It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

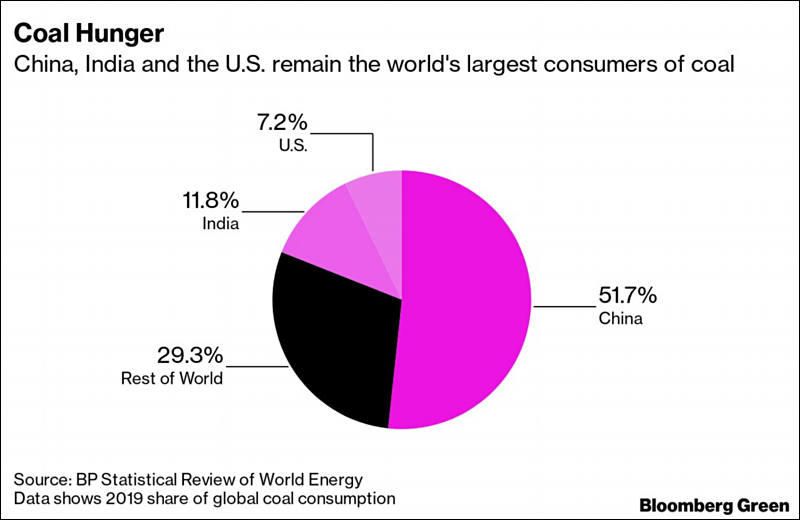

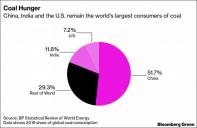

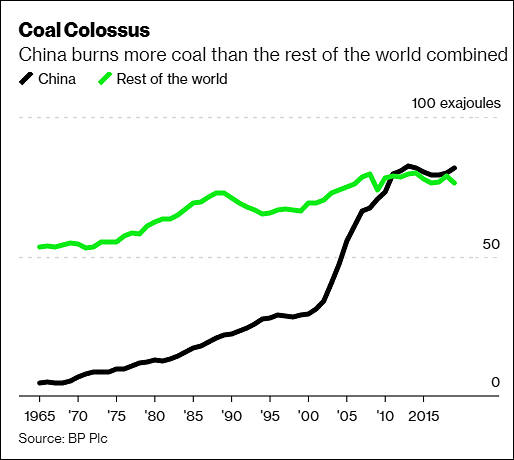

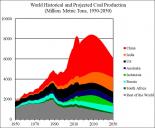

Goldman Sachs Group Inc. is making a case for "peak coal" in a research note Sept. 22, offering that global thermal coal production and demand reached a high water mark in 2013 and will only decline in the future.

"Peak coal is coming sooner than expected," Goldman said.

According to its latest model, Goldman predicts worldwide demand for thermal coal used in power production will decline from a high of 6.15 billion tonnes in 2013 to 5.98 billion tonnes at the end of its forecast range in 2019. Total global production is also expected to peak in 2013 at 6.20 billion tonnes and decline to 5.99 billion tonnes in 2019.

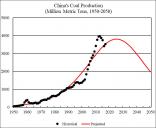

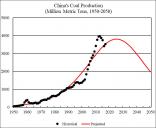

China coal mining also do not rise, debt situation is very bad.

https://www.snl.com/InteractiveX/Article.aspx?cdid=A-33970119-12844

zebra82.jpg624 x 377 - 29K

zebra82.jpg624 x 377 - 29K

zebra83.jpg608 x 387 - 42K

zebra83.jpg608 x 387 - 42K -

China is pushing hard

China's coal output hit record highs in December and in the full year of 2021, as the government continued to encourage miners to ramp up production to ensure sufficient energy supplies in the winter heating season.

China, the world's biggest coal miner and consumer, produced 384.67 million tonnes of the fossil fuel last month, up 7.2% year-on-year, data from the National Bureau of Statistics showed on Monday. This compared with a previous record of 370.84 million tonnes set in November. read more

For the full year of 2021, output touched a record 4.07 billion tonnes, up 4.7% on the previous year.

