-

Follows0Replies4Views2.4KWolfgang Petersen Dies at 81

-

Wolfgang Petersen, the German writer-director who surfaced in Hollywood following the triumph of his submarine masterpiece Das Boot to make the action blockbusters In the Line of Fire, Air Force One and The Perfect Storm, has died. He was 81.

Petersen died Friday at his Brentwood home of pancreatic cancer.

Das Boot is real masterpiece, as well as The Perfect Storm.

4 comments 5 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views1.0K

-

Follows0Replies0Views1.0KGermany: Food inflation

-

Agricultural producer prices in June 2022 were 33.9% higher than in June 2021. The Federal Statistical Office (Destatis) reports that the increase compared to the same month of the previous year is thus slightly lower again. In May 2022, the rate of change was +35.6%, in April 2022 +40.0%. Compared to the previous month, prices fell by 1.9% in June 2022. Prices for crop products (+35.7%), as well as for products of animal origin (+32.8%) increased significantly compared to the same month of the previous year, although not as much as in May 2022 (+36 .9% and +34.7% respectively).

The increase in prices for crop products this month is mainly due to grain prices. In June 2022, the increase in cereal prices was 59.3% higher than in the same month of the previous year. In May, the price increase was still 71.5%. Compared to the previous month, prices fell by 8.0%.

Prices for fruits fell, for vegetables, potatoes and rapeseed rose

Producer prices for fruits in June 2022 were 11.0% lower than a year ago. Price reduction was recorded for table apples from -16.2% and strawberries from -8.5%.

For vegetables (+2.9%), in particular, prices for cauliflower (+36.2%) and asparagus (+35.2%) increased. In May 2022, asparagus prices were still 21.0% lower than the same month last year.

Prices for table potatoes continued to rise in recent months: in June 2022, they increased by 116.1% compared to June 2021. In May 2022, the year-over-year change was +111.4%.

The commercial rapeseed crop increased by 41.2% in June 2022 compared to June 2021. Thus, the trend of the last few months has continued, but not as much as recently. In May 2022, the previous year's change was +60.8%.

Prices for animal products increased by 32.8%, and for milk - by 44.9%

Prices for animal products in June 2022 were 32.8% higher than in June 2021. The price of milk in June 2022 was 44.9% higher than in the same month of the previous year; in May 2022, it amounted to +40.4% year-on-year. Egg prices rose 28.2% in June 2022 compared to the same month last year, due in part to higher energy, transport and packaging costs.

Pet prices increased by 23.5% in June 2022 compared to June 2021. In May 2022, prices increased by 30.7% compared to the same month of the previous year. High prices here continue to manifest themselves, including as a result of the increase. Energy costs and feed prices.

Cattle prices were 22.8% higher in June 2022 and pigs for slaughter were 19.5% higher than the same month last year.

Poultry prices increased by 40.0% in June 2022 compared to June 2021, mainly due to the increase in chicken prices (+44.7%).

-

-

Follows0Replies0Views1.1KWar: On U.S. Chip and Science Act

-

Recently, the U.S. Chip and Science Act of 2022 (hereinafter referred to as the "Chip Act") was formally signed into law by President Joe Biden. The 1,000-plus-page bill gained notoriety from the very beginning of its drafting and was called by US politicians and the media "the United States' sharp weapon to win economic competition in the 21st century" and "the most significant government intervention in industrial policy in decades." It is clear that this bill is largely directed against China. Let's see in more detail.

First.

There is a historical and practical reason why the US is in a hurry to spend so much money on the chip industry: in the 1990s, the US chip manufacturing capacity accounted for 37% of the world market, but now it has fallen to 12%. The Chip Act is intended to encourage chip companies to return to the US to install new production lines, expand manufacturing capacity, and restart US chip manufacturing growth.

According to a White House statement, the bill would provide $52.7 billion in subsidies for U.S. chip manufacturing, R&D and training, a 25% investment tax break for companies that open U.S. chip factories, and over the next 10 years, about $200 billion has been allocated to the development of American research in the field of artificial intelligence, quantum computing and other areas. The total amount of funds provided by this Law is more than 280 billion US dollars.

The plan is grandiose, but its implementation implies a "carrot and stick" strategy.

The "carrot" is to receive money, which in the amount of 52.7 billion US dollars will be channeled through the "four major funds" to respectively stimulate the production of microcircuits, security development and innovation of microcircuit production, development and education of personnel in the field of microcircuit production , as well as to create special chips for national defense. The "whip" is directly aimed at China.

