It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

The London-based company said that it plans a 10-fold increase in annual low carbon investments to $5 billion by 2030 as it tries to deliver on its promise of net zero emissions by 2050 and prepares for a world that uses much less oil.

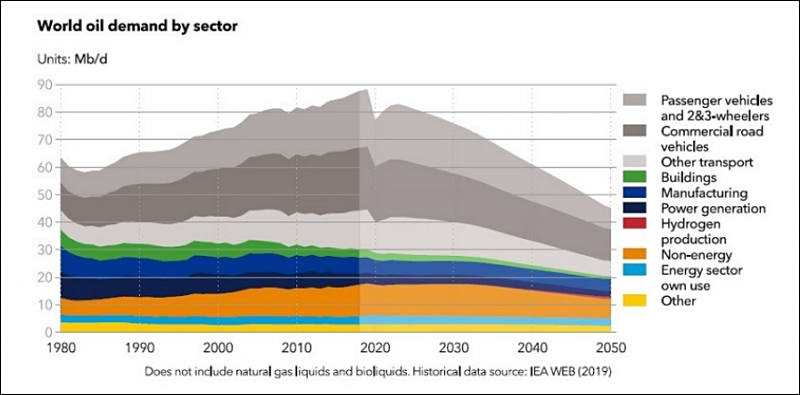

The company expects demand for fossil fuels to fall by 75% over the next 30 years if the increase in global temperatures is limited to 1.5 degrees celsius, or by 50% if warming is less than 2 degrees, BP head of strategy Giulia Chierchia told investors. BP said its oil and gas production will fall by at least one million barrels a day by 2030, a 40% reduction on 2019 levels.

The coronavirus pandemic has hammered demand for oil, gas and coal, with factories shut, planes grounded and motorists ordered to stay at home.

https://edition.cnn.com/2020/08/04/business/bp-oil-clean-energy/index.html

Ruling class want you to live in misery, cold and not much food (surprise - all present food low prices are due extreme amount of cheap fertilisers that are all made from oil or gaz).

Also, all the area required and resources for new solar panels will come from your present consumption and from the lands that are now used for agriculture.

Ruling class already authored deadly virus to keep energy usage and life level much lower and they won't stop, as they are now in desperate attempt to not being eliminated. We should help them to go ASAP where they belong - to the hell.

-

Denmark will stop extracting oil from the North Sea in 2050, the Danish government has said, adding it would cancel its eighth licensing round, announced earlier this year.

Denmark is not a particularly large producer of oil and gas, with its average daily output this year estimated at 83,000 bpd of oil and 21,000 of oil equivalent. Yet it is the largest in the European Union, which excludes Norway and, from next year, the UK.

The small Scandinavian country is also one of the most ambitious climate goal-setters. Copenhagen plans to reduce emissions by 70% from 1990 levels by 2030 and become carbon-neutral by 2050.

Ruling class always present their most horrible failures as their biggest achievements.

-

OPEC, Russia and other oil major producers reached an unusual agreement on production quotas on Tuesday, with Saudi Arabia committing to reducing its oil production by one million barrels a day and Russia and Kazakhstan winning relatively modest production increases.

To prop up the market, the Saudis volunteered to cut production by one million barrels a day — the equivalent of about 1 percent of world supply — to about 8.1 million barrels a day. That pledge came late and was not reflected in quota numbers published by OPEC after the meeting. The Saudis had been producing more than 11 million barrels a day at the peak of a price war with Russia last spring.

SA passed peak oil, just can't make it now.

-

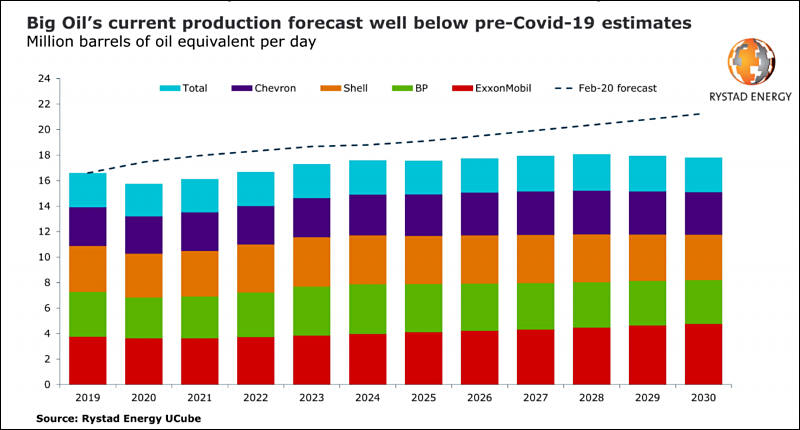

The downturn brought by the Covid-19 pandemic and the accelerating energy transition has created a new reality for the world’s oil and gas industry, whose production will peak lower and earlier than expected before the 2020 market crisis, a Rystad Energy analysis shows. The five integrated supermajors – ExxonMobil, BP, Shell, Chevron and Total – posted a combined record loss of $76 billion in 2020.