-

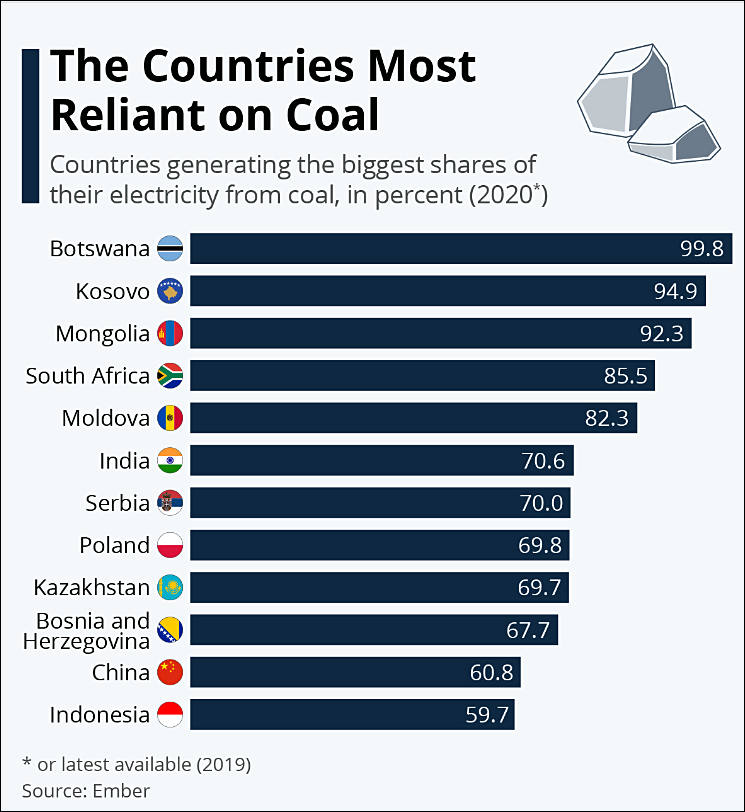

Indonesia banned coal exports in January over concerns that low supplies at domestic power plants could lead to widespread power outages, a senior energy ministry official said Saturday.

The country of Southeast Asia is the world's largest thermal coal exporter, exporting about 400 million tonnes in 2020. Its largest consumers are China, India, Japan and South Korea.

Indonesia has a so-called Domestic Market Commitment (DMO) policy, which requires coal miners to supply 25% of their annual production to the state-owned Perusahaan Listrik Negara (PLN) at a maximum price of $ 70 per tonne, well below current market prices.

“Why is everyone banned from exporting? This is outside our limits and it is temporary. If the ban is not respected, almost 20 power plants with a capacity of 10,850 megawatts will be shut down, ”said Ridvan Jamaludin, general director for minerals and coal. The Ministry of Energy said in a statement.

-

IEA's Coal 2021 report says global power generation from coal soared 9% in 2021 to an all-time high of 10,350 terawatt-hours. The rebound comes amid a rash of green policies and stupid political choices, such as decommissioning oil and gas-fired power plants and fossil fuel exploitation projects

-

The global energy crunch forced a German electricity producer to halt a power plant after it ran out of coal.

Steag GmbH closed its Bergkamen-A plant in the western part of the country this week due to shortages of hard coal, it said by email. The closure is the first sign that Europe may need to count on mild and windy weather to keep the lights on as the continent faces shortages of natural gas and coal is unlikely to come to rescue.

Energy prices are soaring from the U.S. to Europe and Asia as economies rebound from a pandemic-induced lull and people return to the office.

And now we can see it all.

-

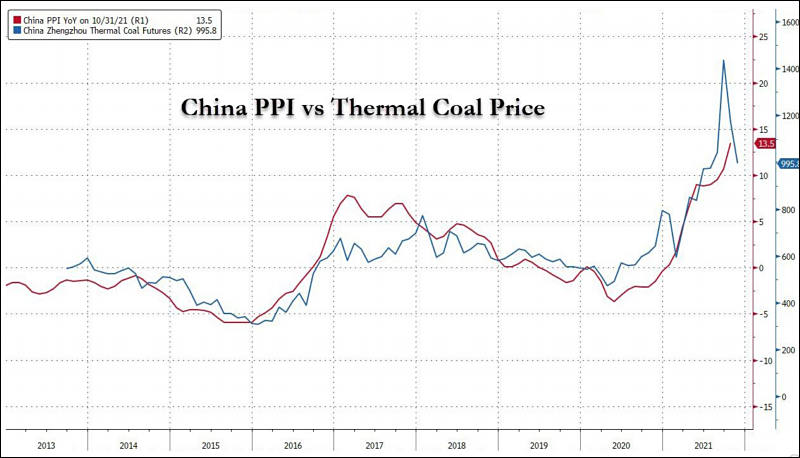

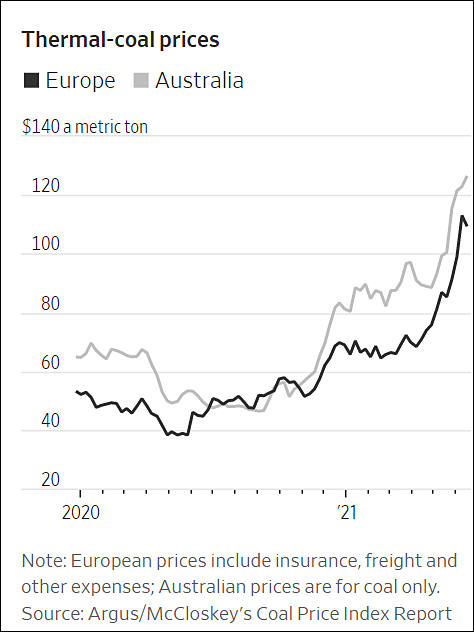

Coal prices have climbed to their highest level in a decade, making the fuel a hot commodity in a year when governments are pledging reductions in carbon emissions.

