It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

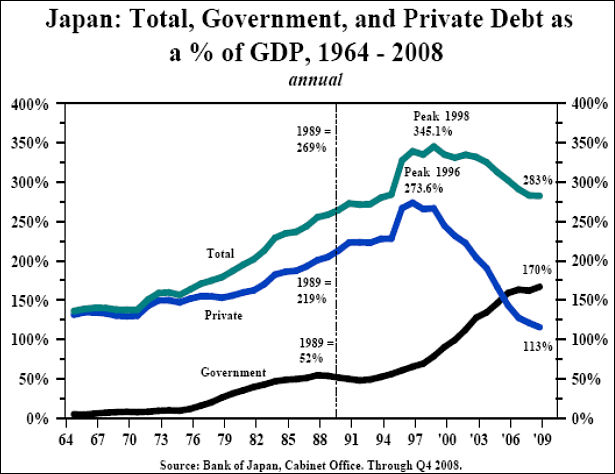

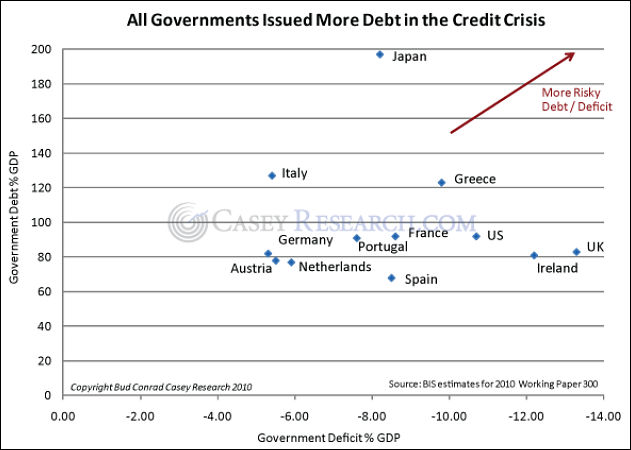

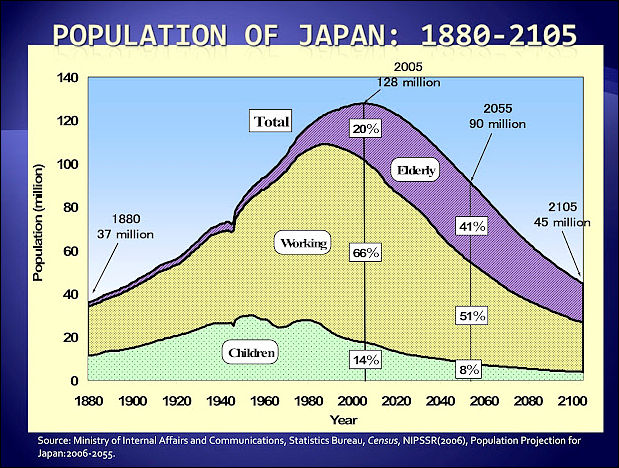

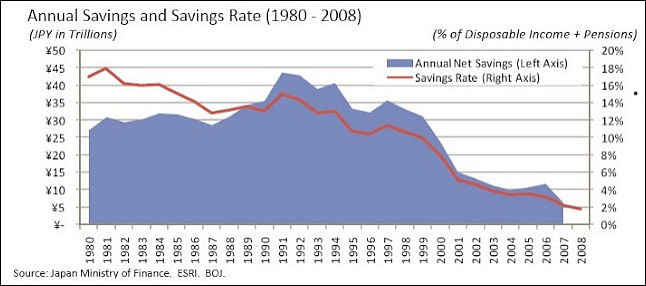

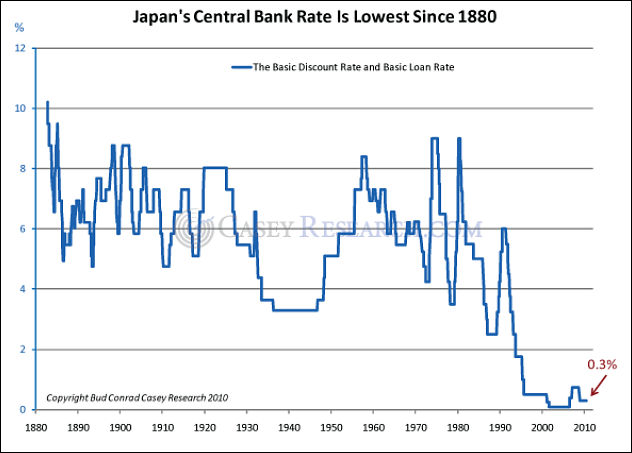

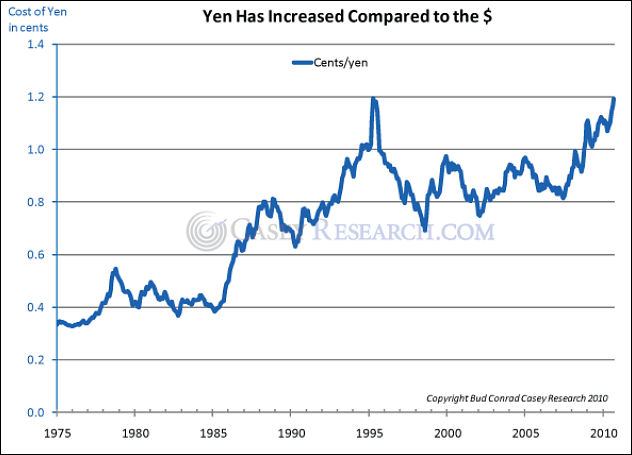

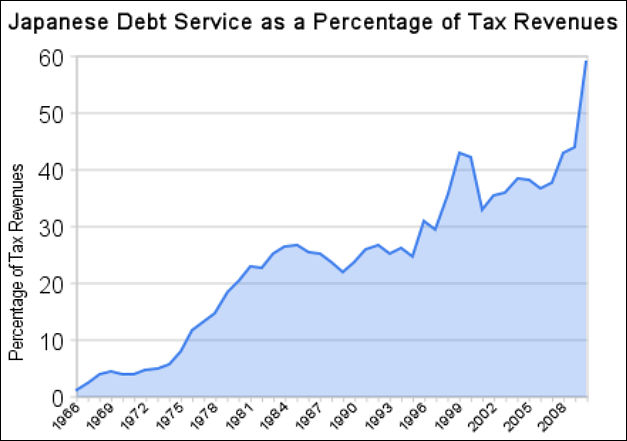

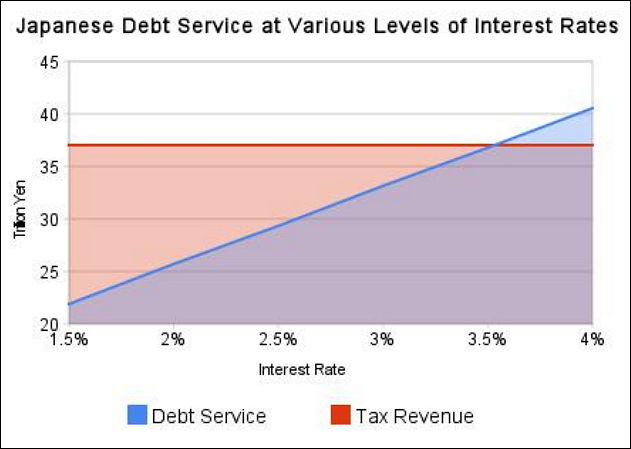

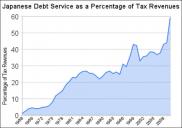

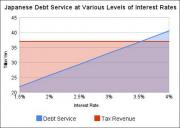

Charts from old, but useful post on ZeroHedge http://www.zerohedge.com/article/guest-post-when-japan-collapses

japan1.jpg615 x 474 - 57K

japan1.jpg615 x 474 - 57K

japan2.jpg631 x 450 - 44K

japan2.jpg631 x 450 - 44K

japan3.jpg619 x 468 - 97K

japan3.jpg619 x 468 - 97K

japan4.jpg646 x 286 - 40K

japan4.jpg646 x 286 - 40K

japan5.jpg632 x 453 - 46K

japan5.jpg632 x 453 - 46K

japan6.jpg632 x 455 - 45K

japan6.jpg632 x 455 - 45K

japan7.jpg627 x 441 - 35K

japan7.jpg627 x 441 - 35K

japan8.jpg631 x 449 - 37K

japan8.jpg631 x 449 - 37K -

Monthly trading of Japanese government bonds among the biggest holders including banks and insurers shrank to 37.9 trillion yen ($385 billion) last quarter, the least on record going back to 2004, according to Japan Securities Dealers Association data. Totan Research Co. and Spiro Sovereign Strategy also said BOJ monetary stimulus is cutting the tie between economic fundamentals and bonds, which yield 0.6 percent for 10 years, the least in the world. “The JGB market is dead with only the BOJ driving bond prices”.

-

Japan…………

-

I hope the zombie masters of Japan's zombie banking and political system die a horrible painful humiliating death. Pour encourager les autres

