It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

Prices inflation

sa18233.jpg756 x 389 - 36K

sa18233.jpg756 x 389 - 36K

sa18234.jpg747 x 461 - 58K

sa18234.jpg747 x 461 - 58K -

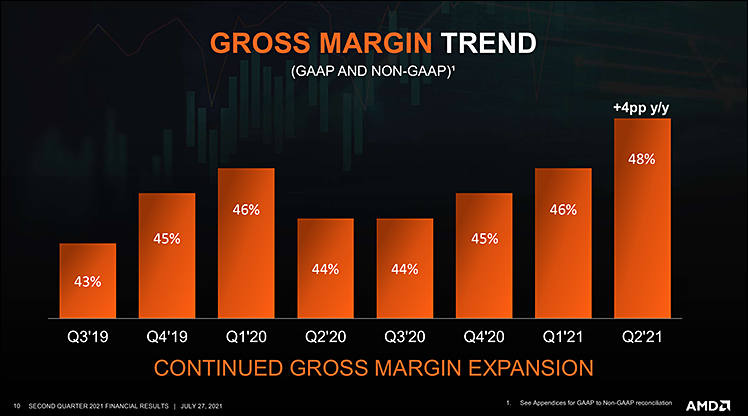

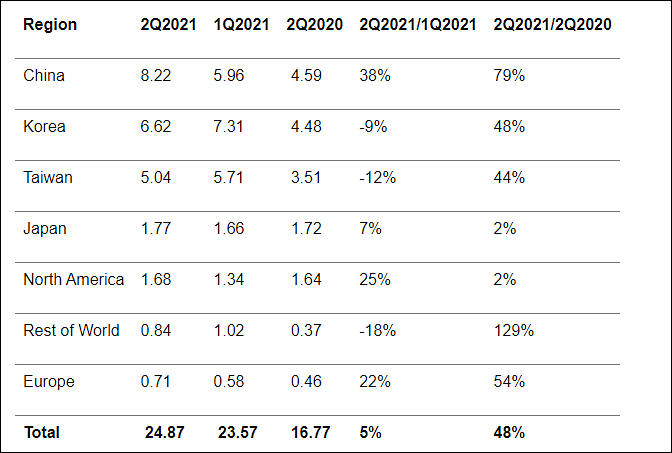

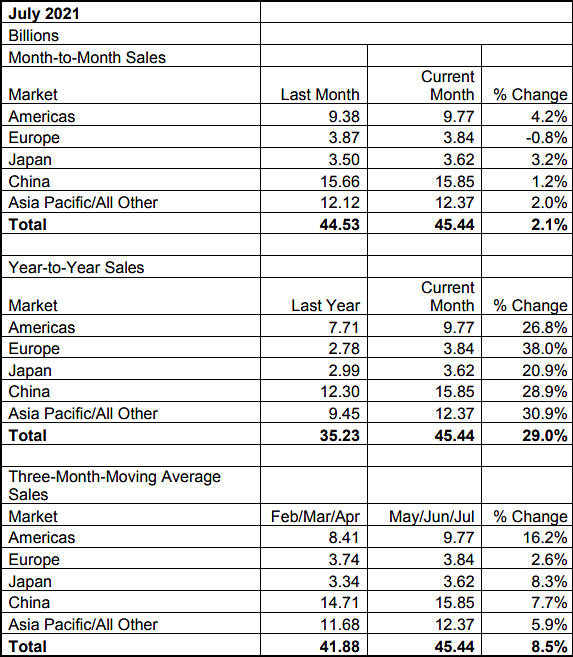

According to the SEMI association, which unites more than 2,400 companies involved in the development and production of semiconductor products, the cost of chip manufacturers for the purchase of equipment in the second quarter increased by 5%, and in annual comparison, the increase was an impressive 48%. If a year ago $ 16.77 billion was spent on these needs, then in the second quarter of this year, costs increased by 48% to $ 24.9 billion.

