technology has enjoyed a strong pull-in of SSD orders since the start of April, particularly high-capacity SSD order.

Most orders are coming from new crypto scam users.

-

NAND flash device controller and module supplier Phison Electronics has raised its quotes for the second time this year to reflect rising foundry and backend costs, as well as costs of IC substrates and other related chip components.

-

The supply of NAND flash controllers remains tight, constraining shipments of eMMC storage devices and SATA SSDs, according to industry sources.

-

NAND flash prices are expected to register single-digit sequential increases in the second quarter of 2021, and then rise further modestly through the second half of the year, according to Silicon Motion Technology president Wallace Kou

-

PC OEMs are expected to increasingly adopt DRAM-less SSDs in their entry-level and mid-range models for cost reasons, according to industry sources.

DRAM-less SSDs are already being adopted by channel distributors, said the sources. With the supply of DRAM memory becoming tight, PC OEMs consider DRAM-less SSDs as an alternative to ordinary SSDs for their consumer-grade models including entry-level and mid-range notebooks, the sources indicated.

Major SSD controller suppliers including Marvell, Phison Electronics and Silicon Motion Technology have all offered solutions for DRAM-less SSDs, the sources said. Demand for such low-cost design is set to take off this year, when the overall SSD supply is constrained by shortages of related chips and components.

Most fun here is that almost all extra profits they will get by removing DRAM will go into useless things, instead of offering better products.

-

TrendForce analysts, who have a wealth of information on flash memory and SSD deals, have revised their previous outlook on prices for these products. They previously predicted that in the first quarter of 2021, the price of wafers with NAND chips will decrease by 10-15% in the quarter. The new forecast says that there will be no decline, and prices for flash platters will generally remain at the level of the fourth quarter of 2020.

-

NAND flash device controller suppliers including Phison Electronics and Silicon Motion Technology have stopped offering quotes for new orders, and are mulling a 10-15% price hike in the first quarter of 2021

Inflation coming.

-

The new iPhone 12 series that comes in 64GB, 128GB and 256GB options will consume 5-6% of the overall NAND flash memory produced in 2021, according to industry sources.

Overall smartphones take from 60 to 85% percentage.

-

Despite a continued rally in memory spot market prices, channel distributors in China continue to see disappointing SSD and DRAM module sales, according to sources at memory module makers

Who could have thought.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,991

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,367

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm101

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320