https://www.wsj.com/articles/thermal-coal-prices-hit-decade-high-amid-gas-shortage-11624620773

sa17550.jpg474 x 632 - 45K

sa17550.jpg474 x 632 - 45K -

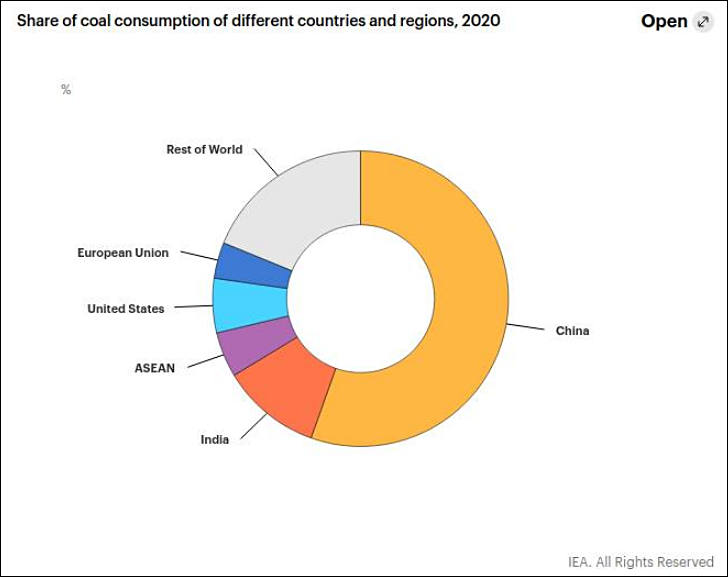

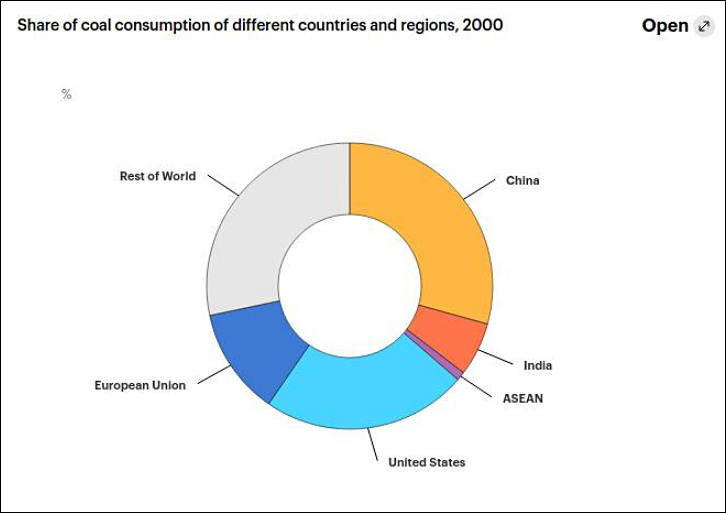

and it 2000 it was

Without moving production to China it had been real disaster in EU and US.

Real problem of EU and US is that their services do not cost as much as they though. Actually most of them are commodity now and others are only exist because huge developers salaries that are in turn protected by huge armies.

sa16841.jpg728 x 577 - 32K

sa16841.jpg728 x 577 - 32K

sa16842.jpg726 x 513 - 29K

sa16842.jpg726 x 513 - 29K -

Several cities in at least three provinces in central and southern China are experiencing a power crunch, with some local governments beginning to ration power use during peak times, according to multiple domestic media reports. Entire provinces are taking the surprise step of limiting industrial power and even cutting heating in government offices, expected to take effect Dec.11

Similar rules have been implemented in the neighboring Jiangxi province, with authorities warning of the possibility of power interruptions during morning and late-afternoon peak periods. Meanwhile, the central Hunan province rolled out a series of power restrictions for businesses and factories on Dec. 8, urging them to consume less power. And Hubei, another central province, has expressed concerns over power usage due to tight coal supplies.

Reports of regional energy shortfalls come as China is aiming to curb its production of coal — a high-polluting fossil fuel that’s used to heat homes and power thermal plants — in order to meet its ambitious climate goal to become carbon-neutral by 2060.

At same time Chinese bureaucrats started coal war with Australia who was their biggest supplier.