sa18214.jpg672 x 453 - 55K

sa18214.jpg672 x 453 - 55K -

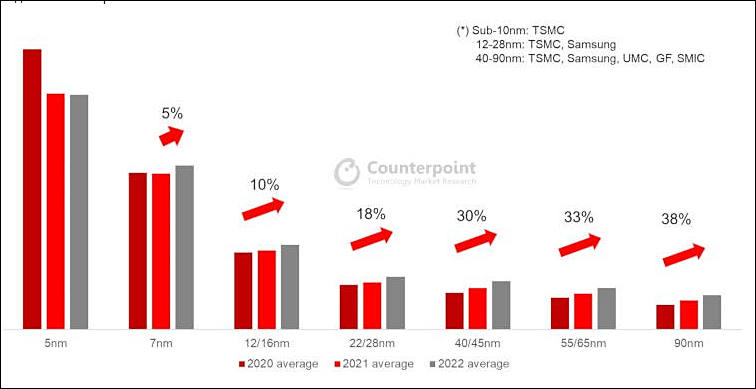

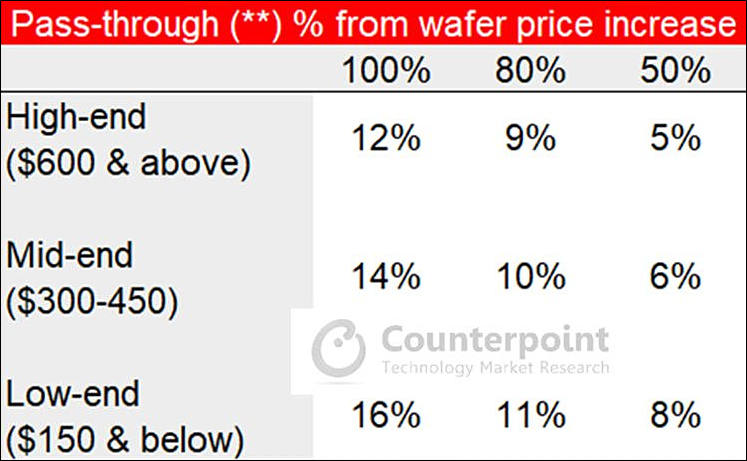

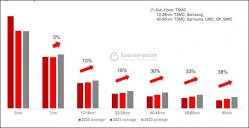

TSMC price hike - some are more equal than others

A number of resources note that for the largest customers of TSMC, the increase in prices will not be so significant. As the Taiwanese resource TechNews reports with reference to the information of the industry analyst Lu Xingzhi, Apple, being the largest customer of TSMC for the most advanced production processes, received special conditions - an increase in the cost of production by only 3%. Specific information about the conditions for other customers is not given, allegedly even AMD will face an increase of 10 ... 20%. However, the Liberty Times reported that the price increase for AMD will be 5%.

Monopolies.

-

Analysis of Qualcomm's quarterly reports showed that in the period from October last year to June, the company's current production costs increased by 60%, for MediaTek the increase was 64%. The revenues of both companies in this interval grew stronger, and only this allowed them to maintain acceptable business profitability.

-

Huge inflation on semiconductors market got out of control

sa18177.jpg573 x 657 - 109K

sa18177.jpg573 x 657 - 109K -

Samsung Electronics has not stayed away from this trend, and therefore over the past 12 months has invested approximately $ 238 million in the capital of small South Korean suppliers of materials and equipment to reduce dependence on imports.

Of the nine companies that Samsung has invested in, eight are public and the ninth is considered a division of another public company. In most cases, Samsung became a shareholder in these companies through the issue of new shares, the share of the Korean conglomerate in their capital does not exceed 10%. Directly the companies that received funds from Samsung intend to direct them to development and research.

Examples of activities that Samsung is interested in include the production of industrial gases used in lithography, as well as the production of protective coatings for photo masks or chemicals for etching silicon wafers.

The South Korean authorities are also ready to support domestic producers, the budget for next year provides for an increase in targeted subsidies by 9%

All of them need money, free money.

-

The quarterly report of Broadcom, as noted by Bloomberg, revealed a rather modest increase in the company's revenue against the background of competitors. In annual comparison, it grew by only 16%, to $ 6.78 billion, although Qualcomm increased its revenue by 63%, and NVIDIA - by all 68%. Broadcom CEO Hock Tan was forced to admit that the company is carefully filtering the volume of shipped products and their recipients, so as not to leave them without goods in the future.

We see real criminal scam here.

-

Monopolization is severe and became worse.

sa18137.jpg662 x 304 - 59K

sa18137.jpg662 x 304 - 59K -

Samsung and Key Foundry are set to raise prices for contract manufacturing of semiconductor chips in the second half of this year, South Korean newspaper TheElec reported. Both companies have already notified their clients that they are going to increase the cost of their services by 15-20%.

Issues are severe.

-

TSMC has confirmed that the mass production of chips using the 3nm process technology will not begin until 2023. This will affect customer product lines. In particular, the iPhone 2022 will be released with 4nm processors.