For example, the bill prohibits companies receiving US subsidies from significantly increasing production of advanced process chips in China for 10 years, and those who violate the ban could be required to return the entire amount of subsidies paid; the bill also prohibits recipients of federal stimulus funds from expanding semiconductor manufacturing capacity in "certain countries that pose a threat to US national security."

Simply put, receiving this subsidy means you will not be able to invest in higher-tier chips in mainland China for 10 years. A White House spokesman said the Chip Act is intended to encourage semiconductor manufacturers to invest more in the United States rather than China.

The problem is that chip production is an international industry, and all the leaders in this field are multinational companies. Many foreign media believe that the main purpose of the Chip Law is to force TSMC, Samsung, Intel and other multinational chip companies to "choose sides" between the US and China. Mainland China is the world's largest chip market. At present, TSMC has 16nm and 28nm chip factories in mainland China, Samsung has a memory chip factory in Xi'an, and SK Hynix, Intel, Micron and other companies have chip packaging and testing factories in China. In addition, many projects are planned in the country for the production of high-level chips according to the standards of 7 nm and 5 nm.

Once the law goes into effect, if these companies continue to expand their operations in China, they could lose out on huge US subsidies and be at a disadvantage compared to other US chip makers, and even face harassment by US law enforcement all along the manufacturing chain. . But if companies really listen and move their manufacturing facilities to the US, that would again be tantamount to giving up China's huge market opportunity. After all, this high-tech, high-value-added industry has always followed the cycle of "high investment in R&D - broad application in the market - investment in R&D".

Second.

Even before the bill was signed, all US chipmakers received letters from the US Department of Commerce demanding that they stop supplying China with equipment to produce 14nm and higher chips, according to the BBC. According to an analysis by China's semiconductor think tank Chip Research, the "Chip Law" is only a "pre-snack". The main goal is to form a "four-way chip manufacturing alliance" by including Japan, South Korea and Taiwan, which will be the key to curbing the development of the Chinese chip industry.

The transformation of the industry into a geopolitical weapon is clearly contrary to the laws of economics.

Over the past few decades, the chip industry has been largely globalized. Some advanced chips require over 1,000 processes such as etching, diffusion, and packaging to produce, requiring an average of over 70 cross-border interactions.

For example, one "specialized and new" enterprise was built in Shandong province. This company mainly manufactures high-temperature graphite containers, which are used for the production and purification of semiconductor materials. According to the head of the company, the more accurate the required characteristics of the product, the higher the requirements for the uniformity of container heating during high-temperature processing. After many years of research, the company has successfully produced ultra-high temperature high-purity vacuum gas furnace with independent intellectual property rights, which has achieved unique advantages in the market.

But acquiring technological advantage is not a solitary job. Now the company still has to import raw materials from its Japanese partners. Why? The chip manufacturing chain is very long, and it is not easy for one company to make improvements in its area without the cooperation of previous links in the chain. Only when all parties cooperate, realizing their comparative advantages and characteristics, can maximum efficiency be achieved.

The same goes for the international chip market. The United States is the world's number one supplier of semiconductor equipment, and EDA chip design software is also largely monopolized by the three American giants (Synopsys, Cadence, Mentor). At the same time, in raw material supply, manufacturing and other aspects, Taiwan, China, Japan, South Korea and Europe have their strengths.

The founder of TSMC recently made it clear that the production cost of the same chip in the US is about 50% higher than in Taiwan. If you develop the production of chips in the United States, then it will be "useless, wasteful and expensive."

Thus, the Chip Act, through "non-traditional safeguards", is forcing the expansion of US chip manufacturing capacity, not primarily for profit, but to ensure that they are not "caught up" and that they maintain an absolute advantage in development over China. To achieve this goal, the stability of global production and supply chains, including the United States itself, is being sacrificed.

In response to this "hegemonic concern," US companies, the media, and think tanks have raised many objections. During the drafting of the Chip Law, Intel actively lobbied for the US not to curb investment by chip companies in mainland China, fearing that "the bill would undermine the global competitiveness of subsidized companies." Bloomberg criticized the bill as "a huge waste of money." Some US scientists warn that no matter how hard the US tries to strengthen its manufacturing sector, it cannot be separated from the global supply chain.

Third.

Can the US win this brutal and selfish "chip war"? At present, virtually no international mainstream voice is optimistic about this "great gamble".

There are no free lunches. The Chip Act proposes $280 billion, but where will the money come from?

Continue to build up debt? Earlier this year, US government debt topped $30 trillion for the first time, the government deficit continues to widen, and re-borrowing could increase the risk of default on US government debt. Run a money printing press? The irresponsible policy of "financial easing" in the US has already led to serious inflation, the Fed has raised interest rates four times this year. How can money be printed again?