The major chunk of this loss, $69 billion, can be attributed to asset impairments and write-offs as the supermajors re-evaluated their strategy to focus on energy transition and become less dependent on petroleum. Their combined oil and gas output dropped by nearly 5%, or 0.9 million barrels of oil equivalent per day, in 2020 from the year before.

Lower emission targets and demand for cleaner energy have significantly impacted the long-term production outlook for the majors. Rystad Energy forecasts that the majors’ net production will be around 17.5 million boepd in 2025 and peak at around 18 million boepd in 2028, based on our latest revisions. For context, our internal forecast in February 2020 – before the shockwaves from Covid-19 – stood at 19 million boepd for 2025 and 20 million boepd in 2028.

“Last year has certainly tested oil and gas majors like never before. Some recovery can be expected in the near future as demand rebounds and oil prices cross the $60 mark. However, the key to success for the five majors over the next decade will be to strengthen their business in more resilient regions, restructure and resize to match the market needs, and pay back their high debt levels,“ says Rahul Choudhary, upstream analyst at Rystad Energy.

sa16547.jpg800 x 430 - 58K

sa16547.jpg800 x 430 - 58K -

Things are bad

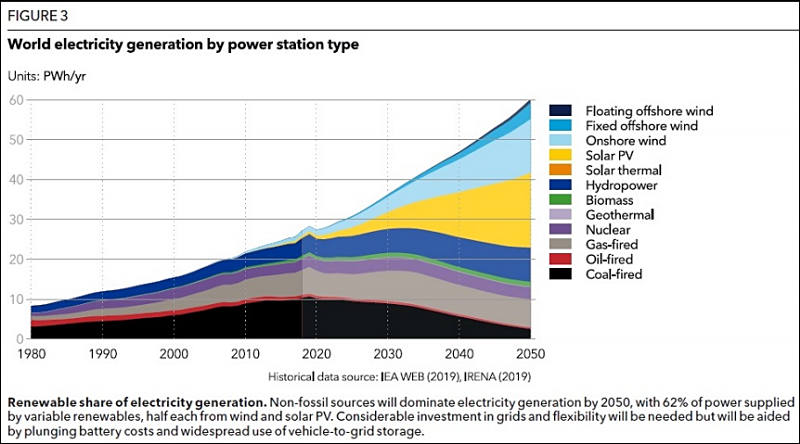

The Berlin Senate approved on March 2 the draft local solar energy law (Solargesetz).

Berlin wants to “make better use of the large solar potential” to meet 25 percent of the capital's electricity needs with solar energy generated in the city by 2050 at the latest.

This goal was formulated in the Action Plan for the development of solar energy in the capital of Germany "Masterplan Solarcity". It has been estimated that 4.4 GW of solar power plants will be needed to achieve this goal.

The law prescribes that photovoltaic generating installations must be installed on the roofs of new buildings, as well as existing buildings, the roof of which is subject to reconstruction. The requirements apply to roofs with an area of more than 50 meters.

At least 30% of the total roof area of new buildings and at least 30% of the net (net) roof area of existing buildings should be allocated for solar power plants. This will ensure that other uses for the roof remain possible. The expansive green roofs can also be easily combined with photovoltaic systems, the statement said.

It clearly won't be good as such measures can be used only in case of big energy issues due to extreme inefficiency and huge costs.

-

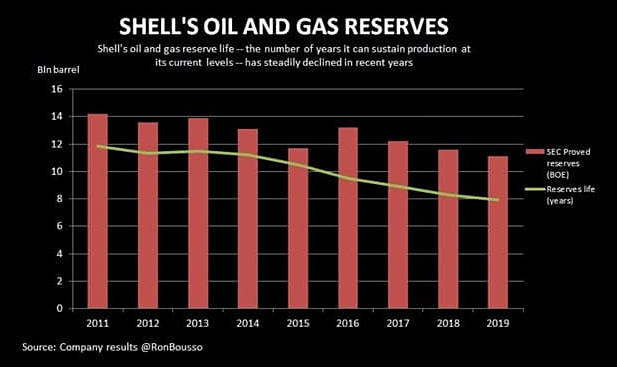

According to Citi, the overall average reserves in place have fallen by 25% since 2015, with less than 10 years of total annual production available. These issues appear to have been under-assessed by financial markets, with analysts unable to accept that the very future of IOCs is under threat.