-

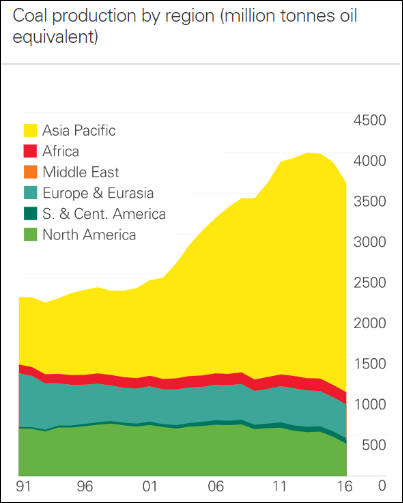

Coal production capacity may rise to 5 billion tons a year by 2025, from 4.1 billion currently, according to Daiwa Capital Markets. Meanwhile the country is set to expand coal electricity capacity by more than 10% to 1,200 gigawatts by 2025, according to Wood Mackenzie.

China do everything to keep cheap coal advantage.

Despite fuzzy promises to not use coal at all in 2060 :-)

sa14938.jpg514 x 460 - 31K

sa14938.jpg514 x 460 - 31K -

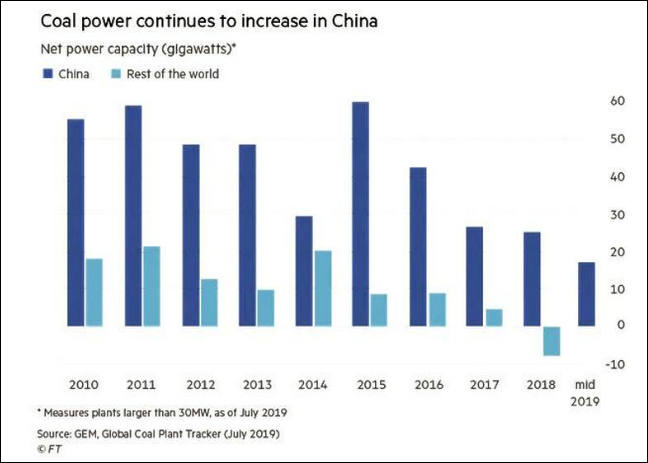

While Xi is making grandiose pronouncements about a 'green revolution' - the backdrop is that in the first half of 2020, China approved 23 gigawatts-worth of new coal power projects, which is more than the previous two years combined according to the report, citing San Francisco-based environmental NGO, Global Energy Monitor (GEM).

"A new fleet of coal plants is in direct contradiction with China's pledge to peak emissions before 2030," said Lauri Myllyvirta, China analyst at Centre for Research on Energy and Clean Air.

Well, normal people realized that without coal it is zero advantage as green energy is very low quality thing and very expensive.

