It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

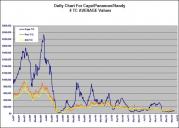

Interesting, isn't it?

Especially considering that big amounts of olive oil are made by small business.

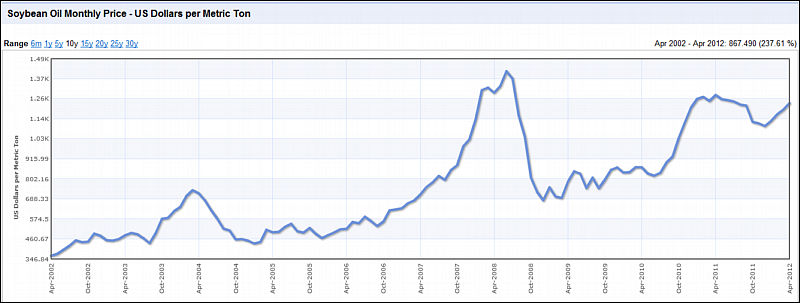

oil.jpg800 x 304 - 44K

oil.jpg800 x 304 - 44K

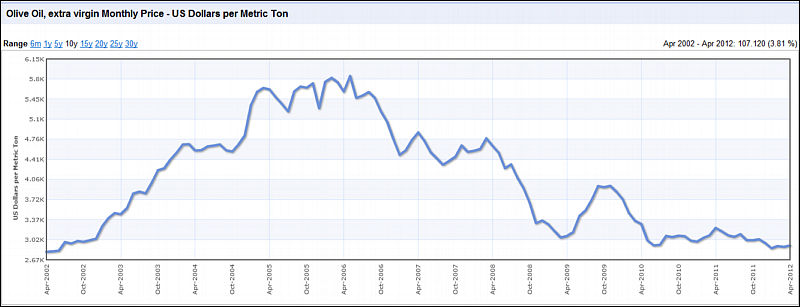

oil1.jpg800 x 303 - 43K

oil1.jpg800 x 303 - 43K

oil2.jpg800 x 307 - 43K

oil2.jpg800 x 307 - 43K -

I heard that much of that virgin olive oil that comes from Italy is not all that olive, at least that's what the greeks say (but then again the greeks have their own oil to sell). Something in the direction that if you compare the yearly olive production in Italy with the yearly olive oil prodution you get numbers that don't fit, you squeeze too many olives (I don't have links to support that and I am not curious enough to search). Does this have something to say in the chart? I don't know.

-

I think it is all pure speculations. As for traders it is very easy to check real contents.

-

Hadn't thought of that. Recently I got a gallon of Italian EVOO for $25 - in Seoul. Seems way too cheap.

My guess - a lot of investment in olive oil production during the boom years of the 90s-06, driven by health consciousness and foodie trends in the US, expanded production and efficiency to a point the market couldn't handle after the crash in 08. Broke people stopped buying fancy olive oil. Saturated markets. I mean, polyunsaturated. ^^

As for soy and sunflower oil, I think they require a lot more energy input on fertilizer, harvesting, and refining, and their price spike just mirrors that of crude oil in 07/08.

Am I missing something, VK?

crude oil prices 10-yr (03-27-2012).png560 x 400 - 19K

crude oil prices 10-yr (03-27-2012).png560 x 400 - 19K -

Broke people stopped buying fancy olive oil. Saturated markets. I mean, polyunsaturated.

I do not believe this. In 2008 people did not start consuming more suddenly, so all this markets have demand only as part of equation. Other, bigger part, are speculation of large traders, banks and funds.

and their price spike just mirrors that of crude oil in 07/08.

It is not their price and crude oil have nothing to do with this, just check other resources and food charts.

