-

Follows0Replies2Views1.8KChina: Population growth stopped

-

On January 17, the National Bureau of Statistics released the latest population figures. In 2021, 10.62 million people were born in China, and 10.14 million died. The annual natural population growth approached zero.

In the past five years, the birth rate in China has shown a clear downward trend. Data from the Seventh National Census show that the total fertility rate for women of childbearing age in 2020 was 1.3, which was already at a fairly low level. In 2021, this ratio hit a new low of 1.15.

As He Dan, Director of the China Research Center for Population and Development, explained, when the difference between the number of births and the number of deaths is 1 million, the population growth rate enters the zone of zero growth. For the period of the 14th Five-Year Plan (2021-2025), the population of China will be in this zone.

He Dan named four main reasons that led to the rapid decline in the birth rate in China: the long-term effect of economic and social development, the decline in the number of women of childbearing age, the replacement effect of reproductive subjects between generations, and the delayed effects of the coronavirus.

The impact of COVID-19 on childbearing has been evident over the past two years. He Dan said that since the outbreak of COVID-19, many people have experienced job insecurity and declining incomes. According to the survey, about 30% of people who originally planned marriage and childbirth have postponed their plans.

In plain English - COVID already kills around 30% of future generation, just due to media attacks.

2 comments 3 comments Vitaliy_KiselevJanuary 2022Last reply - July 2022 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views519Ukraine: Free market eliminated glass industry

-

Due to the increase in the cost of energy resources, 3 enterprises of the glass industry of Ukraine have already stopped completely, and the rest have entered the stage of technological downtime to prevent a complete shutdown of furnaces. After all, the full resumption of their work after the shutdown is extremely problematic, financially costly and virtually impossible for Ukrainian producers.

The catastrophic increase in the price of natural gas, which currently accounts for up to 50% of the cost of glass products, has devastating consequences for the entire sector of the real sector of the Ukrainian economy, as there is a rapid objective increase in the final price of Ukrainian products.

This is one of the negative factors critical for the domestic glass industry - significant lower prices for import of glass products into our country from countries where energy prices for industry are sometimes almost ten times lower than in our country.

In this situation, the products of Ukrainian companies become uncompetitive in both domestic and international markets.

Ukraine's glass industry, which employs more than 12,000 people, is rapidly becoming unprofitable and in fact is in the process of bankruptcy and complete closure.

The Association of Glass Industry Enterprises "Glass of Ukraine" appeals to the Government for support and assistance.

Its the end.

-

-

Follows0Replies1Views1.2KUK: The end of hybrid and electric autos, gasoline is the way to go now

-

With unprecedentedly high electricity prices in the UK in 2021, it has become more profitable for hybrid car owners to fill up with gasoline instead of charging at electric stations, according to a Citibank review. It notes that in the WB, the use of an electric car now costs 50% more than cars with an internal combustion engine. And the owners of hybrids no longer charge them at electric stations, but go to gas stations.

“For most of the past two years, we have been running our hybrid car in electric mode (the 9.7kWh battery lasted about 15km), but not now. I will drive to the gas station until electricity prices return to their previous levels, ”the authors of the review write.

This situation developed in the second half of 2021 against the backdrop of an unprecedented increase in electricity prices in the European Union and the World Bank due to the energy crisis that broke out there, heated up by expensive gas, which powers thermal power plants. According to the Nord Pool energy exchange, on January 14 (prices are formed a day ahead), 1 MWh in the UK cost 373.2 euros, while on January 1, 2022 - 82.9 euros per 1 MWh.

1 comment 2 comments Vitaliy_KiselevJanuary 2022Last reply - January 2022 by Vitaliy_Kiselev Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views556War: Chinese semiconductor business is feeling good

-

Although some of its key semiconductor industry players were put on the Entity List by the US government since 2019, China managed to register double-digit growth in the revenues of all of its semiconductor sub-sectors in 2020, pushing up global market shares to challenge Taiwan and the US, according to several recent reports.

If the robust growth continues, China's semiconductor industry will grow rapidly in the next decade and by 2030 will become a world champion in semiconductor manufacturing, seizing a 24% global market share, as previously predicted by the Semiconductor Industry Association (SIA).

According to an SIA blog, the semiconductor industry in China grew 30.6% in 2020 to reach $39.8 billion in total sales, representing robust annual growth of 36%, 23%, 32%, and 23% for the fabless, IDM, foundry, and OSAT sectors, respectively.

China registered 9% of the global semiconductor market share in 2020, surpassing that of Taiwan for the second year in a row. It is likely to overtake Japan and Europe soon, as the global market shares of the semiconductor industry in the two major economies both stood at 10%.