-

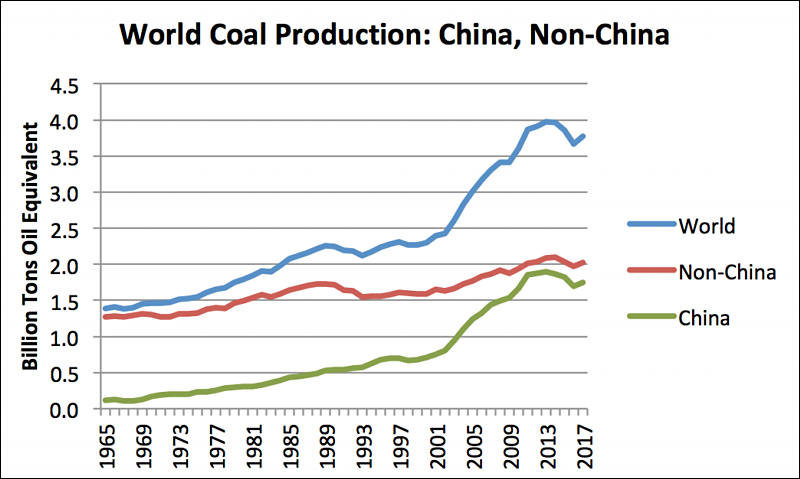

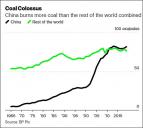

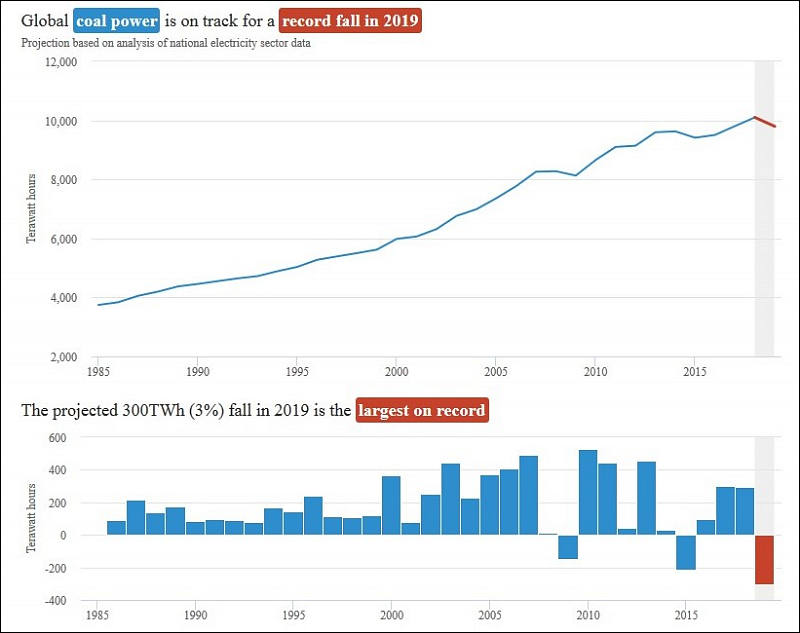

And it is still fall worldwide

US and EU use simple trick - they use cheap gas (to fill gaps) and renewables, but as soon as gas price and availability will be much worse all this construction will fall.

sa11220.jpg800 x 633 - 52K

sa11220.jpg800 x 633 - 52K

sa11221.jpg800 x 531 - 45K

sa11221.jpg800 x 531 - 45K -

China is forced to turn back, even as they don't have enough domestic coal already

Across the country, 148 gigawatts of coal-fired plants are either being built or are about to begin construction, according to a report from Global Energy Monitor, a non-profit group that monitors coal stations. The current capacity of the entire EU coal fleet is 149 GW.

Last year, China's net additions to its coal fleet were 25.5 GW, while the rest of the world saw a net decline of 2.8 GW as more coal plants were closed than were built.

While the rest of the world has been largely reducing coal-powered capacity over the past two years, China is building so much new coal power that it more than offsets the decline elsewhere.

And it is good reason for it- energy costs are much lower.

But the amount of generation added each year drops.

sa11154.jpg648 x 463 - 36K

sa11154.jpg648 x 463 - 36K -

To the public they are saying this shite:

The UN chief on Saturday warned Asia to quit its "addiction" to coal, as climate change threatens hundreds of millions of people vulnerable to rising sea levels across the region.

Antonio Guterres said Asian countries need to cut reliance on coal to tackle the climate crisis, which he called the "defining issue of our time".

"There is an addiction to coal that we need to overcome because it remains a major threat in relation to climate change," he told reporters ahead of a meeting of the Association of Southeast Asian Nations (ASEAN) in Bangkok on Saturday.

He said countries in the region need to be on "the front line" of the fight by introducing carbon pricing and reforming energy policies.

Lies, lies and more lies. To capitalist it is just scary to tell people real situation.

-

China kicked off its annual parliamentary meeting, the National People’s Congress, on Tuesday where Premier Li Keqiang said the country must be prepared for a “tough struggle” as it faces a “grave and more complicated environment.”

Official economic growth target this year, he said, will be 6.0 to 6.5 percent, lower than the growth of 6.6 percent in 2018, the slowest pace since 1990.

And consequences follow. This is only small part, more going on during this year.

-

And suddenly...

China is stepping up its push into clean power with a revised renewable energy target. The nation is now aiming for renewables to account for at least 35 percent of energy consumption by 2030, whereas its previous target only stipulated "non-fossil fuels" making up 20 percent of energy use within the same time frame.

The new plan, called the Renewable Portfolio Standard, aims to tackle the country's soaring pollution levels by reducing its reliance on coal.

Poor journalist do not understand that you can reach 35% not only rising renewable energy, but by dropping other energy consumption, and this is that is happening fast.