How about "digesting" this money by restoring our own economy? US Department of Commerce data shows that in the second quarter of this year, US GDP fell 0.9% year on year, declining for two consecutive quarters and falling into a technical recession. Although Pelosi has called the Chip Act "a major victory for American families and the American economy," in its current form, the massive $280 billion spending will place a heavy burden on the government and taxpayers, potentially exacerbating internal conflicts even further.

Astute people point out that industrial policies that are inconsistent with costs and benefits not only fail to spur entrepreneurial innovation, but tend to encourage arbitrage. Some opponents of the "Chip Act" in the United States predict that highly profitable local chip companies are more likely to use government subsidies to buy back shares and increase their value, rather than invest in R&D and building factories.

If the US insists on a hard technological break with China, it could cost US chip companies 18% of global market share, 37% of revenue and a cut of 15,000 to 40,000 high-skill jobs, Boston Consulting Group predicts, as subsidies, under the Chip Act do not cover the costs for companies to move factories from China to the US.

A few years ago, the Trump administration launched a trade war with China, turning a blind eye to the laws of the market, which in the end did not "make America strong again", but, on the contrary, harmed American businesses and ordinary people. There is nothing wrong with competition between countries in the field of science and technology, but this path must be the right one. Hoping to use the "new cold war in industry" to suppress other countries will only backfire.

-

-

Follows0Replies0Views963UK: Blackouts will become regular in winter

-

Gas-fired power plants in the UK may be switched off as part of plans to prevent blackouts in the winter, the Independent newspaper reported, citing sources.

The contingency plans are scheduled to be tested soon, government officials said. Such "exercises" may take place in September or October, during which gas-fired power plants may be turned off.

"We are experiencing very serious scenarios. These are not unlikely scenarios," one of the sources, who deals with energy planning, quotes the publication as saying.

According to the source, Norway may resort to the rationing of electricity exports, and the volume of supplies from France has already decreased. Electricity from these countries is used in millions of homes. With limited supplies from Norway and France, consumption rationing will be difficult to avoid.

Rationing can be a restriction of the use of electricity for more than six hours per day. "Forget about just working from home, it could be January with the slogan 'Unplug at home'," one official said.

According to the newspaper, officials and ministers recently held a series of meetings, during which they discussed the risks of a mass refusal of citizens to pay for energy.

A spokesman for the Department of Business, Energy and Industrial Strategy did not deny that the UK is facing an increased risk of an energy crisis that is more likely to result in long blackouts for a significant number of consumers.

-

-

Follows0Replies0Views1.0KUS: Inflation is high

-

According to today's BLS report, inflation in the US formally declined and amounted to "only" 8.5% in July versus 9.1% in June.

Parts of economy are now struggling to survive, and are trying to keep prices down, hoping that competitors will die first (which keeps inflation in check), while the other part is tied to the cost of resources and follows them. In general, everything is very uneven, and therefore the detailing is interesting.

If inflation in the service sector remains below headline inflation (6.25%), i.e. so far it is holding it back (at the expense, obviously, of the wages of the unfortunate workers in the sector), but at the same time, albeit slowly, it has been growing for 11 months in a row, and has now reached its maximum level since 1982.

It is curious that in certain segments of the service sector, prices are rising much faster than general inflation:

- health insurance: +20.6% per year

- shipping: +14.0%

- air travel: +27.7%

In terms of product group, the champion, of course, is energy:

- gasoline: +44.0% per year

- gas: +30.5%

- electricity: +15.2%

But many other product groups also entered double-digit figures:

- food at home : +13.1% per year and this is a record since 1979

- cereals and grain products: +15%

- bird: +16.6%

- eggs: +38%

- milk: +14.9%

- juices: +12.9%

- fats and oils: +20.8%

- children's snack: +15%

The cost of new housing increased by 19.7% over the year, new cars by 10.4%, furniture by 10.8%.

-

-

Follows0Replies1Views1.8KSome Epson printers have death counter

-

It seems that the problem with expensive ink and paper jamming are not the only troubles that owners of Epson printers may face. According to network sources, some manufacturer's devices are programmed to stop working at a certain stage of use and display a message stating that the service life has been exhausted.

A user recently tweeted that his “very expensive Epson printer” suddenly showed an expiration date and stopped working. At the same time, the device did not report what exactly caused the cessation of work, but simply recommended contacting the service. It turned out that the matter was in the gaskets, which are designed to collect and hold excess ink in inkjet printers. Over time, they wear out and there is a risk of damage to the paper or even the printer itself due to spilled ink. However, the cessation of work with the actual wear of the gaskets is not connected, but simply occurs after a certain fixed number of printed sheets.