China's fabless semiconductor sub-segment ranked third after the US and Taiwan, taking 16% of the global market share, up from 10% in 2015, even though it was subject to tightened chip export control restrictions.

In terms of wafer capacity increase, China accounted for 26% of the worldwide total, according to IC Insights and SIA, while its top 3 outsourced semiconductor assembly and testing (OSAT) companies collectively garnered more than 35% of the global market share.

China has already announced US$26 billion in new planned funding for 28 additional fab construction projects in 2021, mostly focusing on mature processing nodes.

-

-

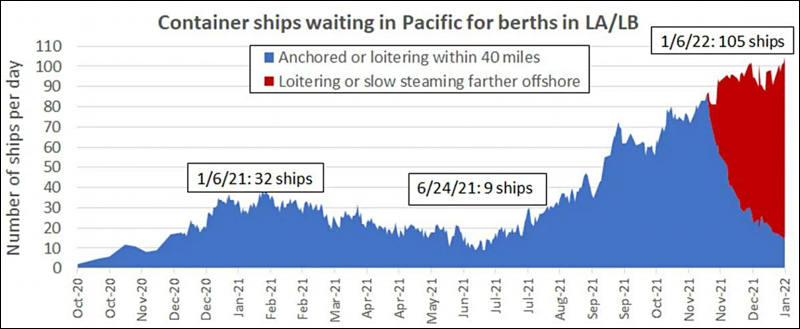

Follows0Replies2Views1.3KMAGA: Situations with ships is very bad2 comments 3 comments Vitaliy_KiselevJanuary 2022Last reply - January 2022 by DrDave

Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views602Cameras Sales: 2021 December Japanese sales, Map Camera

-

Best selling new cameras

- Sony α7 IV

- Nikon Z 9

- Canon EOS R6

- Canon EOS RP

- Fujifilm X-E4

- Nikon Z fc

- Sony FX3

- Sony VLOGCAM ZV- E10

- Ricoh Imaging RICOH GR IIIx

- Canon EOS R5

Best selling used cameras

- Sony α7 III

- Sony α7C

- Fujifilm X-S10

- OM Digital Solutions OM-D E-M1 Mark II

- Ricoh Imaging RICOH GR III

- Canon EOS R

- Nikon D750

- Fujifilm X100V

- Canon EOS RP

- Sony α6000

-

-

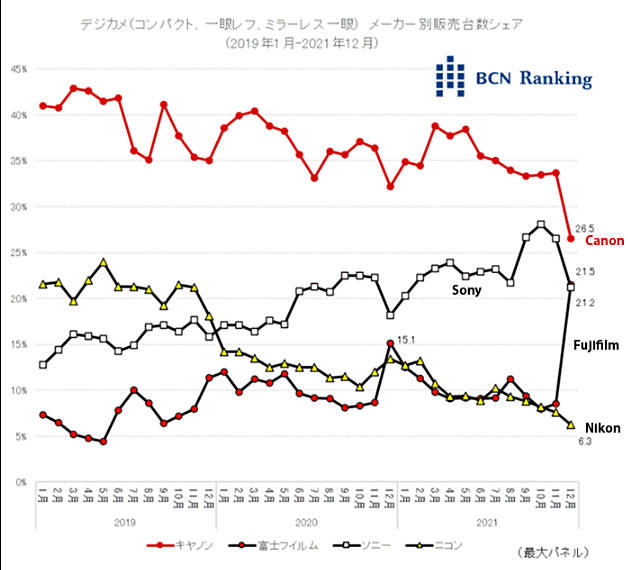

Follows0Replies3Views1.4KJapanese cameras market share by BNC Ranking3 comments 4 comments Vitaliy_KiselevJanuary 2022Last reply - January 2022 by AndrewReid_EOSHD

Subscribe to this blog

Subscribe to this blog

-

-

Follows0Replies0Views603Energy: Role of energy costs in basic materials

-

Cement: the technology is simple - we take almost any raw material, from limestone and clay to slag, which is nearby and cheap, we burn it into cement clinker. These are rotary kilns - for a 140-150m long kiln, the gas consumption is frantic, the temperature in the firing zone is kept up to 1700. The drives on the kiln are motors over 150kW. Plus transporters. Then grinding in ball tube mills is a huge consumption of EE. Well, there is also aspiration, filters, etc. Conclusion - raw materials cost a penny, 80 percent of the cost of cement - energy.

Glass: Stove-pool, we pour sand into it (mined, washed, classified, dried) plus soda (soda production is a separate song, there are shaft furnaces 40-80 meters high, the main costs are gas and EE) - EE and gas. Continuously melting raw materials and forming a bottle or pulling a sheet. Conclusion - raw materials cost a penny, 80 percent of the cost of both soda and glass itself are energy carriers.