-

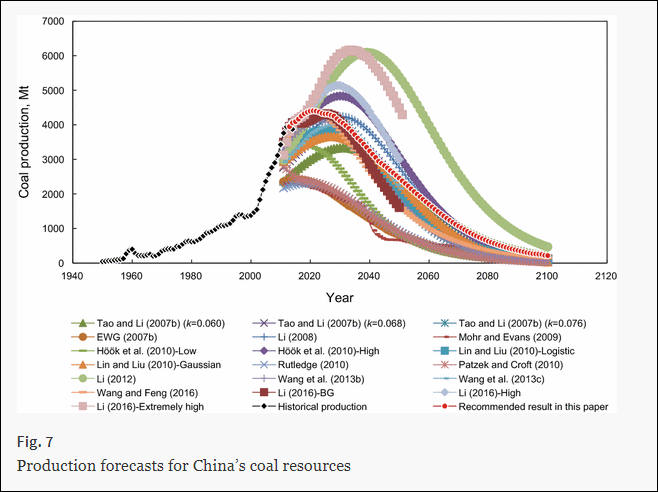

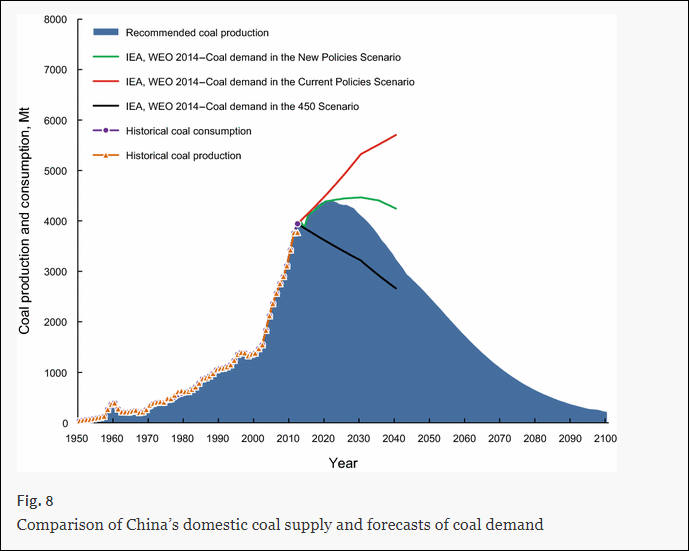

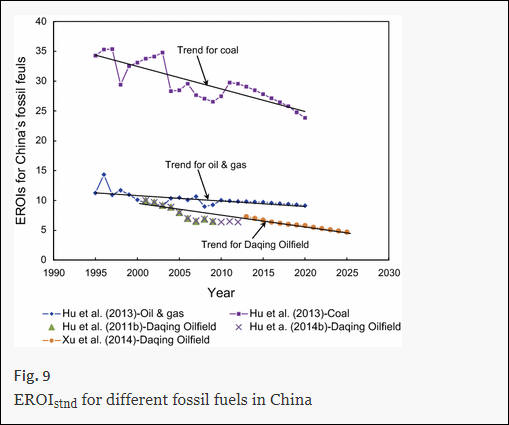

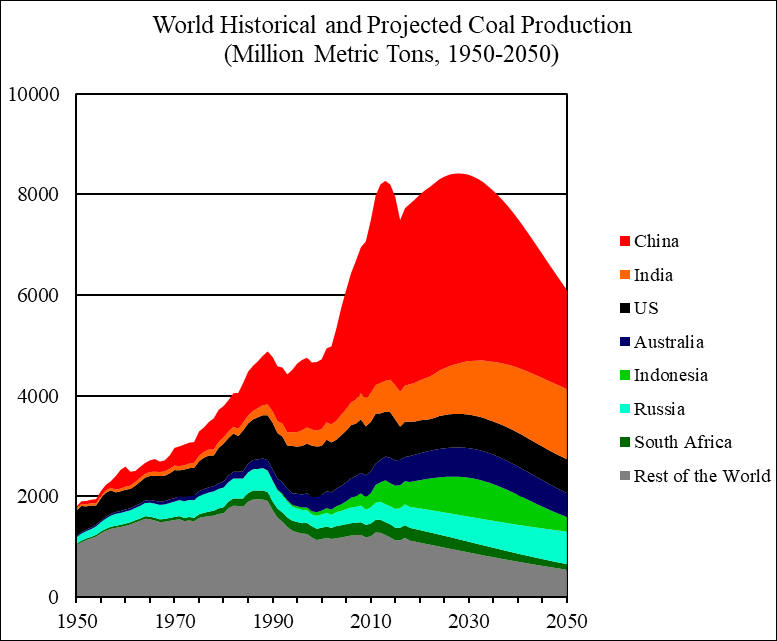

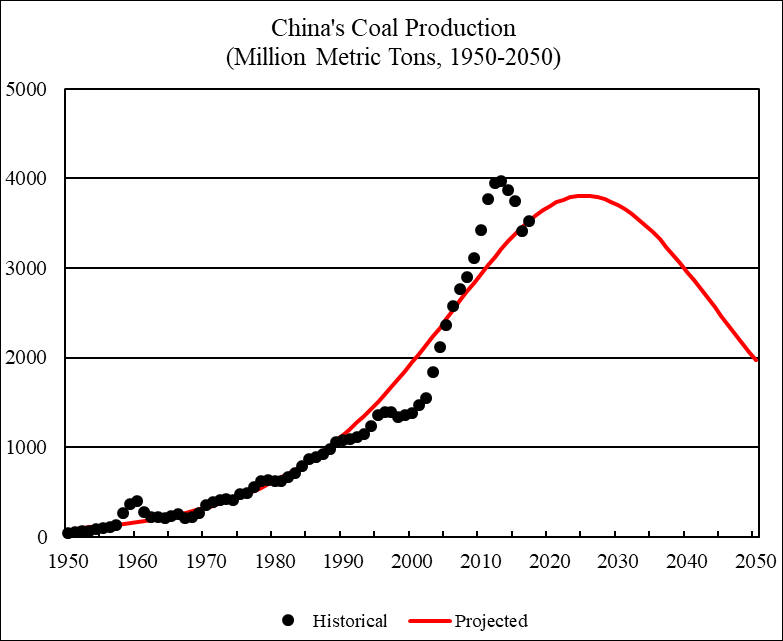

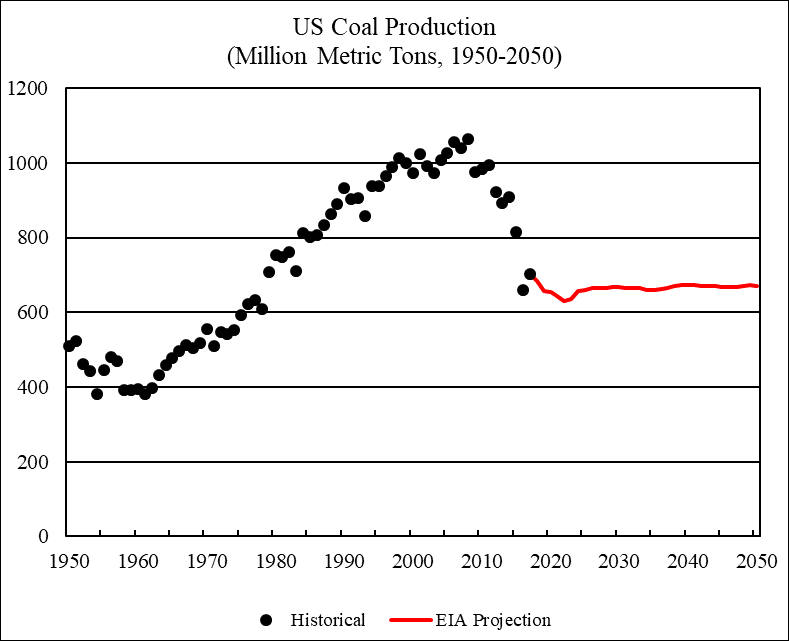

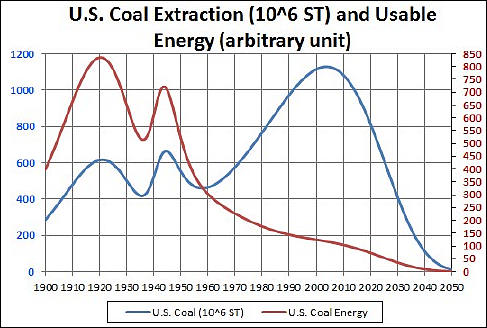

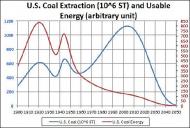

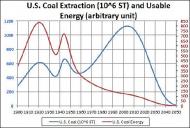

More useful data with prediction towards 2050

Projections are pretty strange

http://peakoilbarrel.com/world-coal-2018-2050-world-energy-annual-report-part-4/

And ne extra big problem

sa4743.jpg777 x 641 - 60K

sa4743.jpg777 x 641 - 60K

sa4744.jpg783 x 641 - 50K

sa4744.jpg783 x 641 - 50K

sa4745.jpg789 x 641 - 55K

sa4745.jpg789 x 641 - 55K

