It allows to keep PV going, with more focus towards AI, but keeping be one of the few truly independent places.

-

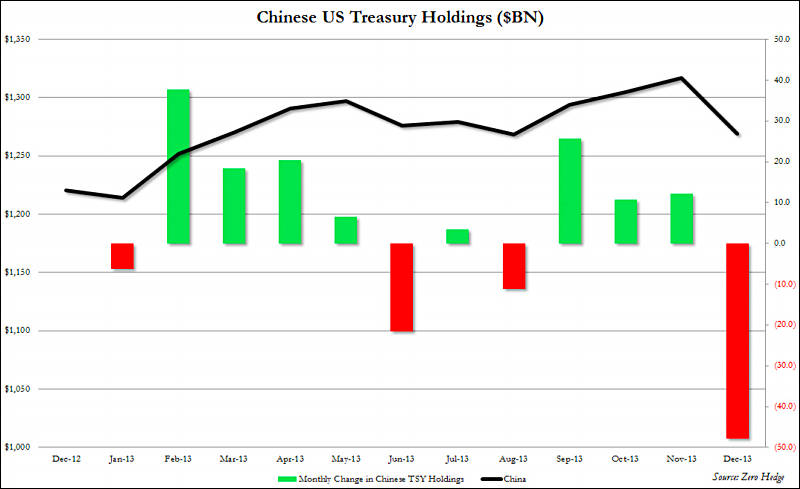

The yuan is in the beginning of a currency run. The Chinese govt is trying to reduce volatility by selling dollars, it gets those dollars by selling its reserve of treasuries for USD. Why ? Heaps of articles about bad loans. Also, the trade surplus with the US is reducing due to a reduction in consumer spending.

Another centrally planned economy!

-

Why ? Heaps of articles about bad loans. Also, the trade surplus with the US is reducing due to a reduction in consumer spending.

Ideas of "bad loans" is popular on some sites, yet people usually completely misunderstand Chinese system. 90% of loans are provided by banks owned by government and they are restructured according to consulting with firms. In other words, Chinese system, has nothing to do with US one.

Also, yep, yuan course can cause some problem as end dollar prices can rise due to this.

-

Chinese just bought 1/3rd of French automotive industry, the second largest in Europe.

-

@Vitaliy_Kesselev - it is the same model practiced in the Soviet Union as well as India - in India, briefly in the 70s and 80s.

The bankers loaned money to their friends and other members of the Communist party (Congress-I in India).

Restructuring is not magic, if capital is destroyed due to malinvestment, it has to be compensated somewhere. Either the stockholders, bondholders or depositors, or the government via bailouts.

-

The bankers loaned money to their friends and other members of the Communist party (Congress-I in India).

LOL. I never laughed so loud lately. It is so wrong information and complete misunderstanding of SU financial system.

Restructuring is not magic, if capital is destroyed due to malinvestment, it has to be compensated somewhere.

Nope, nothing must be compensated. Money are just stimulus used to made real things. Huge advantage of government based financial system (btw this system will be the only one remaining in less then 10 years) is that you can guide resources and stimulus to the areas you need as well as ability to restructure or just forget about loans.

Usually such wrong doom and gloom view on debt is common for ZH and another Austrian school resources. At least ZH use fears to live from affiliate income from gold sales :-)

-

And just Wow..

> Money are just stimulus used to made real things.

-

And just Wow..

Yep, sometimes you need to see things how they are, instead learning definition in the books without understanding.

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,993

- Blog5,725

- General and News1,354

- Hacks and Patches1,153

- ↳ Top Settings33

- ↳ Beginners256

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,368

- ↳ Panasonic995

- ↳ Canon118

- ↳ Sony156

- ↳ Nikon96

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm102

- ↳ Compacts and Camcorders300

- ↳ Smartphones for video97

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,960

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors191

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,420

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,582

- ↳ Follow focus and gears93

- ↳ Sound499

- ↳ Lighting gear314

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff273

- ↳ Power solutions83

- ↳ Monitors and viewfinders340

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear560

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,320