Brick. Ceramics - clay, knead, knead again, and again knead, then mold, dry in huge dryers - it dried 10 times more than the oven. The energy carrier in the dryer is gas or electricity. There are combined ones. Dry for a long time. We take it out, then we burn it in a slot-hole tunnel kiln. Temperature - 950-1100. The heat carrier is gas. Conclusion - raw materials cost a penny, 80 percent of the cost of ceramic bricks - energy. Usually it is automatic plant - personnel costs a penny.

Silicate brick, gas silicate, foam concrete. Sand plus liquid glass (sodium silicate or potassium silicate, boiled into a liquid by steam, steam generators - EE) - mixed, molded, loaded into steaming chambers. Steam steaming - EE or gas. Gas silicate is a little different, but the general conclusion is that raw materials cost a penny, 80 percent of the cost are energy carriers.

Ferrous metallurgy. Cast iron - ore is mined, enrichment - washing, roasting requires lot of EE and gas. If a blast furnace, then coal plus gas plus petcoke, well, there are a lot of things and a huge amount of energy efficiency. If the convector is a jet of oxygen from above into the pot - EE plus gas. From cast iron to steel - or immediately after the convector, after a couple of warm-ups or, more often, chipboard - we melt cast iron plus scrap metal with coal and electric arc additives. Energy consumption is huge. What we pour into chipboard - ferroalloys (75-80% of EE in the cost price), carburizer, metal mirror heaters, etc. Conclusion - raw materials cost a penny, 60-65 percent of the cost of ferrous metal - energy. If we roll it into a product - heating, rolling - EE and gas.

Non-ferrous metallurgy, except for aluminum, is practically the same as ferrous metallurgy, only there are a lot more redistributions for the preparation of raw materials, the percentage of energy carriers in the cost is slightly less.

Aluminum - ore is mined, driven at the GOK to the state of electrocorundum, that is, electromelting and grinding to obtain a powder - electricity is practically the only consumable material. We load it into an electrolyzer (melt bath) and melt it with electricity, remove the alloy, roll it, stamp it. For aluminum - the main cost is from electricity consumption. I completely forgot - when melting, we add pure crystalline silicon, in which 85% of the cost is electricity cost.

All of the above furnaces (rotators, tunnels, glass melting baths, mines, blast furnaces, chipboard, electrolyzers, etc.) need a refractory lining. Refractories - magnesite, corundum, silicon carbide, fireclay, zirconium, diatomite, dinas, etc. - are all fired or melted in electric or gas furnaces. The consumption of energy for different refractories is different, but very large.

Chemistry - furnaces everywhere, fertilizers - furnaces and distillation, food industry - furnaces everywhere, sugar, by the way. Asphalt - well, yes, bitumen, crushed stone and sand.

The general conclusion is that every butt truck, glass bottle or beer can, candy or concrete step has a wild amount of Electricity and Gas invested in it! Just wild. Any change in the price at the initial stage entails the accumulated rise in price and the complete non-competitiveness of the goods.

-

Howdy, Stranger!

It looks like you're new here. If you want to get involved, click one of these buttons!

Categories

- Topics List23,911

- Blog5,718

- General and News1,330

- Hacks and Patches1,148

- ↳ Top Settings33

- ↳ Beginners254

- ↳ Archives402

- ↳ Hacks News and Development56

- Cameras2,342

- ↳ Panasonic984

- ↳ Canon118

- ↳ Sony154

- ↳ Nikon95

- ↳ Pentax and Samsung70

- ↳ Olympus and Fujifilm98

- ↳ Compacts and Camcorders295

- ↳ Smartphones for video96

- ↳ Pro Video Cameras191

- ↳ BlackMagic and other raw cameras116

- Skill1,959

- ↳ Business and distribution66

- ↳ Preparation, scripts and legal38

- ↳ Art149

- ↳ Import, Convert, Exporting291

- ↳ Editors190

- ↳ Effects and stunts115

- ↳ Color grading197

- ↳ Sound and Music280

- ↳ Lighting96

- ↳ Software and storage tips266

- Gear5,407

- ↳ Filters, Adapters, Matte boxes344

- ↳ Lenses1,577

- ↳ Follow focus and gears93

- ↳ Sound496

- ↳ Lighting gear313

- ↳ Camera movement230

- ↳ Gimbals and copters302

- ↳ Rigs and related stuff271

- ↳ Power solutions83

- ↳ Monitors and viewfinders339

- ↳ Tripods and fluid heads139

- ↳ Storage286

- ↳ Computers and studio gear559

- ↳ VR and 3D248

- Showcase1,859

- Marketplace2,834

- Offtopic1,314