As reported by Nikkei Asia, citing its own sources, the first customers for 3-nm solutions from TSMC will be jointly Apple and Intel.

TSMC marketing machine also started to make issues.

-

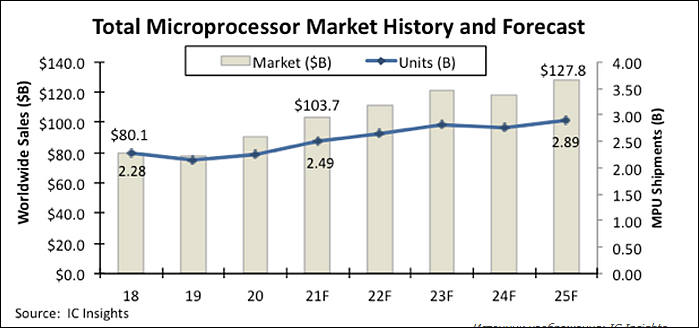

According to the latest report from analysts IC Insights, sales of microprocessors (MPU) amid increased demand for CPUs and SoCs this year will set a record and exceed the figure of $ 100 billion. Experts predict that shipments of these chips this year will reach 2.49 for the first time. billion units. Consumer and server processors account for 46.7% of all microprocessor sales.

sa18082.jpg699 x 328 - 38K

sa18082.jpg699 x 328 - 38K -

Samsung still faces hurdles in 3nm GAA process development, they have several technology issues, such as leakage and other crucial issues, in the development of 3nm gate-all-around (GAA) process technology, according to industry sources. Samsung's 3nm GAA process could also be less competitive than TSMC's 3nm FinFET technology in terms of performance and costs

-

Bitmain, one of the largest manufacturers of special purpose integrated circuits (ASICs) for mining and a supplier of products such as Antminer, has confirmed that Taiwan Semiconductor Manufacturing Co. (TSMC) has notified customers of a price increase for the production of chips.

"On August 25, TSMC announced to all its customers that it is raising the price by 20% for all technological processes," Bitmain said in a statement.

TSMC needs lot of money.

-

TSMC is poised to raise its quotes including those for advanced sub-7nm process technologies, which will result in more manufacturing costs facing Apple and other major clients, according to industry sources.

Nicer.

-

TSMC has notified clients an about 10% price hike for its sub-16nm process manufacturing, with the new prices set to be effective starting 2022, according to sources at IC design houses.

-

Another hikes coming

United Microelectronics (UMC) has notified clients prices for its 28nm and 22nm process manufacturing will be adjusted upward in September, November and January 2022

-

Price hikes can do magic:

The worldwide semiconductor market is forecast to surge 25% in 2021, according to the World Semiconductor Trade Statistics (WSTS). WSTS estimated previously a 19.7% increase.

Following 6.8% growth in 2020, the worldwide semiconductor market is expected to grow 25.1% to US$551 billion in 2021.

-

Samsung Electronics is unlikely to move its 3nm gate-all-around (GAA) FET technology to volume production until 2023.

In reality they have staggering issues with their present best process still.

-

IC shortage is disrupting production at many industry sectors amid tight foundry capacity. PC makers have disclosed that short supply of small ICs is expected to persist through 2022.

Capitalism is efficient! Make sure to remember this.

-

Apple has been TSMC's largest client, with its chip orders for the iPhone, iPad and Apple Watch continuing to account for more than 20% of the foundry's total wafer revenue, according to industry sources.

Interesting info.

-

A new wave of prosperity is taking place in the global semiconductor industry. Fabless chipmakers, foundries and backend houses have all seen their supplies fall short of customer demand, which is expected to persist through 2022.

-

TSMC is on track to move its 3nm process technology to volume production in the second half of 2022 for Apple's devices, either iPhones or Mac computers, according to industry sources.

3nm is the last marketing step before long pause.

-

Intel CEO Pat Gelsinger spoke about the company's plans to build a new plant in the United States. As part of the IDM 2.0 program, the manufacturer plans to build an advanced factory that will process silicon wafers and assemble chips using the latest technologies.

We are considering building a plant in the USA. It will be a very large complex consisting of 6-8 production lines. The cost of each will be about $ 10-15 billion. This is a 10-year project with a budget of $ 100 billion. 10,000 people will participate in the construction. They will create jobs for 100 thousand people. In general, we want to create such a small town.

-

Having already raised its quotes for 28nm process technology, TSMC has moved to maintain the prices throughout the second half of this year, according to industry sources.

Criminals.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320