The issue is reportedly affecting Epson L130, L220, L310, L360, and L365 printers, but it is possible that it affects some other models. It is noteworthy that the first reports of a problem with ink pads appeared about five years ago, and since then a lot of videos have appeared on the Internet, the authors of which show how to replace a worn-out element on their own and reset the blocking of further work.

Same old shit with new turn.

If you don't know I made extremely popular thing for Epson printers to reset waste counter and more :-)

1 comment 2 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by endotoxic Subscribe to this blog

Subscribe to this blog

-

-

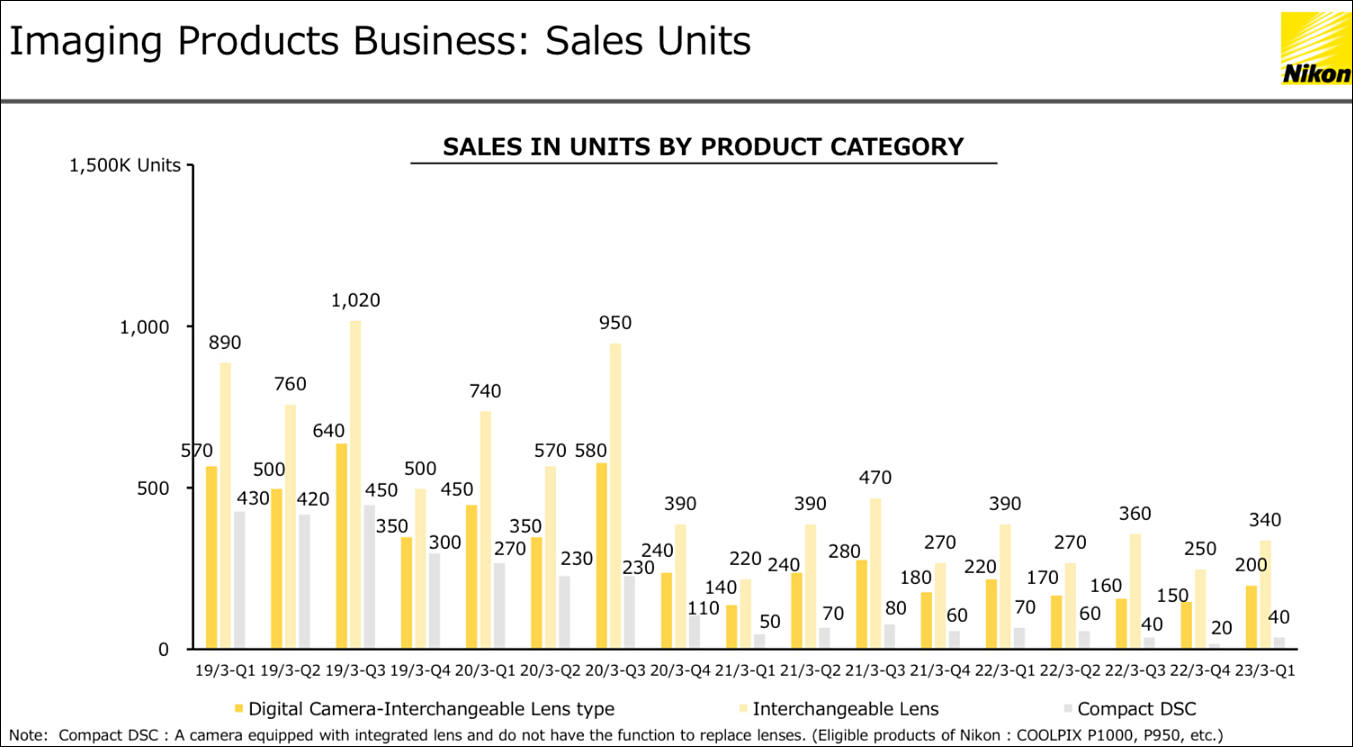

Follows0Replies1Views1.5KNikon effective management in one chart1 comment 2 comments Vitaliy_KiselevAugust 2022Last reply - August 2022 by firstbase

Subscribe to this blog

Subscribe to this blog

-

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,913

- Blog5,718

- General and News1,332

- Hacks and Patches1,148

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,342

- ↳ Panasonic984

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon95

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm98

- ↳ Compacts and Camcorders295

- ↳ Smartphones for video96

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,959

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors190

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,407

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,577

- ↳ Follow focus and gears93

- ↳ Sound496

- ↳ Lighting gear313

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff271

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear559

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,314