National Oil Companies (NOCs) have managed to maintain their impressive reserves. Major producers such as Aramco, ADNOC, IOC, and NOC, are looking at reserve and production ratios that go beyond 25 years. If IOC production is culled or choked, the demand for oil from NOCs will increase substantially. Profit margins per barrel are also a major investment issue, as IOCs have been looking at the more challenging environments, such as deepwater, offshore, Arctic, or shale, while NOCs still have major conventional reserves in place.

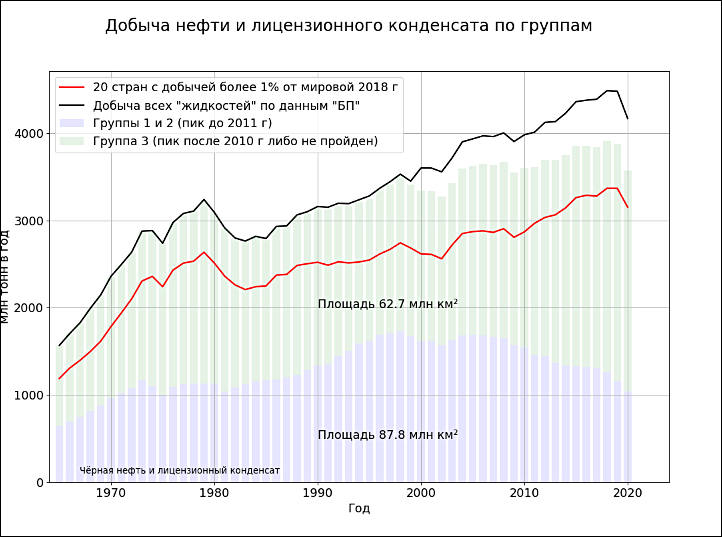

sa16974.jpg617 x 367 - 32K

sa16974.jpg617 x 367 - 32K -

At the end of March, US President Joe Biden invited the leaders of more than 40 countries, including the presidents of dark Mordor and China, to a video conference on climate change. Scheduled for Thursday, April 22nd, it will warm up ahead of the November World Climate Forum in Glasgow, the most important climate meeting since the 2015 Paris summit.

The White House notes that the current summit has several tasks:

- discuss reductions in harmful emissions to prevent global air temperatures from rising by more than 1.5 ° C;

- prepare a plan to mobilize funds to achieve zero carbon emissions from governments and private businesses;

- find ways to extract economic benefits from the implementation of the environmental agenda.

The topic of environmental protection is one of the key issues for the new American administration. During the summit, they will present a program to reduce carbon dioxide emissions over the next ten years. Biden's predecessor, Republican Donald Trump, withdrew US participation in climate projects and withdrew from the Paris Agreement.

It is one of the key things - reduce life level within US and also outside.

-

New York authorities have filed a lawsuit against oil and gas companies BP, ExxonMobil and Royal Dutch Shell, as well as the American Petroleum Institute. They are accused of misleading residents of the largest metropolitan area in the United States on issues related to climate change, according to a statement released Thursday on the official website of its mayor, Bill de Blasio.

The document emphasizes that the defendants "systematically and purposefully misled consumers in New York about the role their products play in triggering the climate crisis." These companies, as well as the American Petroleum Institute, a major trade and industrial association, according to the plaintiffs, "resorted to deception" in "competing with safer energy alternatives."

https://www1.nyc.gov/office-of-the-mayor/index.page

This is well beyond Goebbels level.

-

UN Secretary General Antonio Guterres said all OECD countries must phase out coal no later than 2030 in order to comply with the Paris Agreement on climate change.

The European Union's goal, agreed in December 2019, is to achieve net zero emissions by 2050. This means that Germany, Poland and the Czech Republic - the three largest coal burners in Europe - are under increasing pressure to switch to clean energy.

For these countries, abandoning coal is no longer only an ecological but also an economic imperative. CO2 prices in the EU carbon market have reached all-time highs in recent months, rising for the first time above € 40 per tonne in April, despite having been below € 10 for many years.

This makes bituminous and lignite - the most carbon-intensive energy source - increasingly unviable economically. A recent study by the think tank "Agora Energiewende" showed that most lignite plants in Germany, Poland and the Czech Republic will become consistently unprofitable in the second half of the 2020s.

Green fascist will be next guys hanged by the people.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,964

- Blog5,723

- General and News1,342

- Hacks and Patches1,151

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,361

- ↳ Panasonic990

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm99

- ↳ Compacts and Camcorders299

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras121

- Skill1,961

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips267

- Gear5,414

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,579

- ↳ Follow focus and gears93

- ↳ Sound498

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff272

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,319