sa4746.jpg487 x 328 - 43K

sa4746.jpg487 x 328 - 43K -

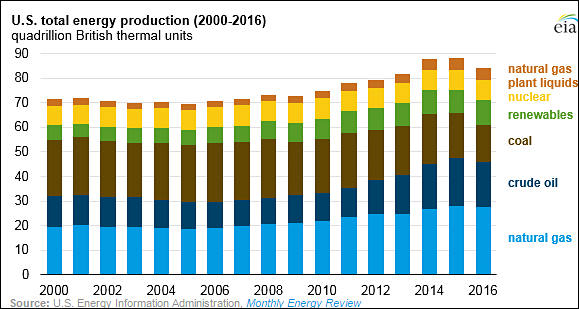

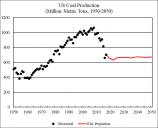

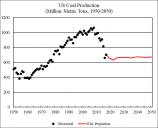

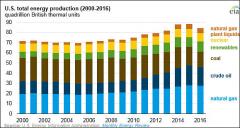

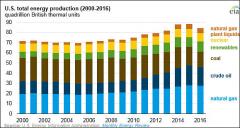

U.S. fossil fuel production fell 7% from 2015 to 2016. Most of this decline was from coal production, which decreased 18% and fell to its lowest level since 1978. Relatively low natural gas prices, especially in the first half of 2016, and relatively flat electricity demand contributed to the decline in coal production. Petroleum and natural gas production also declined, falling 5% and 2%, respectively, as prices for both fuels were below their respective 2015 levels.