-

Japan is done.

-

Good post about same shit

A strong yen, deflation and rising government debt form a short-term equilibrium that lasts as long as the market believes it is sustainable. The yen has seen a relentless upward trend since it depegged from the dollar in 1971, up to 83.4 from 360 again to the dollar. When wages and asset prices rise, a strong currency can be justified. When wages and asset prices fall, a strong currency is suicide. Japan's nominal GDP peaked in 1997 and its nominal wages did too. Its property prices have declined every year since. The Nikkei rose in only four out of the last fifteen years and is still close to a three-decade low.

Japanese policymakers, businesses, academics, currency traders and the average Mrs. Watanabe all believe in a strong yen. This belief is wrong but self-fulfilling. It has lasted so long because the Japanese government adopts policies to offset the destabilizing effects of deflation due to a strong yen. Hence, Japan's national debt has marched upwards along with the value of yen. It is expected to top yen 1,000 trillion in 2012, 215 percent of GDP, 7.8 million yen (or roughly US$ 94,000) per person, and about half of net household wealth per capita.

The sustainability of Japan's deflationary path depends on the market's confidence in Japan's debt market. As Japanese institutions and households hold almost all of the government's debts, their faith in the government's creditworthiness is the mojo for Japan's seemingly harmless deflationary spiral.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,987

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- economics 319