-

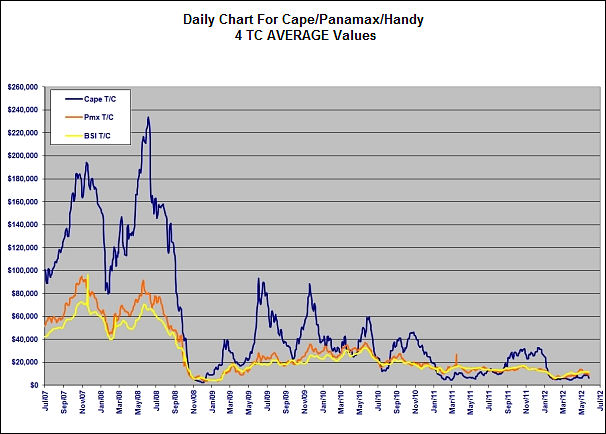

Also look at Baltic Dry Index

The Greek owned fleet is the largest in the world . Today, the Greek fleet accounts for some 18 per cent of the world’s tonnage; this makes it currently the largest single international merchant fleet in the world.

Interesting isn't it?

Btw it also explains why main media strike is focused on Greece. And not on Great Britain or Japan.

oil3.jpg606 x 434 - 56K

oil3.jpg606 x 434 - 56K -

@Vitaliy_Kiselev @jweeke I agree with both of you as you have reasons. Actually you express the same opinion from different angles of view, no contradictions between your statements.

@Vitaliy_Kiselev sorry for noob question:

How this : "The Greek owned fleet is the largest in the world . Today, the Greek fleet accounts for some 18 per cent of the world’s tonnage; this makes it currently the largest single international merchant fleet in the world"

does explain this: "why main media strike is focused on Greece. And not on Great Britain or Japan." ?

What is the relation between those facts?

-

What is the relation between those facts?

Relation is pretty simple if you look at countries debt and economical situation.

You can just look at some prior posts at this blog.My theory is that Greece has strategic position (similar to Sirya, btw) and also very interesting resource that can be handy in future trade wars that will happen before the real global war.

-

That makes sense. Olive oil hinges on standard supply, demand, and shipping, while soy and sunflower get run around by speculators. And now we get good cheap olive oil because freight is nearly free.

So do you think the soy, sunflower, etc, are aggressively speculated on BECAUSE they're produced by massive corporations? Or is it a more complicated relationship?

-

@Vitaliy_Kiselev Thanks, noted

-

Greece is a major player in the international shipping industry, with nearly 4,000 ships – 8 percent of all vessels sailing – and 15 percent of the world's total moving capacity. Greek ship owners control 25 percent of the world tanker fleet. Shipping accounts for 6 percent of Greece's GDP and generates 75 percent of the Mediterranean country's estimated 400,000 jobs tied to maritime activities, according to George Gratsos, president of the Piraeus-based Hellenic Chamber of Shipping.

Since 2000, Greek ship owners have ordered nearly 500 vessels from China's shipyards. 155 vessels have been delivered while an estimated remaining 250 are still under construction, wrote Theodore Vokos, president of Posidonia Exhibitions, in a research note. Posidonia holds the maritime industry's largest annual shipping event in Athens.

"From 2002 to 2011, Greece was directly investing roughly US$64 billion in the Chinese shipping industry every one-and-a-half to two years," Kyrakides said

Via: http://www.china.org.cn/business/2012-01/19/content_24444746.htm

-

I think that it is olive oil that moves not according to most other food related charts.

While it is <1% of GDP, I think its value is significant due to number of workers and situation in small and average business. -

So basically at the moment we're in deep shit. Well, as a nice side effect, I can afford to use a lot of delicious olive oil. Any other commodities you put in that group of indicators?

-

General view on current situation in commodities sector is well summarized here:

-

This is report from May 2011 as I see

-

A lot of olive oil is made in Greece, Spain and Tunsia...but bottled and packed in Italy.

-

@Vitaliy_Kiselev You are right. Sorry. The news in the report sound as if they are written for May 2012, many similarities. Still the report is of interest as it shows how many different factors are involved in swings at commodities markets.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,990

- Blog5,725

- General and News1,353

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,366

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm100

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320

Tags in Topic

- economics 319