After declining slightly in 2015, U.S. renewable energy production increased 7% in 2016. Wind energy made up almost half the increase in renewable production, while solar energy accounted for nearly a quarter. Both fuels saw substantial electricity generating capacity additions in 2015 and 2016.

-

sample1055.jpg579 x 309 - 49K

sample1055.jpg579 x 309 - 49K -

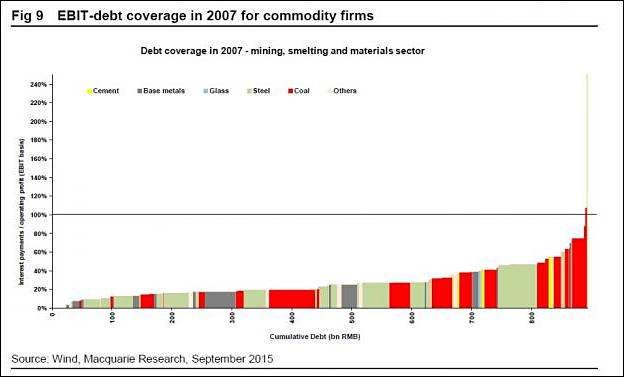

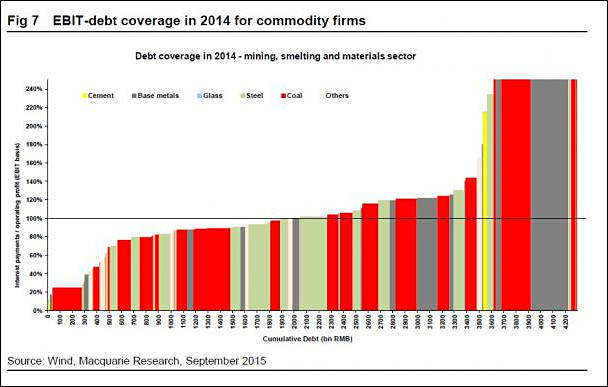

I mention debt because the first two charts you posted were about debt - and they look so terrible because debt shot up in that period not because of rising costs to extract coal.

Yes, there are debt problems in China. Also low transparency in reporting, which is why I used US figures with better reporting. Coal is a transportable material and there are lots of ships going back to China from the US with empty holds, so if China really were running out of coal, they could always buy from the US. (Currently, they buy a good quantity of the coal used for smelting steel, not much of the coal used to produce energy.)

Where does the lowering demand for coal come from? I believe it is: 1) lower cost petroleum, 2) low cost of steel and other products requiring coal for production due to high stockpiles, 3) environmental regulations/restrictions on coal burning for energy.

I don't think we're reading the shale oil and gas charts the same. To me they show a pretty regular pattern of new wells peaking within a year or so but then generating a fairly predictable tail pattern. Output was higher in 2011-14 most likely due to more wells being drilled while oil prices were quite high. With lower prices in 2015-16, fewer new wells were drilled--companies couldn't afford it in the US where most need >$45/barrel to break even. 2017-18 will probably look more like 2011-12 if the price of oil continues to increase.

My point here is, "Peak coal" refers to a peak in the demand for coal, not the supply.

-

Chinese firms used a lot of coal to make a lot of steel at a loss

If you are not on the debt market , loss or not does not count, as it was financed from government. Was it right? Of course, at tactical level.

Your curve charts show the cost of servicing debt, not cost of extraction. Between 2007 and 2014 mining companies took on a lot more debt to stay in operation while resource prices were low due to global economic meltdown. They are loaded down with debt but not because their costs to extract have risen. Instead, it's due to rapidly lowering demand and built up stockpiles that depress the price.

I mean curve on recent charts :-) Or you can just go and look for Chinese internal debt issue.

Us mining companies, Chinese mining companies or who?

From where arise "rapidly lowering demand", what are fundamental reasons?

In the US, coal extraction dropped 10.3% in 2015 but coal consumption dropped 13.1% and as a result US stockpiles of coal rose 20.6% to 238.8 million short tons or 3.5 months-worth of current US consumption. Employment at US coal mines dropped 12.0% during this period indicating that productivity increased during that time. At the 2015 consumption rate of 798 million short tons, the US estimated recoverable reserves (the amount that could be mined using only present technology) of 255.8 billion short tons would last 320 years.

If you just look down at consumption charts in US and China you will see difference.

US present and temporary coal issue arise from this http://www.personal-view.com/talks/discussion/15618/us-issues-with-shale-oil-and-gas-in-charts#Item_2 . Yet nature laws are still inevitable.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,987

- Blog5,725

- General and News1,353

- Hacks and Patches1,152

- ↳ Top Settings33

- ↳ Beginners255

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,364

- ↳ Panasonic993

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320